Previewing Retail Sector Earnings As Inventory Issues Linger

Image Source: Unsplash

Walmart (WMT - Free Report) shares have recouped a big part of the losses they suffered following the disappointing April-quarter results on May 17th. The Walmart sell-off was reinforced by an even more disappointing release from Target (TGT - Free Report) the following day.

Unlike the market’s indiscriminate negative reaction to Walmart and Target’s quarterly reports in May, it reacted favorably to Walmart’s July-quarter release on August 16th even though Target shares sold off on its quarterly report the following day.

This recent history is useful to keep in mind as we look ahead to the October-quarter reports from Walmart and Target on Tuesday (11/15) and Wednesday (11/16), respectively.

The chart below shows the year-to-date performance of Walmart (blue line) and Target (red line) shares relative to the S&P 500 index (green line).

Image Source: Zacks Investment Research

Part of the explanation for Walmart’s stock market stability is the nature of its business which offers a high degree of defense during periods of economic instability and uncertainty. Walmart also benefits from its perceived value proposition to customers that likely prompts segments of consumers to ‘trade down’ to its stores.

The big issue in the last two quarterly releases for Walmart and Target centered on rising inventory levels, which reflected the combined effects of shifting consumer behavior and moderating sales. The market seems to believe, based on its treatment of the two stocks, that Walmart is further along in addressing its inventory issue than Target.

We have no reason to disprove the market’s optimism about Walmart on the inventory issue, but we can nevertheless see the stock as vulnerable to any signs of weakness in this week’s quarterly report. On the flip side, Target shares appear ‘spring loaded’ for a bounce if the company’s release Wednesday morning turns out to be ‘less bad’ than the market fears.

With respect to the Retail sector 2022 Q3 earnings season scorecard, we now have results from 21 of the 34 retailers in the S&P 500 index. The Retail sector companies that have reported already are digital vendors like Amazon (AMZN) or restaurant operators like McDonald’s (MCD).

Unlike the official S&P sector classifications that leaves retail sector players spread around different sectors, primarily Consumer Discretionary, Zacks’ stand-alone Retail sector classification that houses conventional retailers, digital players and restaurants allows for a more granular understanding of trends in the space.

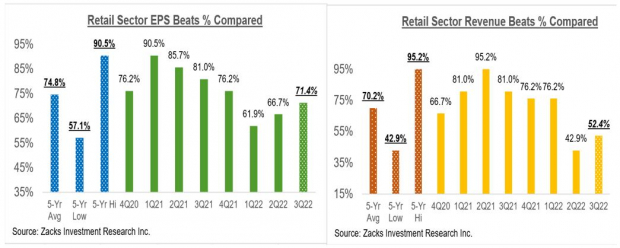

Total Q3 earnings for these retailers are down -5.8% from the same period last year on +10.4% higher revenues, with 71.4% beating EPS estimates and 52.4% beating revenue estimates.

The comparison charts below put the Q3 beats percentages for these retailers in a historical context.

Image Source: Zacks Investment Research

As you can see above, retailers have been struggling to come out with positive surprises thus far, with the trend particularly notable on the revenues side.

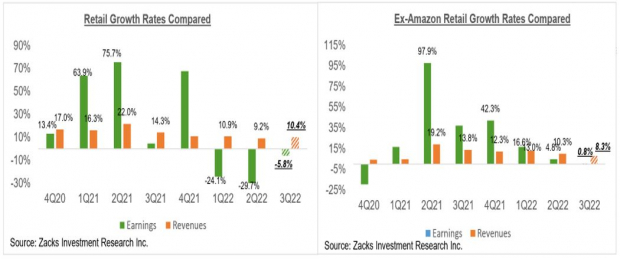

With respect to the earnings and revenue growth rates, Amazon’s weak numbers play a significant role in the year-over-year growth rate for the sector (Amazon is part of the Zacks Retail sector and not the Zacks Technology sector).

