People All Over AI

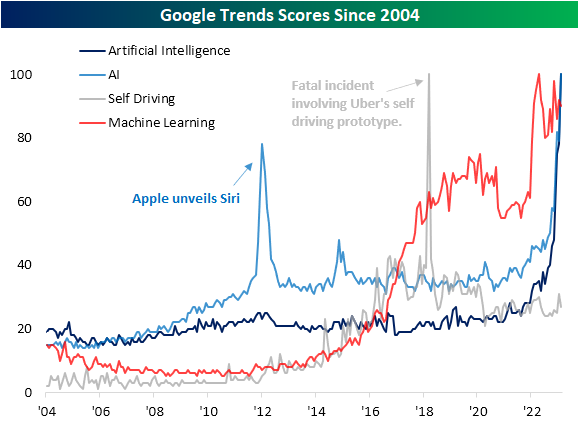

In today’s Morning Lineup post, we compared Chat GPT’s rapid emergence into the mainstream to the rise of a number of other products. While Artificial Intelligence, or AI, has been a buzzword for some time now, this year it certainly has been in the spotlight more than in the past. Given the popularity of Chat GPT, some mega-caps like Alphabet (GOOGL) and Baidu (BIDU) have jumped in on the opportunity to announce their own versions. To quantify how in focus AI has become, below we show the Google Trends scores for a handful of related terms. Readings of 100 would indicate the peak in searches for a given topic globally.

Searches for “Artificial Intelligence” or its abbreviation have reached a new record while the field of “Machine Learning” has similarly seen searches rip higher and remain elevated in the past year. One interesting area which has not seen searches rise much is in regards to the automotive industry. Searches for “self-driving” have not picked up much within the range of the past few years. That is also well below the record from March 2018 when searches spiked due to a fatal incident involving Uber’s self-driving car. That being said, it is worth noting that even before the Chat GPT craze, these searches had been moving higher quite rapidly.

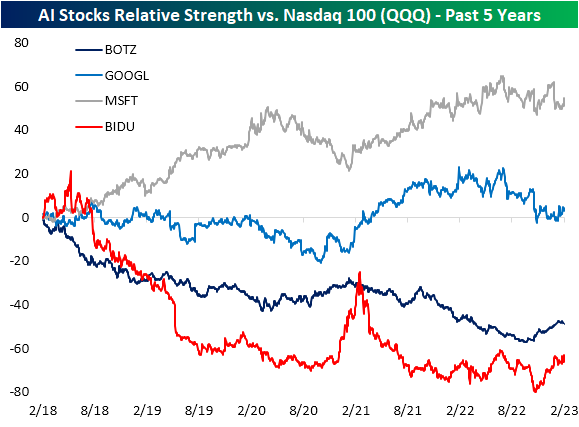

As we discussed earlier, although the broad topic of AI is in vogue, related stocks have not gotten much of a boost in reaction to this news. For those having made announcements regarding AI in recent days like Alphabet (GOOGL), Microsoft (MSFT), and Baidu (BIDU), relative strength versus tech more broadly (proxied by the Nasdaq 100 ETF (QQQ) has not done anything too notable in terms of long term trends. For MSFT and GOOGL, relative strength has been sideways at best over the past year, and BIDU has been moving higher in recent months, but that follows a few rough years for the stock relative to US tech. The same can be said for a more encapsulating basket of AI-related stocks proxied by the Global X Robotics and Artificial Intelligence ETF (BOTZ). While the relative strength has been trending lower (meaning underperformance versus tech more broadly) the past few months have seen a rebound.

More By This Author:

$2.9 Trillion In Market Cap Added

The “Chat AI” Invasion

FANG Index Has Best One-Month Rally On Record

Click here to learn more about Bespoke’s premium stock market research ...

more