Ebay Slows Down For A Higher Degree Correction After Earnings

Image Source: Pixabay

eBay is a global online marketplace connecting millions of buyers and sellers across 190+ markets, offering auctions and fixed-price sales. Founded in 1995, it’s now a mature e-commerce platform focusing on categories like collectibles, refurbished goods, and AI tools for users.

Recently, eBay’s stock sold off despite beating Q3 earnings estimates, revenue hit about $2.82 B (vs. $2.73 B expected) and EPS was $1.36 (vs. $1.33 expected). The drop came after management issued weaker forward guidance, projecting slower GMV growth (4–6% for Q4) and ongoing margin pressures. Investors reacted negatively to signs of deceleration despite solid current results.

(Click on image to enlarge)

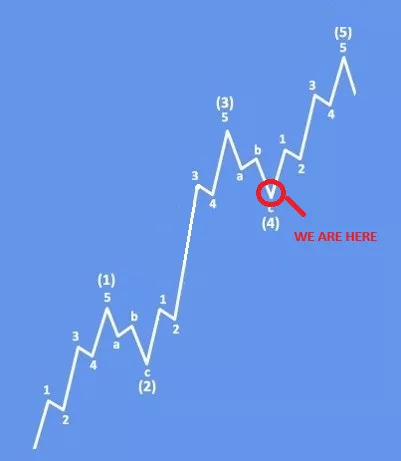

From an Elliott Wave perspective, eBay appears to be in a strong and extended fifth wave advancing from the April lows, with the impulsive structure still looking incomplete. The recent sell-off following earnings may represent a deeper, higher-degree ABC correction within wave IV, particularly considering the presence of a newly opened and unfilled price gap.

The ideal support zone lies between 83–77, where the correction could potentially find a floor before resuming higher. We continue to anticipate a final push to new highs in wave V, likely extending beyond the 100 area. However, it’s important to note that once a five-wave sequence completes, markets often enter a slower, corrective phase, suggesting we may be approaching the late stages of the broader bullish cycle (red wave three) heading into year-end.

The Elliott Wave Principle is a form of technical analysis that identifies patterns in market movements. A bullish impulsive wave is one of the most important and common wave structures in an uptrend. It describes how prices typically move in the direction of the main trend. A bullish impulsive wave consists of five waves labeled 1, 2, 3, 4, 5. Basic Impulsive Bullish Pattern shows that eBay can be finishing wave 4 correction before a bullish continuation for wave 5.

More By This Author:

ASML Is Unfolding A Five-Wave Impulse Into All-Time Highs

Zcash Remains Under Strong Bullish Pressure

Netflix Wave 4: Consolidation Before The Next Breakout