Netflix Wave 4: Consolidation Before The Next Breakout

Image Source: Unsplash

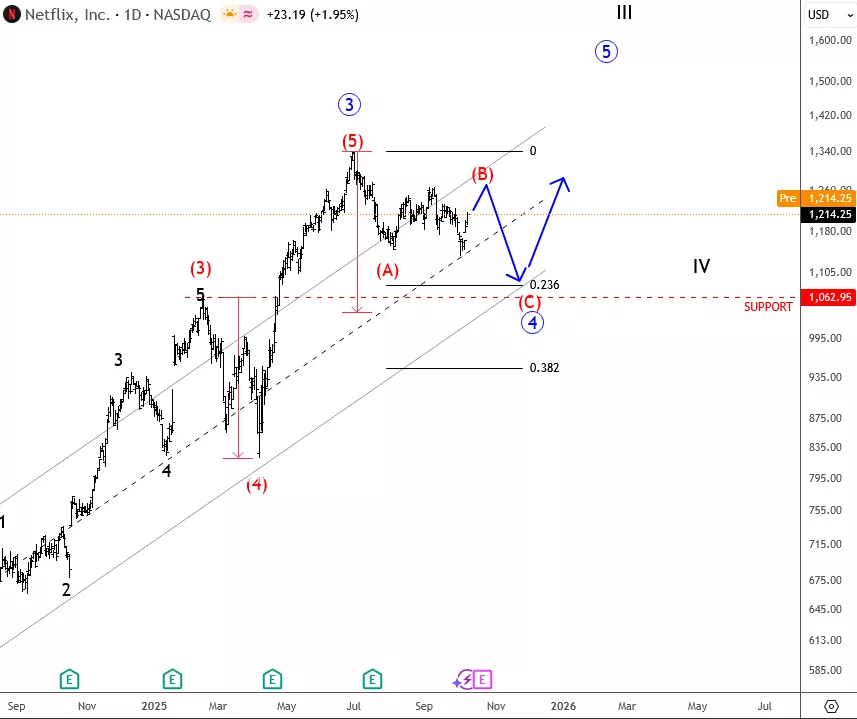

In our latest stocks report (currently free to access), we highlighted that Netflix (NFLX) was likely consolidating in wave 4, and that the recent rally was a wave B “sucker’s rally.”

Here’s a snippet from that report:

“The current strength we’re seeing this week could still just be wave B as part of an ongoing wave four.

For those waiting for better entry levels, the 1000–1060 area is worth keeping an eye on; support at 1060 and 1000, and resistance at 1260.”

This was what we sent out to our members in latest report, you can review the full report here directly and check other stocks too - https://app.wavetraders.com/stocks/charts

Today, after 15 days, we can see how Netflix, Inc. is trading still within wave 4 correction in what appears to be a zigzag correction for now.

The supports I've mentioned in previous report are still in place and resistance at 1260 held the price nicely. We are looking for the next Fibonacci numbers at 23.8% and 38.2%

Moreover, at US open, we've created a gap that we covered with members, which plays as a magnet going into the future. It has been covered in our members chat-room as well

A reminder that its still free US stocks service that is in beta.. therefore you can enjoy the free Elliott Wave reports!

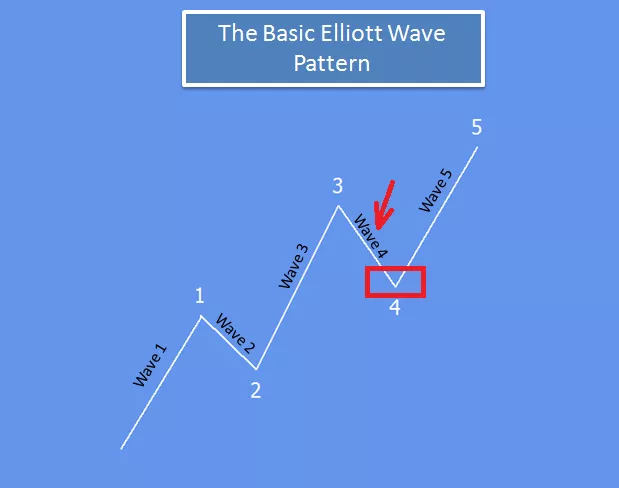

Small educational content

Currently, we are trading in proposed wave 4 correction - which usually trades within the next Fibonacci numbers:

・Fibonacci level - 23.6%

・Fibonacci level - 38.2%

・Fibonacci level - 50.0%

More By This Author:

Silver Pulls Back For Wave 4 Correction

Ripple Is Still Bullish Despite Recent Spike Lower

Apple Is Just About To Break All-Time Highs Within An Impulsive Rally

Check out our resources - https://wavetraders.com/academy

https://x.com/ewforecast - Official X

https://x.com/GregaHorvatFX - Gregas X

https://t.me/EWFTraders - Telegram