The two comparison charts below show the Q3 earnings and revenue growth relative to other recent periods, both with Amazon’s results (left side chart) and without Amazon’s numbers (right side chart).

Image Source: Zacks Investment Research

This Week’s Reporting Docket

We have more than 350 companies on deck to report results this week, including 15 S&P 500 members. Notable companies reporting this week, aside from a host of traditional retailers, include Nvidia (NVDA - Free Report), Cisco Systems (CSCO - Free Report), Applied Materials (AMAT - Free Report), and others.

Q3 Earnings Season Scorecard

Including all of the results that came out through Friday, November 11th, we now have Q3 results from 461 S&P 500 members that combined account for 92.2% of the index’s total membership.

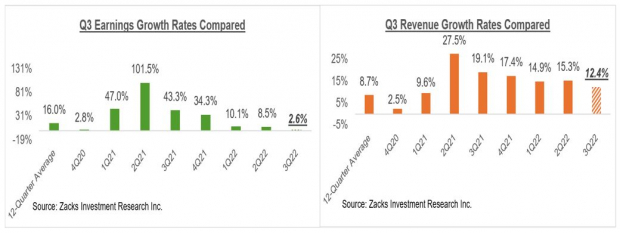

For the 461 index members that have reported results already, total earnings are up +2.6% from the same period last year on +12.4% higher revenues, with 69.4% beating EPS estimates and 67.9% beating revenue estimates.

Here is how the 2022 Q3 earnings and revenue growth rates for these companies compare across different periods.

Image Source: Zacks Investment Research

Here is how the 2022 Q3 EPS and revenue beats percentages for these companies compare across different periods.

Image Source: Zacks Investment Research

The EPS and revenue beats percentages are below what we had seen from this same group of companies in recent quarters, but otherwise within the historical range by now.

Tracking Earnings Estimate Revisions

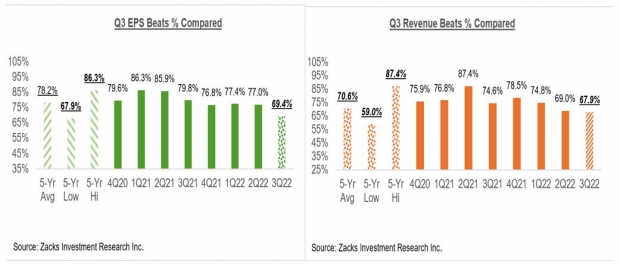

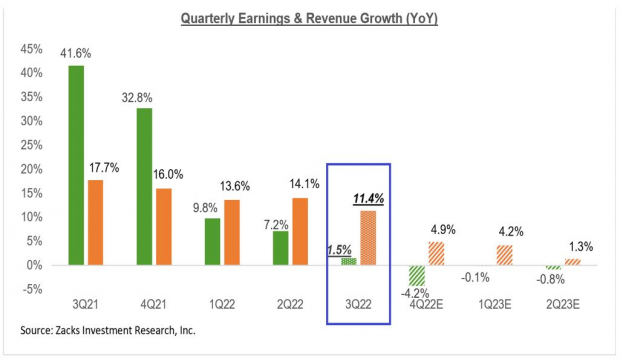

The chart below that shows the blended earnings and revenue growth for 2022 Q3 relative to what we saw in the preceding four quarters and what is expected in the coming three periods.

Image Source: Zacks Investment Research

This is no surprise, as the global economy is going through a synchronized slowdown, under the combined effects of rising interest rates in response to inflationary pressures, still-lingering logistical challenges that have started to ease up and China’s continuing zero-Covid restrictions.

The orange bars in the chart above represent revenue growth. So, for 2022 Q3, revenues are on track to grow +11.4% from the same period last year even though earnings are only expected to be up +1.5%. This seemingly elevated revenue growth is a direct function of pricing power, with companies able to pass on rising input costs to end consumers. We intuitively know that this can’t go on forever and current projections for the next three quarters bears out this intuition.

