Monday, February 13, 2023 1:17 PM EST

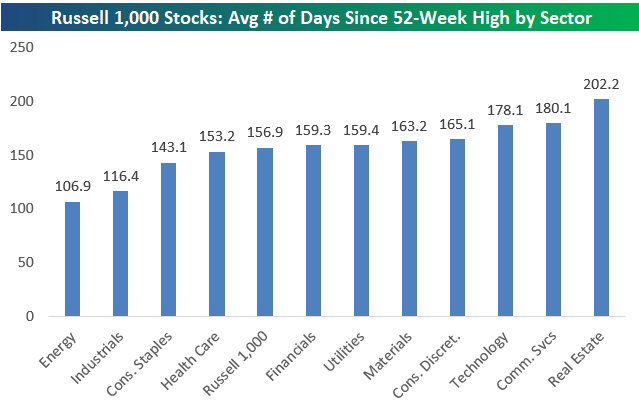

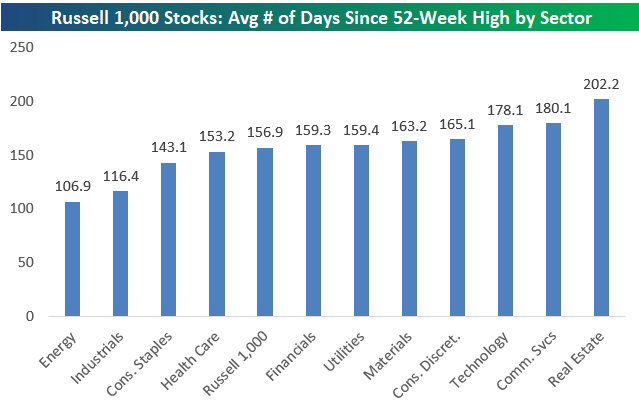

20% of stocks in the large-cap Russell 1,000 have made 52-week highs at some point so far in 2023. However, about 23% of stocks in the index made their last 52-week highs in February 2022. Across the entire index, the average stock made its last 52-week high 156.9 days ago. Real Estate stocks made their 52-week highs an average of 202.2 days ago, the furthest back of any sector, while Energy stocks on average made their 52-week highs 106.9 days ago (the most recent of any sector).

Below is a list of Russell 1,000 stocks with market caps above $50 billion that have made new 52-week highs at some point in 2023. Of the 28 stocks that made the list, there’s representation from eight of eleven sectors. That’s pretty spread out. The only sectors that aren’t represented are Materials, Real Estate, and Utilities. Health Care, Industrials, and Technology each have six stocks that made the list. The largest stocks include names like Exxon Mobil (XOM), Eli Lilly (LLY), Merck (MRK), Mastercard (MA), Oracle (ORCL), and Visa (V).

More By This Author:

Jobless Claims Above Expectations

Refis Rise

People All Over AI

You can monitor the daily list of new 52-week highs in our Tools section with a new

more

You can monitor the daily list of new 52-week highs in our Tools section with a new Bespoke Premium membership. Click here to sign up for a two-week trial today.

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. This is not personalized advice. Investors should do their own research and/or work with an investment professional when making portfolio decisions. As always, past performance of any investment is not a guarantee of future results. Bespoke representatives or clients may have positions in securities discussed or mentioned in its published content.

For more global markets and macroeconomic coverage, make sure to check out Bespoke’s Morning Lineup and nightly Closer notes, as well as our weekly Global Macro Dashboard. Start a two-week free trial to Bespoke Institutional to access The Closer and the rest of Bespoke’s suite of Institutional products.

less

How did you like this article? Let us know so we can better customize your reading experience.