Netflix Is Finishing Its Correction After The Stock Split

Image Source: Pixabay

Netflix (NFLX) recently announced a 10-for-1 stock split, its first since 2015. Shareholders of record on November 10, 2025 will receive nine additional shares for each one they own, with split-adjusted trading starting November 17, 2025. The split is designed to make the stock more accessible, particularly for employees using stock-based compensation, without changing the company’s overall value.

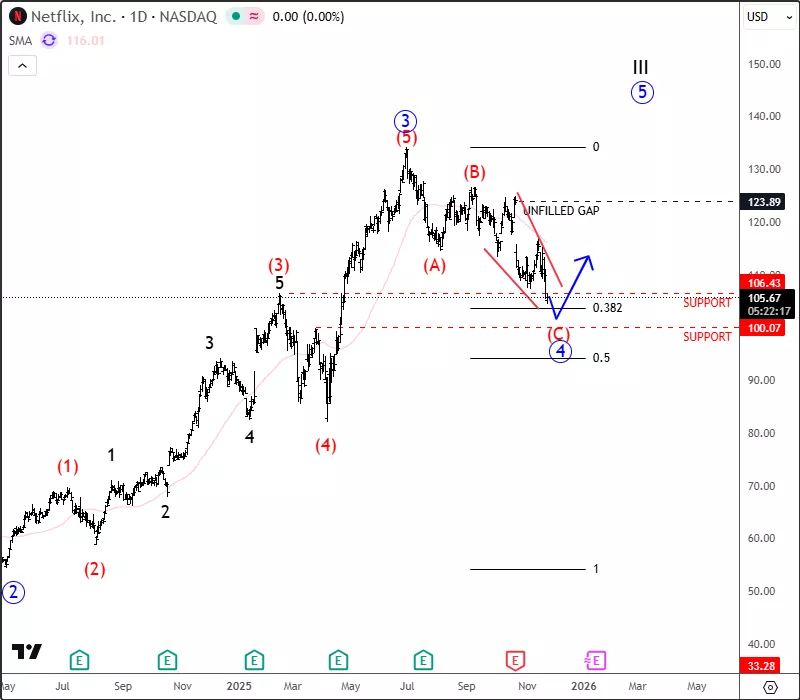

Stocks are slowing down, and we can see Netflix keep trading in a projected ABC correction, as shared back in October 24.

However, in today's update, we want to mention and highlight that a correction can be nearing the end, as we see it potentially finishing the wedge pattern within wave (C) of an (A (B) (C) corrective decline.

(Click on image to enlarge)

NFLX Daily Chart

Netflix came lower few weeks back after disappointing earnings, which fits well with the idea of a deeper fourth-wave retracement. There’s is now an unfilled gap near 123, and I think that level could be reached when the trend is ready to resume higher. From an Elliott wave perspective, the broader trend remains bullish, and with three waves down now from the highs and ending diagonal in (C) wave it seems like a new reversal may not be that far away. Ideally price will turn up for a new recovery, ideally from around 100 level.

Highlights:

Trend: Bullish (wave four correction in late stages

Support: 100, 99

Resistance: 123 gap

Note: Gap near 123 may attract recovery after completing the current correction

More By This Author:

Zcash Is Eyeing 2018 Highs

Apple Hit All-Time Highs As Anticipated, But It's Still Unfolding An Impulsive Rally

USD/JPY Forming The Wedge Pattern?