Large-Cap Indices Give Out Signs Of Fatigue

The June-quarter earnings season is upon us, and US equity indices increasingly are giving out signs of fatigue. Halfway through, they have already rallied mid- to high-teen percent this year. Digestion of these gains is the path of least resistance in the weeks and months ahead. Equity bears have an opening.

The 2Q24 earnings season begins in earnest next week as the leading banks including JP Morgan (JPM) report their books.

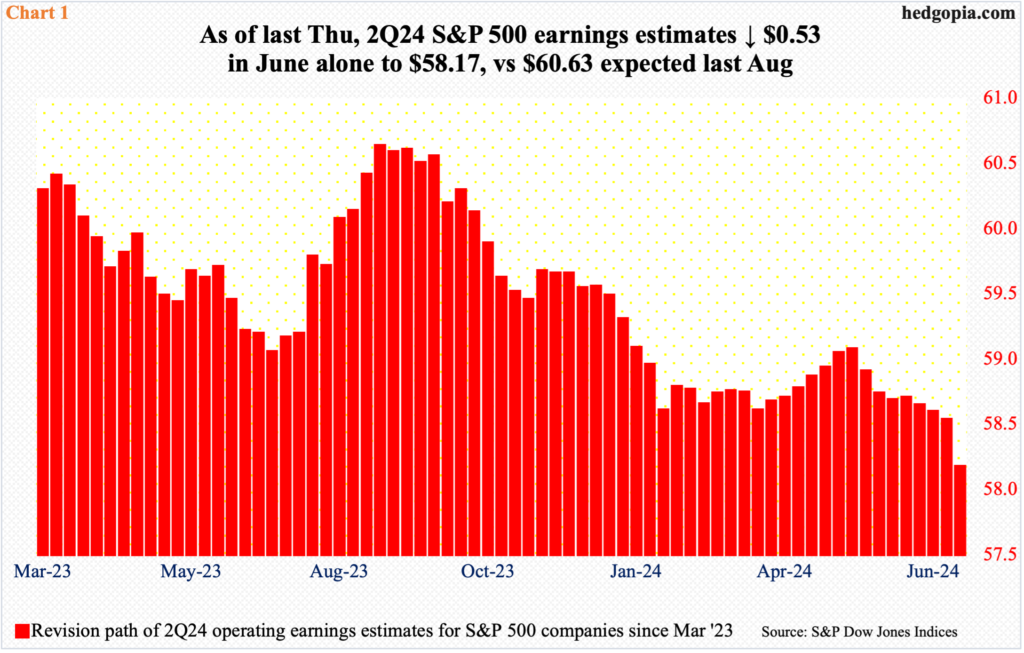

In June alone, consensus estimates for S&P 500 companies were cut by $0.53 to $58.17, with a drop of $0.36 in the 10 days through last Thursday (Chart 1). The sell-side expected as high as $60.63 last August before bringing out the scissors. This has been the established norm.

These analysts start out optimistic and begin revising their numbers lower as the year progresses and as the quarter nears. For reference, these companies brought home $54.63 in the March quarter; this compares to expectations of $57.45 in May last year.

Ahead of this, the S&P 500 hovers near its highs. The large cap index has had a phenomenal first half. Through last Friday’s new intraday high of 5524, it was already up 15.8 percent year-to-date.

Amidst this, there are signs rally fatigue is beginning to set in.

Last Friday’s fresh high came in a reversal session, with the index ending at 5460, down 0.1 percent for the week. This was the first down week – albeit nominal – in four and second in the last 10. Post-last October’s bottom, except for minor selling in March-April – down 5.9 percent – it has been straight up, with RSI divergence on the weekly, indicating slowing momentum.

Last week, a gravestone doji formed on the weekly, preceded by a weekly candle leaving behind a long upper shadow (Chart 2). Bears have an opportunity to press.

Immediately ahead, the June 12th gap-up gets filled at 5370s.

The Nasdaq 100, which is dominated by large-cap tech companies, acts the same way. It, too, reached a new intraday high last Friday – 20018 – only to reverse hard lower to end the session at 19683, down 0.1 percent for the week, forming a weekly spinning top. This was preceded by a weekly gravestone doji.

It seems tech bulls increasingly are coming under temptation to lock in gains. At Friday’s high, the Nasdaq 100 was up 1.6 percent, all of which – and then some – was given back. Through that high, it was up 19 percent for the year. From last October’s bottom, the index was up 42.4 percent. These are heady gains and have come without much of a correction. Time is ripe for one.

Immediately ahead, the June 12th gap-up gets filled at 19200s.

More By This Author:

CoT Report - We Look At What Large Specs, Hedge Funds Are Buying

Levered-Up Consumers With Low Savings And Falling Deposits Set To Cut Back Spending

Action This Week After Nasdaq 100’s Gravestone Doji Last Week Worth Watching

This blog is not intended to be, nor shall it be construed as, investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any security or ...

more