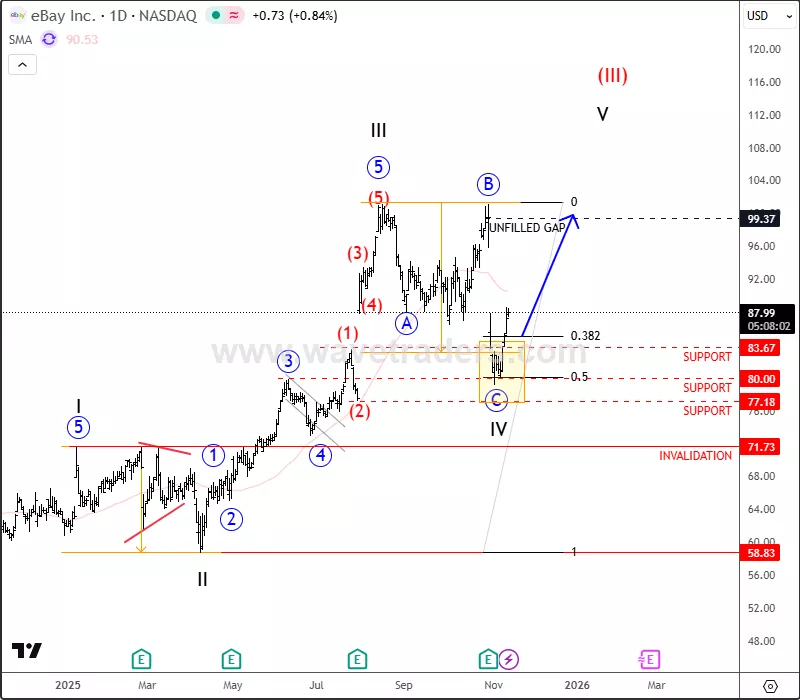

Ebay Finishes A Projected Correction And Resumes Its Bullish Trend

Image Source: Pixabay

We talked about eBay on October 30th, where we mentioned and highlighted that it's in wave C of higher degree ABC correction in wave 4 after reported earnings.

A reminder: eBay’s stock sold off despite beating Q3 earnings estimates, revenue hit about $2.82 B (vs. $2.73 B expected) and EPS was $1.36 (vs. $1.33 expected). The drop came after management issued weaker forward guidance, projecting slower GMV growth (4–6% for Q4) and ongoing margin pressures. Investors reacted negatively to signs of deceleration despite solid current results.

(Click on image to enlarge)

eBay Daily Chart From October 30

As you can see today, eBay is bouncing nicely from the projected support zone, suggesting that the ABC correction within the higher-degree wave 4 may be complete. Wave 5 now appears to be in progress, which could drive the price back toward the previous highs, targeting the open/unfilled gap area.

(Click on image to enlarge)

eBay Daily Chart From November 12

For short-term traders, the recent bounce provides an opportunity to align with the developing bullish wave structure, with invalidation placed below the 77 support level. Medium-term investors may look for continuation signals above the recent swing high to confirm the start of wave 5 targeting the 100–105 zone.

eBay is a global online marketplace connecting millions of buyers and sellers across 190+ markets, offering auctions and fixed-price sales. Founded in 1995, it’s now a mature e-commerce platform focusing on categories like collectibles, refurbished goods, and AI tools for users.

More By This Author:

McDonald's Is Looking For The Final Leg Up

Crypto Market Stabilizes, While Bitcoin Dominance Drops; Altseason?

DASH: How We Spotted The Bottom And Bullish Turn