Refis Rise

Mortgage rates have come off of recent lows with the 30-year national average from Bankrate.com currently at 6.53%. While rates are not making new lows, those are much more attractive levels than last fall when they peaked well above 7%. On a rolling 3-month basis, the decline in mortgage rates continues to rank as some of the largest since the late 1990s (after the largest increase since the 1990s).

Given the alleviation on the rates front, purchase applications have been rebounding. The Mortgage Bankers Association’s weekly purchase application index is currently 19.2% above the post-pandemic low put in place in the first week of the year.

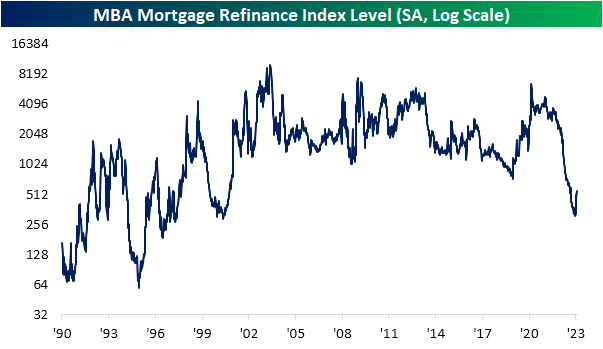

When rates were rising rapidly, massively stifling demand last year, refinance applications had taken a much larger hit than purchase applications. At the worst levels during the holidays, refinance applications reached the lowest level since May 2000. Since the start of the year, though, refinance applications have surged. Although there is still plenty of lost ground still to make up as applications continue to run below the past two decades’ range, the 68% month-over-month increase in applications has been the largest jump since March 2020 when applications doubled. Of all weekly readings since 1990, the current one-month increase ranks in the top 5% of all month-over-month moves on record.

More By This Author:

People All Over AI

$2.9 Trillion In Market Cap Added

The “Chat AI” Invasion

Click here to learn more about Bespoke’s premium stock market research ...

more