Raising Interest Rates Is Not The Solution To Inflation In The Short-Term. No Recession In 2023.

In this article, we argue that, in the short-to-medium term, raising rates is the wrong way to lower inflation and that a recession is unlikely in 2023.

Most central banks are hiking rates at present as a reflection of the dominance of the New Keynesian prioritisation of monetary policy as a counter-stabilising, anti-inflationary policy tool over fiscal policy. One central bank is not following suit — the Bank of Japan. The BOJ has not shifted rates, is maintaining its yield curve control policy and the government is expanding fiscal policy. The diametric opposite to the New Keynesian approach. We now have enough data to assess the relative merits of the two approaches. Japan has lower inflation, no currency crisis and its citizens are better off as a result of the monetary-fiscal policy initiatives….Prof. Bill Mitchell

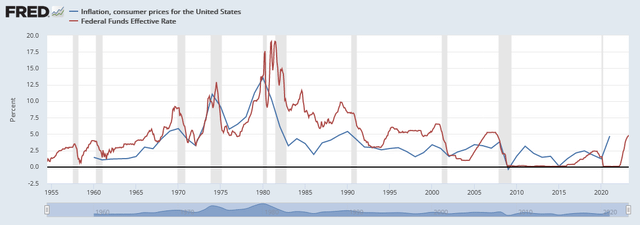

From the start, we have said that inflation is a supply issue and that increasing interest rates will work against inflation-reduction until rates get so high that private debt can no longer be serviced and assets get sold off, causing a recession. The chart below shows how inflation rises and falls with rates, i.e. positive correlation.

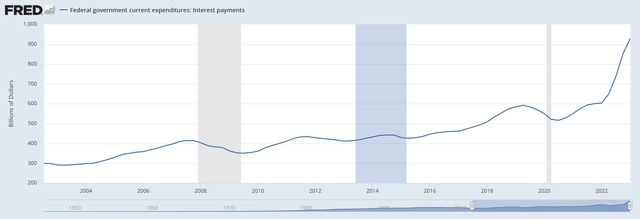

Higher rates add income to those entities that already have excess money while taking away from low-income mortgage holders. Inflation is moderating but would have fallen faster if hundreds of billions of dollars had not been created and given to the already rich.

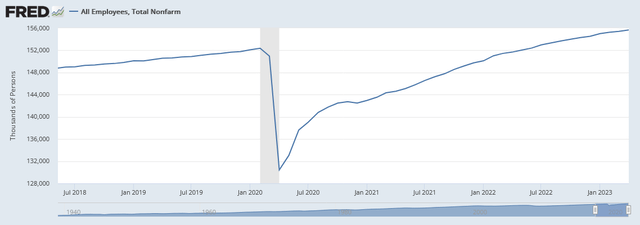

Because people have jobs…

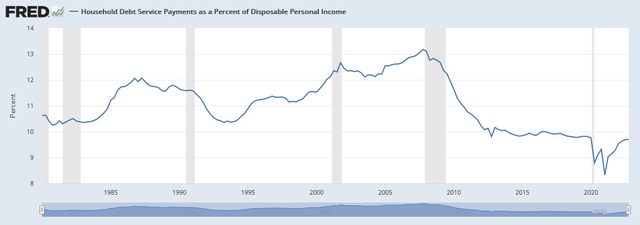

…and because households are near historic-low indebtedness…

…the economy can withstand significantly higher rates before a recession takes hold.

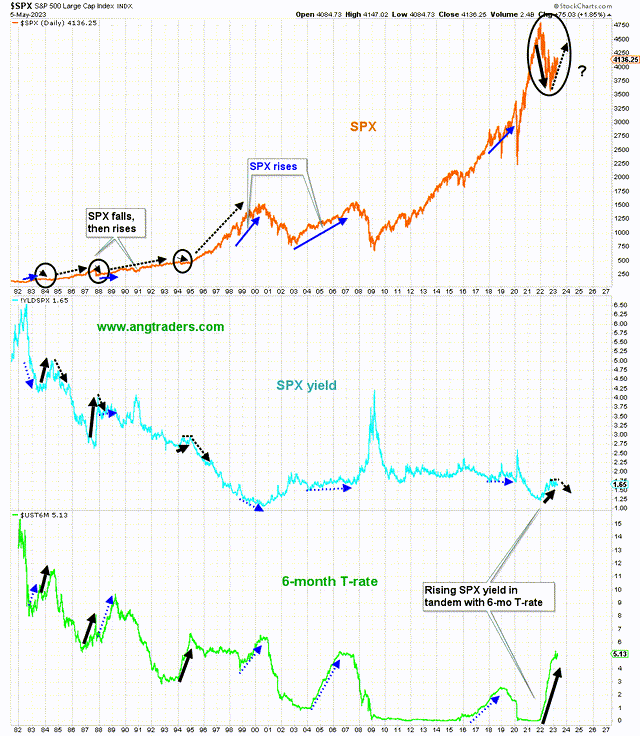

The SPX has always rallied in tandem with the 6-month T-rate, as it is now doing (chart below).

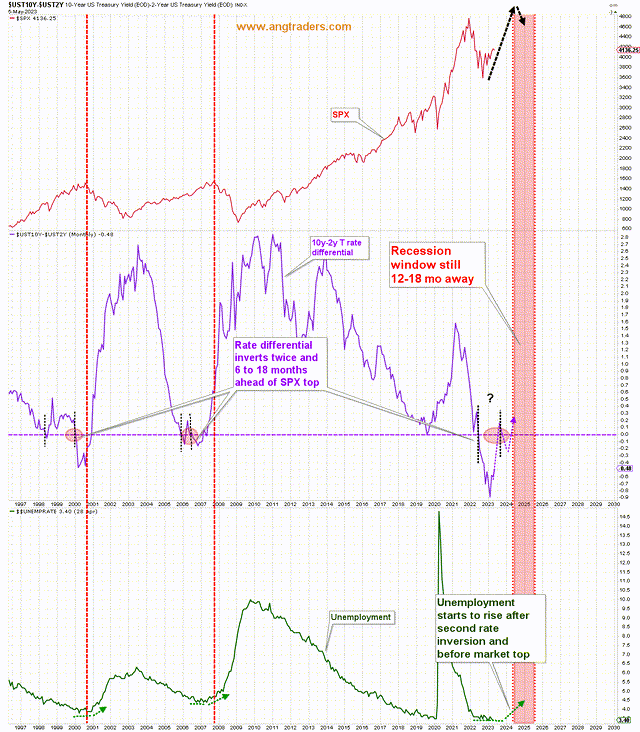

Historically, the 10y-2y differential has inverted twice before a bear market develops. According to that pattern, the differential has inverted only once and is currently heading higher. A recession is unlikely in 2023 (chart below).

In spite of eighteen months of incessant warnings of an impending recession, non has occurred (chart below).

…and for at least the next six months, we maintain that the economy will remain recession-free; notwithstanding a default of the US debt.

Investors can take advantage of the “herd’s” economic misunderstanding by going long broad-spectrum ETFs such as QQQ, SPY, DIA, and IWM.

More By This Author:

A Technical Check-Up Of The Stock Market

A Shot Of Liquidity

Liquidity Breakout And The Resart Of QE