High Dividend 50: Truist Financial Corporation

High-yield stocks pay out dividends that are significantly more than market average dividends. For example, the S&P 500’s current yield is only ~1.3%.

High-yield stocks can be very helpful to shore up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Truist Financial Corporation (TFC) is part of our ‘High Dividend 50’ series, where we analyze the 50 highest yielding stocks in the Sure Analysis Research Database.

This article will examine the company to see if Truist Financial is worthy of investment.

Business Overview

Truist is a holding company in the U.S. that resulted from a merger of equals between BB&T and SunTrust Bank in late 2019.

Truist offers a wide rage of financial services, including retail and commercial banking, investments, wealth management, asset management, mortgage, corporate banking, capital markets, and specialized lending. The company is valued at $54 billion.

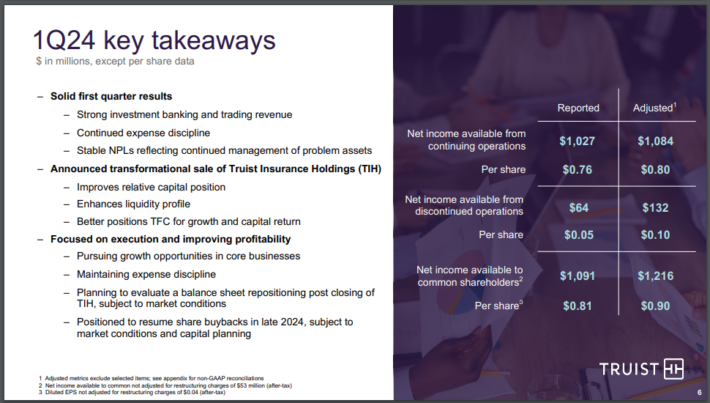

Truist reported first quarter results on April 22nd, 2024.

Source: Investor Relations

The company’s adjusted net income totaled $1.22 billion, or $0.90 per share, which compared unfavorably to adjusted net income of $1.4 billion, or $1.05 per share, in the prior year.

Average assets declined $29 billion, or 5.2%, to $531 billion year-over-year while average loans and leases were down $19 billion, or 5.8%, to $3.09 billion. Deposits were lower by 5% to $389 billion.

Net interest income of $3.425 billion, which was down from $3.918 billion in the prior year. As a result, the net interest margin contracted 28 basis points to 2.89%. This was the result of higher deposit costs coinciding with a decline in earning assets.

Truist recorded a $500 million provision for credit losses, down slightly from $502 million in the prior year. In addition, net charge-offs totaled $490 million, or 0.64%, of average loans and leases, which was up from $297 million, or 0.37%, in the first quarter of 2023.

Truist is expected to earn $3.37 per share in 2024, which would be a 6.1% decrease from the prior year. We expect that the company will grow earnings-per-share by 9% annually over the next five years.

Growth Prospects

Truist has struggled to produce growth in recent years. The bank’s earnings-per-share have compounded at a rate of 3% over the last decade.

However, earnings-per-share have declined by almost 2% annually over the last five years.

Truist does have some ways to improve its bottom-line. This includes organic growth through commercial and retail loan growth.

Average loans did decrease almost 6% in the most recent quarter on a year-over-year basis, but were down just 1.3% on a sequential basis, so the pace of the declines has stabilized.

Also hindering results has the been the increased cost of deposits given the high interest rate environment that currently exists. This has weighed on net interest income as seen by the recent declines.

Interest expenses have surged, including a 65% increase in the first quarter as it becomes more costly for banks to offer higher interest rates on deposits.

There are some areas that Truist can leverage to improve its business performance.

The company has made investments to improve its digital capabilities. This has paid off substantially in a very short period of time.

Source: Investor Relations

Customers across the banking industry are moving towards the use of digital access to complete many of their banking tasks. First quarter digital transactions of 76 million represented a 13% increase from same period in 2023. More than three-quarters of deposit took place in self-service channels, an increase of 5 percentage points over the past five quarters.

The adoption of Zelle, a leading peer-to-peer payment service, has been especially strong, with transactions up more than 40% in the most recent quarter.

Truist is also taking steps to focus on its core business by eliminating those not key to the company’s future. This includes the sale of its remaining stake in Truist Insurance Holdings for $10.1 billion.

Additionally, Truist made the strategic decision to sell nearly $28 billion of its lower-yielding investments at an after-tax loss of $5.1 billion. The company then invested close to $19 billion in shorter duration investments that yield almost 5.3%.

Competitive Advantages & Recession Performance

Prior to merging, BB&T and SunTrust were regional banks that lacked the size and scale of the larger names in the industry.

That changed following the tie up as Truist is now a top-10 bank commercial bank in the U.S. that commands a larger market share of high-growth areas around the country.

This should help the bank during the next recessionary period, something both banks struggled with during the Great Recession:

BB&T’s performance during the 2007 to 2009 period:

- 2007 earnings-per-share: $3.14

- 2008 earnings-per-share: $2.71 (14% decline)

- 2009 earnings-per-share: $1.15 (58% decline)

SunTrust’s performance during the 2007 to 2009 period:

- 2007 earnings-per-share: $4.56

- 2008 earnings-per-share: $2.12 (54% decline)

- 2009 earnings-per-share: -$3.98 (288% decline)

Both companies saw their earnings-per-share decline drastically during this period, with SunTrust performing much worse.

That said, the combined entities held up much better during the Covid-19 pandemic. Earnings-per-share did fall 13% in 2020, but rebounded to make a new high the very next year.

Given the company’s performance during economic downturns, it is likely that a decrease in profitability would occur in the next recession.

Dividend Analysis

While the company’s long-term results and recession performance have been underwhelming, Truist’s dividend growth has been quite strong. Over the last decade, the dividend has a CAGR of just over 9% over the last decade.

It should be noted that Truist has maintained the same quarterly payment for 8 consecutive quarters. If the company does not increase its dividend this calendar year then Truist’s 12 year dividend growth streak will end.

Shares yield 5.1%, which is among the highest yields that the stock has offered in the last 10 years.

Typically, an unusually high yield coupled with a stagnant distribution could foretell that the dividend could be at risk for being cut or even eliminated.

While we do not believe that a dividend cut is imminent, there is the likelihood that dividend growth will remain muted in the near-term.

The company should distribute at least $2.08 per share in 2024, resulting in a payout ratio of 62%. Aside from last year, the normal payout range has been 35% to 45% since 2014.

With company’s payout ratio well outside of its usual range, shareholders should not expect to see much in the way of dividend growth.

That said, if our projected earnings growth materializes then the payout ratio could become much more reasonable, leading to the possibility of future increases.

Final Thoughts

Truist has transformed from two regional banks to one of the larger commercial banks in the country. Growth has been sporadic over the long-term and the recession performance leaves much to be desired.

Accompanying the slowdown in earnings has been a dividend pause. The heightened payout ratio and dividend yield implies the potential for a reduction in shareholder payments, though we believe that a pause is the most likely outcome.

Investors looking for dividends from the banking industry might find the yield attractive, but we caution that those looking for dividend growth could be disappointed by the name.

Those looking for earnings growth and income could do well owning shares of the company.

More By This Author:

3 Dividend Kings Yielding Over 3%High Dividend 50: Wesbanco, Inc.

High Dividend 50: Donegal Group Inc.

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more