Investor Sentiment And Stock Market Timing

Fear is the most highly evolved emotion in humans; everyone experiences. Tracking the level of fear in the investing community helps us judge where the stock market is relative to its highs and lows. History doesn’t repeat itself, but people tend to repeat history. Maximum fear (of losing) is found near market lows, while “fear of missing out” (i.e. greed) occurs near market tops. That is where the old-saying, ‘the market climbs a wall-of-worry,’ comes from.

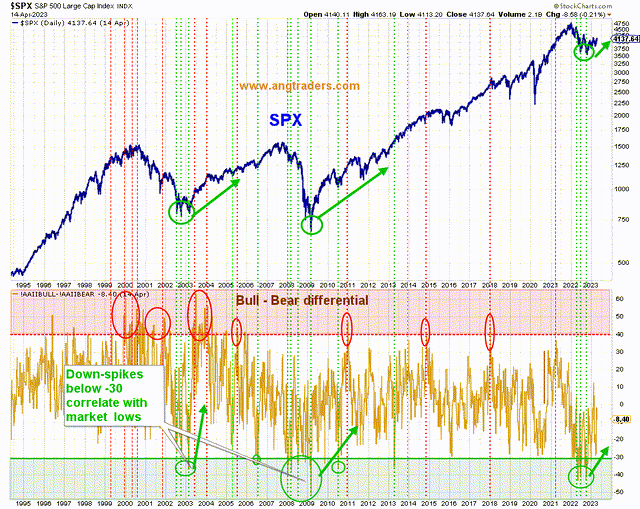

The AAII (American Association of Individual Investors) bull-bear differential has started bouncing off a level which has marked major market lows in 2003 and 2009. This level of fear is what one sees early in a bull run, not close to the end of a bull market.

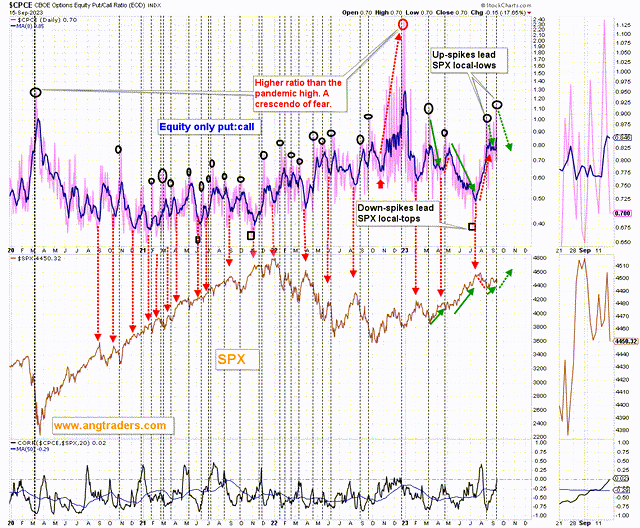

The nominal put:call ratio has made a new up-spike (black-oval) which correspond to local-lows in the SPX. This level of fear demonstrates a bullish-bias in the market.

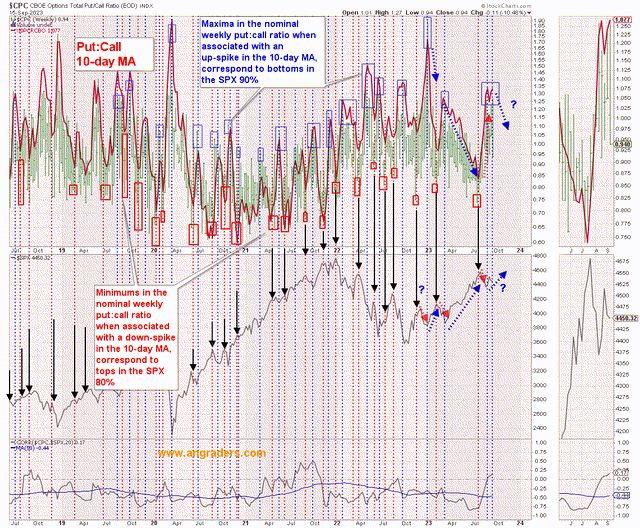

Maxima in the nominal weekly put:call ratio when associated with an up-spike in the 10-day MA, correspond to bottoms in the SPX 90% of the time. This fear level is more representative of a bottom than it is a top.

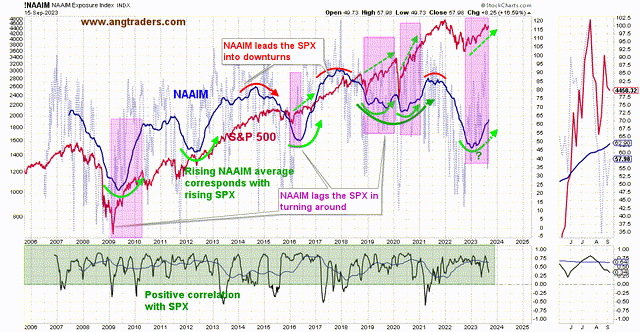

The NAAIM ( National Association of Active Investment Managers) exposure index is behaving like it does at the start of major bull moves, not like it does at the end.

There is enough worry in the market to keep it climbing higher.

More By This Author:

The Stock Market Floats On Fund-Flows

Raising Interest Rates Is Not The Solution To Inflation In The Short-Term. No Recession In 2023.

A Technical Check-Up Of The Stock Market