Macy's: What's Next After The Doom?

In my previous articles, I have been fairly clear on M's future and its 2019 performance, as well as the after-effects of COVID-19 pandemic, has left the stock reeling. I had recommended a sell rating when the stock was trading at over $18 post which it hit rock-bottom at sub $5 levels. The company continues to face monumental challenges with its stores closed and general apprehension of the public for apparel purchases. The company had been taking several measures furloughing most of its employees, withdrawing guidance and dividends and tapping its $1.5bn credit line. The investors had growing concerns on the company's ability to pull through and have ability to pay short term needs.

Liquidity Analysis

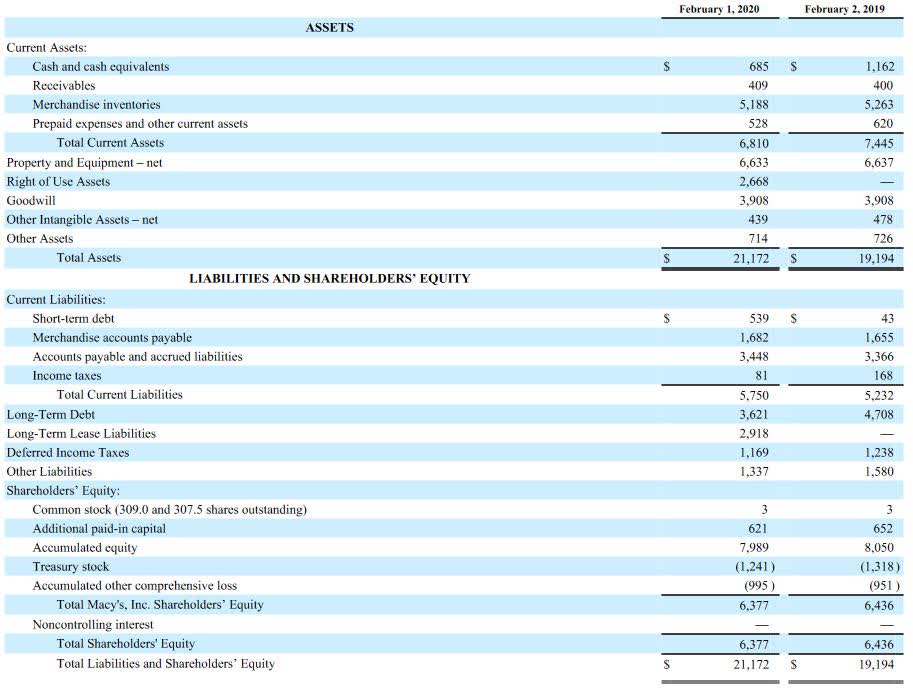

A look at the key ratios highlights some positives as well as negatives. Here is the most recent balance sheet (as of Feb 1).

(Click on image to enlarge)

(Source: Macy's 2019 Form 10-K, p. F-8)

The company has $685 mn in cash plus the additional $1.5 bn credit line which it encashed a few weeks back totaling to about $2.2 bn. It also declared suspending its dividends after Q1, however, the company paid about $120 mn in dividends on April 1. This puts the liquidity of the company at roughly $2.1 bn. This puts the acid test ratio or the quick ratio at 0.37 ($2.1 bn cash against its current liabilities of $5.75 bn) which means the company has 37 cents for every dollar worth of current liability and in the times where the situation can get awry too early too fast, this flashes as a warning signal in the hindsight.

Looking at the liabilities, the $539 mn short term debt includes an immediate payment in capital leases of only $6 mn while the rest of $533 mn is present in the form of senior notes which matures only in 2021. With the massive cash burn that the company would be facing, it is a no-brainer for it to make a loss at least for few quarters, entailing it to not cough up the $81 mn in income tax liabilities. Now, coming to accrued liabilities and account payables, about $850 mn of payments comes around in the form of lease liabilities, accrued wages and worker's compensation reserve which are likely to be spread through the later part of the year. Also, the $839 mn in gift cards and customer rewards could either be covered through the company's existing inventory or could more likely be pushed over to the later part of the year as people might not be looking to stock up their wardrobe in the current situation. This comes about to $1.76 bn worth of liabilities not being "immediate".

Real Estate Support

Macy's has continued to look at its real estate portfolio monetizing $1.5 bn in the period of 2016-18 which moderated to under $150 mn in 2019. Amidst a severe liquidity crunch, investors are currently eyeing M's real estate portfolio. Starboard in its presentation in 2016 had pegged M's real estate value at $21 bn. Cowen later pegged the valuation of the company's sizeable real estate assets at $16 bn. What could be the worth of it today, however, is anybody's guess. Drawing parallels to the situation, Sears was long considered an undervalued investment due to its huge real estate portfolio. However, the company went under bankruptcy but was able to raise $2.7 billion in 2016 by selling 235 stores to real estate investment trust Seritage Growth Properties, but those primarily being the cream of the portfolio. On the other hand, Macy's flagship stores, like the ones at Herald Square in NY, Union Square in SF, and the State Street store in IL are likely worth billions themselves.

Conclusion

Challenges persist for Macy's due to the closure of the stores as well as uncertainty around the demand pick-up even when the stores open and apprehension on store footfalls remain. That being said, the company's vast real estate portfolio, network scale, and vendors, as well as value unlocking through real estate and e-commerce sales, would provide a floor to the stock price. The stock has jumped a staggering 31% in last two days (I got delayed in finishing this up and posting yesterday, unfortunately), I'd probably put a $5 as a good entry point for high risk-reward investors. Also, I have recently joined the Twitter bandwagon at https://twitter.com/PennyWiser14. Look forward to seeing you there as well.