Have Earnings Estimates Come Down Enough?

Image Source: Pexels

The overall picture that emerged out of the Q3 earnings season was one of stability and resilience, even as the negative revisions trend accelerated.

Earnings weren’t great, but they weren’t bad either. Many in the market feared an earnings cliff that would force management teams across many industries to provide downbeat guidance.

Not much growth was expected given where we are in the economic cycle. But the actual growth coming through the results was ever so slightly better than expected. It is this performance relative to expectations rather than the absolute level of earnings or the growth pace that is of relevance to the market.

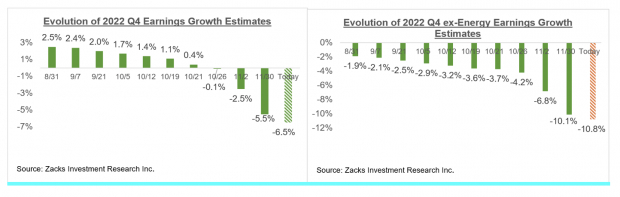

Expectations for 2022 Q4 and beyond have been reset lower, as we have been pointing out for a while now. Analysts have been steadily cutting their estimates, reversing the positive revisions trend that we witnessed during the Covid quarters.

We saw this in the run-up to the start of the Q3 earnings season, and the trend continues with respect to estimates for the current period (2022 Q4) and full-year 2023.

The charts below show how earnings growth expectations for the 2022 Q4, as a whole, and on an ex-Energy basis, have since the quarter got underway:

Image Source: Zacks Investment Research

The chart below shows how the expected aggregate total earnings for full-year 2023 have evolved on an ex-Energy basis:

Image Source: Zacks Investment Research

As we have consistently been pointing out, aggregate S&P 500 earnings outside of the Energy sector peaked in mid-April and have been steadily trending down ever since.

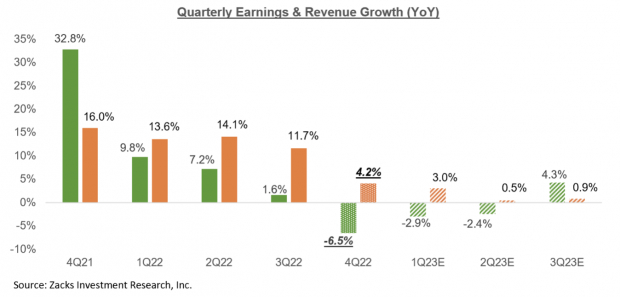

The Overall Earnings Picture

The chart below that provides a big-picture view of earnings on a quarterly basis. The growth rate for Q4 is on a blended basis, where the actual reports that have come out are combined with estimates for the still-to-come companies.

Image Source: Zacks Investment Research

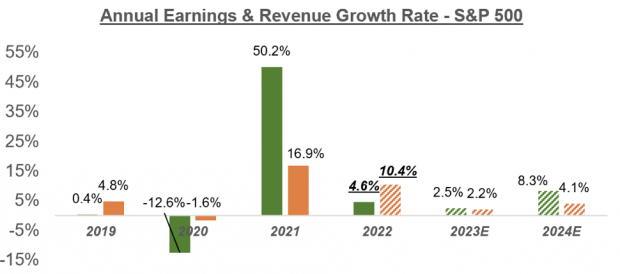

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue:

Image Source: Zacks Investment Research

As you can see, earnings next year are expected to be up only +2.5%. This magnitude of growth can hardly be called out-of-sync with a flat or even modestly down economic growth outlook. Don’t forget that headline GDP growth numbers are in real or inflation-adjusted terms while S&P 500 earnings discussed here are not.

As mentioned earlier, 2023 aggregate earnings estimates on an ex-Energy basis are already down by more than -11% since mid-April. Perhaps we see a bit more downward adjustments to estimates over the coming weeks, after the Q4 reporting cycle really gets underway. But we have nevertheless already covered some ground in taking estimates to a fair, appropriate level.

This is particularly so if whatever economic downturn lies ahead proves to be more of the "garden variety” than the last two such events. Recency bias forces us to use the last two economic downturns, which were also among the nastiest in recent history, as our reference points. But we need to be cautious against that natural tendency as the economy’s foundations at present remain unusually strong.

More By This Author:

Are We Headed For An Earnings Cliff?

Breaking Down Retail Earnings That Highlight Slowing Consumer Spending

Previewing Retail Sector Earnings As Inventory Issues Linger

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more