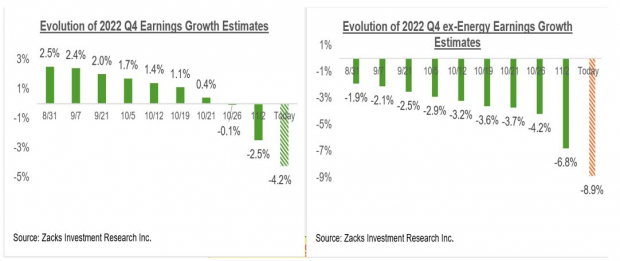

The above chart shows that earnings in the current period (2022 Q4) are expected to be -4.2% below the year-earlier level on +4.9% higher revenues. Estimates have been steadily coming down, in line with the trend that we saw ahead of the start of the Q3 earnings season.

Image Source: Zacks Investment Research

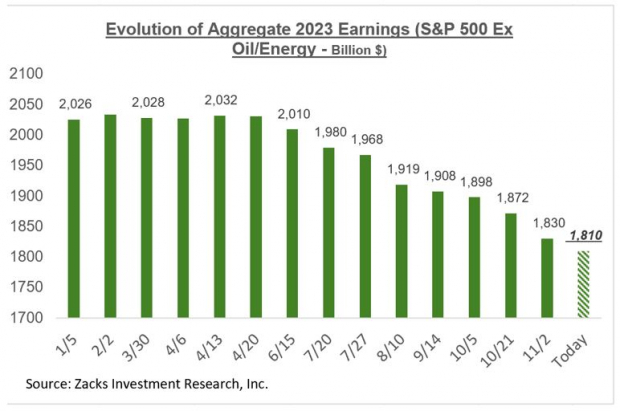

Estimates for full-year 2023 have been coming down as well, with the negative revisions trend particularly notable on an ex-Energy basis. You can see this in the chart below that shows the aggregate 2023 earnings estimate on an ex-Energy basis.

Image Source: Zacks Investment Research

Since mid-April, 2023 earnings estimates in the aggregate have come down by -8.1% for the S&P 500 index as a whole and -10.9% on an ex-Energy basis. The cuts to estimates have been particularly notable for the Tech (down -18.2% since mid-April), Construction (-22.3%), Retail (-18.4%), Industrial Products (-11.9%), Consumer Discretionary (-18.1%) and Aerospace (-12.0%).

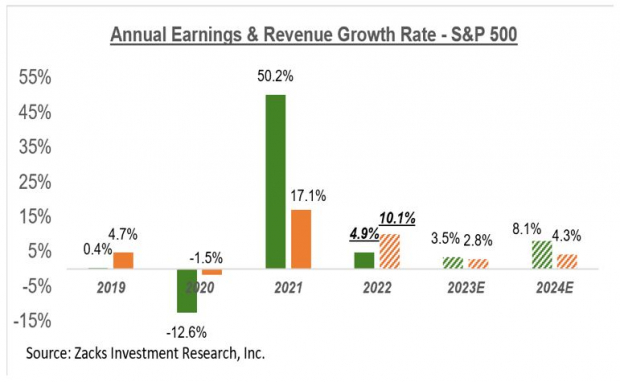

The chart below shows the overall earnings picture on an annual basis.

Image Source: Zacks Investment Research

There are some in the market who think that 2023 earnings should be below the 2022 level instead of the current expected +3.5% growth simply because the U.S. economy is expected to go through a moderate recession.

I am not suggesting that 2023 earnings can’t be below the 2022 level; they can be and on current revisions trend are likely headed there. But it is wrong to expect moderate declines in ‘real’ GDP to automatically result in ‘nominal’ or non-inflation adjusted corporate earnings to also decline. Corporate revenues and earnings are ‘nominal’ values and will reflect the effects of inflation. Inflation is expected to come down in 2023 but nevertheless remain positive.

More By This Author:

Q3 Earnings Season - Better Than Expected Or Lackluster?

3 Things We Learned From The Q3 Earnings Season

How To Make The Most Of Today's Market

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more