Is The Meltup Ending? "For The First Time In A While" We Are Seeing Put Skew Bid

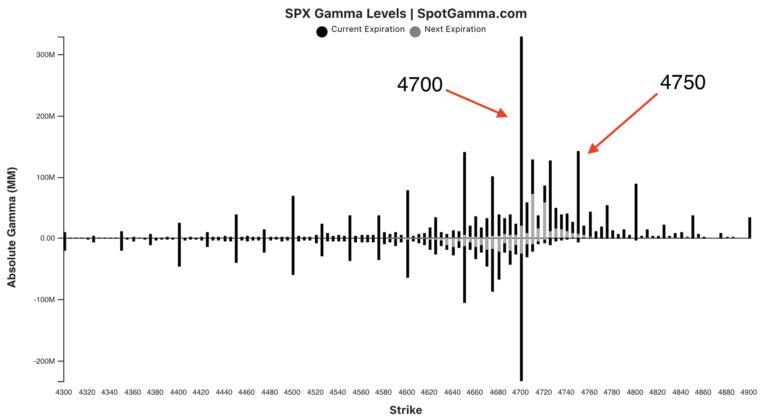

Goldman's quadrupling down on its year-end meltup call has been spot on so far, and the S&P overnight gravitated back up to the 4700 strike which continues to house the most $Gamma on the board at $8.8B, followed by the 4750 strike with $6.7BN.

(Click on image to enlarge)

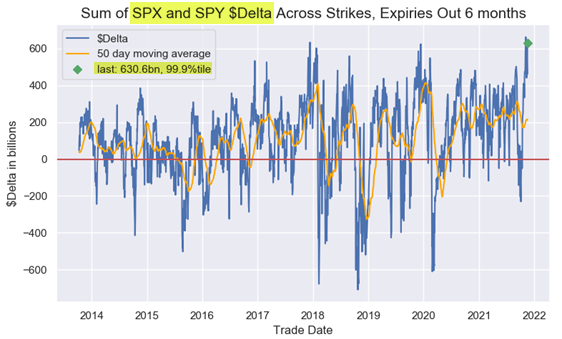

And, as Nomura's Charlie McElligott reminds us, heading into Friday's op-ex, SPX/SPY Net Delta is 99.9%ile (since ’13)...

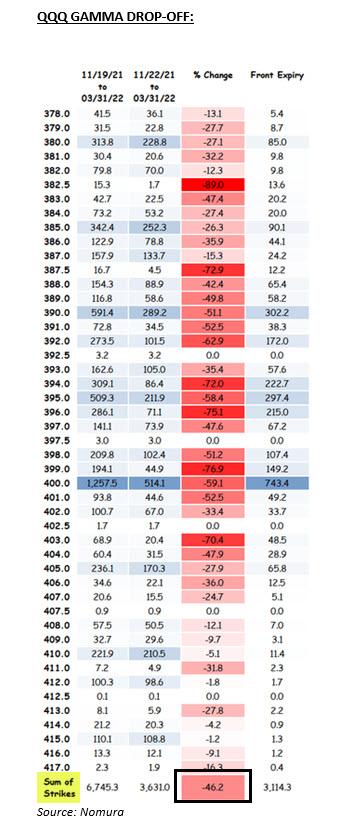

... and will see 24% come off, along with 29% of the Gamma; for Nasdaq / QQQ, Net $Delta is 99.6%ile, with 42% of the Delta coming off and 49% of the Gamma (!); and for IWM, Net $Delta is 99.0%ile, with 29% of the Delta and 40% of the Gamma dropping.

So as we now wait for the ever-important Friday Equities Op-Ex and this aforementioned very substantial front-month $Gamma / $Delta drop-off, which as usual allows for a pick up in volatility heading into it and what McElligott poetically calls a "local volatility expansion on the index level" as we unclench, the recent equity vol dynamic has really been all about the “spot up, vol up” action in the high multiple (expensive) “hyper-Growth” names.

