Nvdia EPS Takeaway: Valuation Is Not A Timing Tool

Nvidia (NVDA), one of the biggest winners of 2023 and the most followed AI-related stock, rocketed higher in after-hours trading after reporting blowout Q1 earnings. Highlights include:

Beat on Top and Bottom Lines: Q1 Revenue came in at $7.19 billion versus estimates of $6.51 billion. EPS of $1.09 beat estimates of $0.92.

Massive Revenue Guidance: Nvidia now sees second-quarter revenue of $11 billion versus estimates of $7.18 billion! The unexpected guide higher is likely why NVDA added more than $150 billion in market cap in after-hours trading.

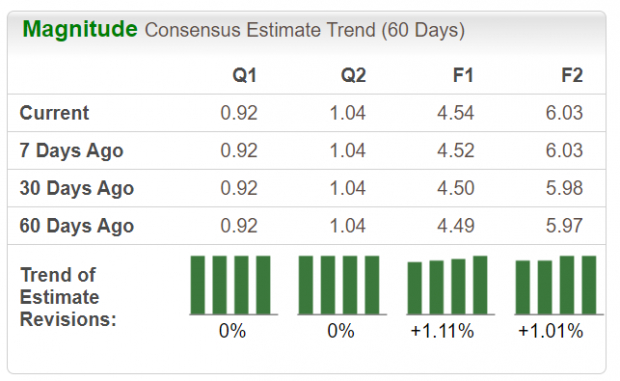

(Click on image to enlarge)

Image Source: Zacks Investment Research

Pictured: Analysts will need to scramble to raise NVDA EPS estimates in the coming days.

With a (perceived) Lofty Valuation of 94x EPS, Why is NVDA up 20%?

A common misstep amateur investors make is to attempt to rely on valuation metrics such as the price-to-earnings ratios (P/E) as a timing device. Valuation has value (no pun intended) however, it should be used by an investor with an extremely long-time frame, deep knowledge of a company’s fundamentals, and the stomach to handle volatility. For this reason, Warren Buffett, the most famous and successful value investor, says, “Our favorite holding period is forever.”

Though Buffett’s style has allowed him to become one of the wealthiest humans on earth, different investors have different styles and preferences. For shorter to intermediate-term traders, valuation has less predictive power because:

Valuations are based on historical data: Every fundamental metric is based on past data or future assumptions. Market conditions can change rapidly with the onset of new innovations like the internet, AI, and other “game-changing” technologies.

The Market is the Ultimate Decider: Valuations can be useful but not in a standalone nature. For example, in bull markets, high valuation stocks tend to outperform, and in bear markets, they tend to underperform.

Not Qualitative: Investors cannot use traditional metrics to weigh decisions on non-traditional growth stories. Valuation does not consider qualitative aspects such as management quality, disruptive technology, and investor sentiment.

Takeaway

The earnings blowout by Nvidia proves that the leading semiconductor is the current market leader and that there is real money behind the AI revolution. As with any innovative stock like NVDA, using valuation metrics in a vacuum is a recipe for disaster. Industry group peer Advanced Micro Devices (AMD) and other tech stocks shot higher in sympathy.

More By This Author:

4 Stocks To Watch On Dividend Hikes As Market Volatility Continues

4 Blue-Chip Stocks From A Struggling Dow For A Stable Portfolio

Bear Of The Day: Central Garden & Pet (CENT)

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more