The Stock Market Floats On Fund-Flows

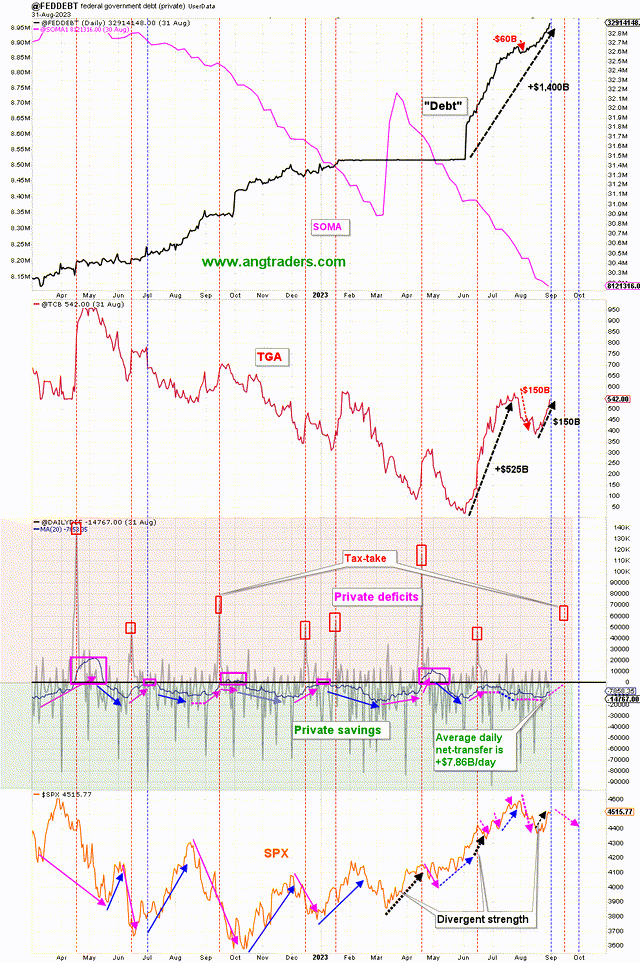

August is now finished and the fund-flow numbers are in:

- net-transfer for the month of August is +$258B (14% higher than last August),

- the net-transfer so far fiscal 2023, is +$1,579B (41% higher than last year at this time).

This positive net flow suggests that the seasonal weakness around the September tax-take and new fiscal budget negotiations could be muted this year; we may not see as big of a dip as we normally do in the September-October time period.

As expected, the SPX rallied to close out the month of August, and even though the average net-transfer is weakening, the SPX could still hold up in early September ahead of the September 15 tax-take, but some weakness is likely after that--even if it is less severe than in the past.

Aggregate bank credit has been on a down-trend all year, driven lower mostly by weak commercial and industrial loans. The government's fiscal impulse (much of it coming from interest payment) has prevented this weakness from affecting the economy or the stock market. The way I see it, this low level of loan creation gives us room for credit expansion in the future if the fiscal stimulus is interrupted.

The liquidity model has been stagnant all summer and the normal positive correlation with the SPX has diverged into the negative. A return back to the norm can come from the liquidity rising with the SPX, or the SPX dropping with the liquidity.

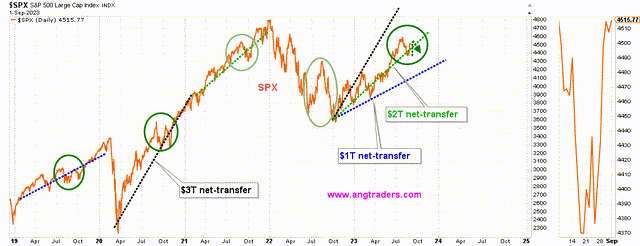

The SPX has bounced back above the $2T net-transfer rate, but since we are on-pace to have only a $1.6T net-transfer, we are still expecting a drop below the green line in September-October as the tax-take and new budget "fist-fights" take their toll.

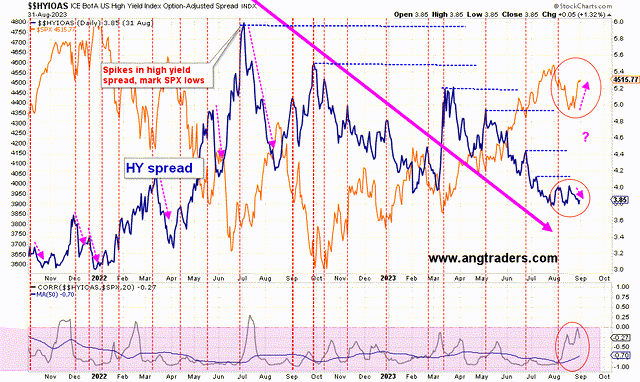

The HY spread is starting to return to its bull trend (negative correlation).

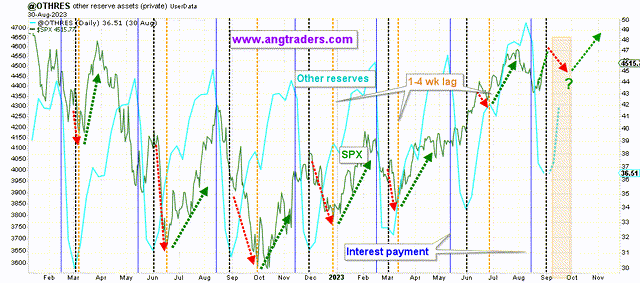

The "other" reserves reaches a minimum once each quarter (black vertical dotted-lines) and the SPX makes a low 1-4 weeks later (yellow-verticals). According to this pattern, the SPX will make a low around the end of September and rally after that.

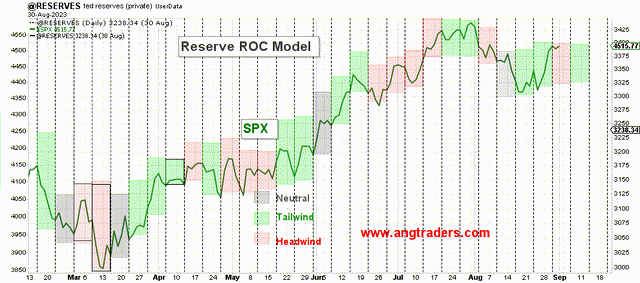

The reserve model is in a headwind period until the end of next week when a tailwind is set to start.

The foreign reverse repo model has implied a local minimum (green box) in the SPX. It is uncertain which way it goes from here, but the best guess is that we go a bit higher in the first two weeks of September and then dip lower.

In summary: Fund flows for August were positive, suggesting a potential muted dip in September-October compared to previous years. Aggregate bank credit has been on a down-trend, but fiscal stimulus has prevented it from affecting the economy or stock market.The SPX is expected to make a low around the end of September and rally after that, according to historical patterns.

More By This Author:

Raising Interest Rates Is Not The Solution To Inflation In The Short-Term. No Recession In 2023.

A Technical Check-Up Of The Stock Market

A Shot Of Liquidity