USD/JPY Forming The Wedge Pattern?

Photo by Cullen Cedric on Unsplash

USD/JPY is in a nice recovery mode, but with overlapping price action that currently looks like a corrective move up from the 2025 low. Ideally, this recovery fits into an A-B-C structure, with an ending diagonal now unfolding, but already in late stages as price approaches the 155–156 region.

USDJPY 4H Chart

With that in mind, USD/JPY may be nearing a turning point in the weeks ahead, potentially reversing lower from the upper side of a higher-degree triangle range. If the pattern completes as expected, the pair may start looking down again—possibly toward that unfilled gap around 147.50.

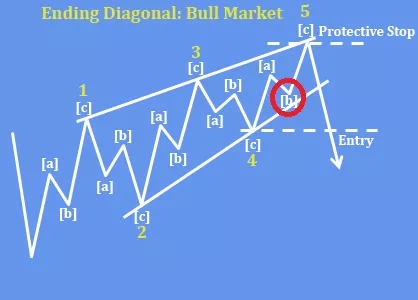

Basic Elliott Wave Ending Diagonal / Wedge Pattern

Remember, an ending diagonal is a terminal pattern that typically appears in wave 5 or wave C. It’s characterized by overlapping waves, a contracting or sometimes expanding wedge shape, and each leg subdividing into corrective 3-wave moves. This pattern often signals exhaustion, meaning momentum tends to fade as price approaches the final swing high.

For a detailed view and more analysis like this, you may want to join our live webinar today on Monday, November 17 @ 15.00CET: DIRECT LINK

More By This Author:

Bitcoin Is Coming Lower, As Technology Sector Slows Down; Diagonal Pattern?

Ebay Finishes A Projected Correction And Resumes Its Bullish Trend

McDonald's Is Looking For The Final Leg Up