Macy's - Where Are We Headed?

I had presented my thoughts before on Macy's (M) several months back on Talkmarkets. While I was neutral on the stock then, an unimpressive track record coupled with lackluster growth means that Macy's was sidelined by the investors with M's growth pangs. This again meant the stock continue to be in doldrums with the stock currently trading under $20, its 52-week low, after topping $40 a year ago. I have also presented my thoughts on the expected decline in the stock when the company was trading at $35 and the result is here to see. Now with Macy's about to report its Q2 results on 14th August, I have revisited my thoughts down below.

Macro View

US Retail Sales posted robust growth smashing analyst estimates with the three month annualized sales minus food services, autos, building materials and gas growing 7.5% in the second quarter, the strongest quarterly performance since the final three months of 2005. Robust consumer spending continues to drive the economic growth in the US where business investments and manufacturing remain weak due to tepid demand and US-China trade war. Unemployment at 50-year low coupled with rising wages mirrors in the strong consumer confidence reflected in the numbers.

(Click on image to enlarge)

However, although the retail sales have grown robust in this quarter, the department stores were caught among the wrong side of the market. Department store sales fell 1.1% compared to the preceding quarter and 5.9% YoY with the industry's continued struggle against rising e-commerce competition and trade wars. reflecting a not-so-great quarter for the department stores which are due to report results in the coming weeks.

What about Macy's?

Macy's had reaffirmed this year's guidance of no growth in the previous quarter. Analysts are expecting the company to post $5.57bn in revenues earning 46 cents per share, that is, a zero growth in revenues with earnings declining c.13% YoY. While the company did post better than expected numbers in the first quarter, Macy's and Bloomingdales continue to face an uphill task for growth. While the company has been focused on store upgrades and delivered some positive results, it remains to be seen if the strategy works across a wider base of stores. What remains a silver lining is the performance of Bluemercury and online sales of the company. Bluemercury is the brand under which Macy's operates luxury beauty stores similar to Ultra Beauty which has grown from 100 stores in 2016 to 164 in Q1 2019. Also, the company has been aggressively expanding its SKUs with Vendor Direct sales reaching ~10% of the total sales in its latest quarter.

Where do we go from here?

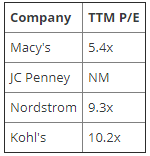

While Macy's continue to face pressure and reach new lows, the stock trades at 5.4x its trailing twelve-month earnings compared to ~11x its 5-year average. It is also among the cheapest stock compared to other department stores.

Although given it looks the company trading at all-time lows with a sharp decline in share price, I would still recommend against catching a falling knife amid continued poor performance of Macy's and the departmental stores in general. We should look at the performance this quarter to see if there are any green shoots, which looks unlikely. I would continue to recommend to avoid the stock for now and I'd revisit my thoughts provided there is any change post the company's results in the next two days.

The jury is still out for me when it comes to $M. Honestly, I'm surprised the company has done as well as it has.

Yes, it's been a tough few years for retail.

Good stuff, thanks.