It is no secret that these names - like TSLA for example - have been “crashing up” with vols simultaneously higher on massive grabbing into short-dated deep OTM Call optionality from retail punters creating a “Gamma squeeze” and hedgers (Dealers, MMs) covering their Delta risk while overwriters and/or legacy Call sellers got "REKT", feedback-looping into the daisy-chain which feasts on itself the higher spot goes (but also then prone for sharp reversals on the way lower as options move out of the money and Delta is purged under its own collapse), which one can see in Rivian stock today, which is plunging 17% and is once again smaller than Volkswagen.

(Click on image to enlarge)

Yet in a notable departure from recent days, McElligott points out that for the first time in awhile, we are again seeing (downside) Put Skew bid in these Secular Growth high flyers, as folks are getting increasingly nervous yet-again on a Rates/UST selloff (yields higher) into the Dec inflation data “upside surprise” risk... but at the same time that these “Growth” Nasdaq / Tech / Cons Disc indices, ETFs and single stocks themselves are back ripping to all-time highs.

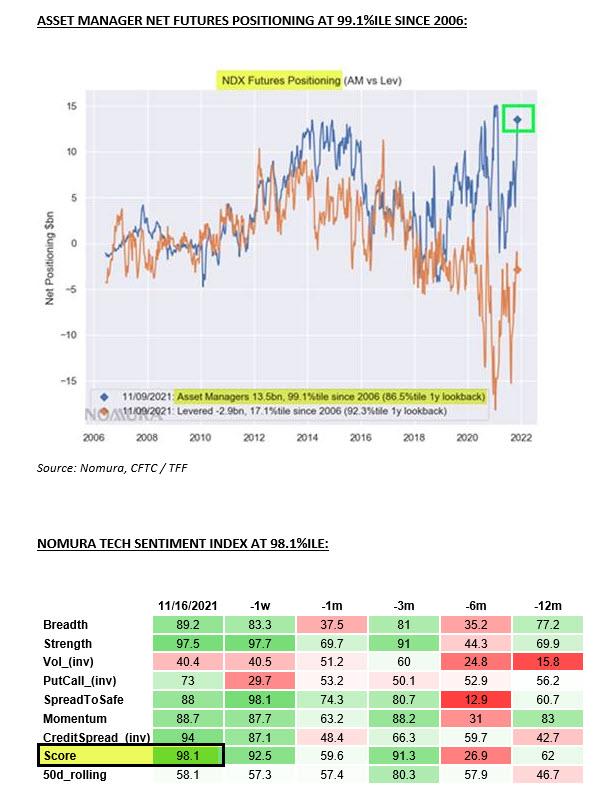

This reversal is coming with a number of other “extremes” emerging out of the Nasdaq (MSFT, AAPL, AMZN, TSLA, NVDA, GOOG / GOOGL, FB, ADBE, and NFLX at 55% weighting), Tech (MSFT, AAPL, NVDA at 50% of XLK) and Cons Disc (like TSLA at 19% of XLY alone):

- Asset Manager net notional in Nasdaq 100 futures is $13.5B net (99.1%ile since 2006) after adding +$3.3B this last weekly period (98.9%ile 1w add)

- Nomura Sentiment Index reading for the Tech sector just printed 98.1%ile since 2004

- Nomura Sentiment Index reading for Cons Disc sector just printed 93.4%ile since 2004

Looking at this sentiment reversal, McElligott agrees with Goldman's recent assessment and says that "this scramble is a function of the FOMO many had after having whiffed on this Nasdaq rally of late (which really was a function of the UST short squeeze from late Oct to early Nov, after folks were set-up for reflationary bear-steepening/cyclical value outperf), and are now grabbing back into “Growth” exposure for into the year-end trade, particularly as on the mega-cap Tech side, you get that big uplift into year-end from the buyback bid, on top of the fact that Nov has been the best month of both Global and US Equities fund flows since 2000 per EPFR which will provide those Mega Cap weightings a nice lift as well."

In other words, the meltup will likely continue even without the crazy gamma squeezes observed in a handful of retail favorite stocks, and since traders are now also hedging downside risks, the odds of an actual drop are even lower.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more