Q3 Earnings Season - Better Than Expected Or Lackluster?

Image: Bigstock

The earnings picture has been weighed down by headwinds like inflation, supply-chain bottlenecks, and macroeconomic uncertainty over the last few quarters and these factors were very much at play in the Q3 earnings season as well.

In addition to these headwinds, the strong U.S. dollar emerged as a significant negative earnings factor that weighed on the profitability of all companies with big international operations. These range from Tech players like Microsoft (MSFT - Free Report) and Adobe (ADBE - Free Report) to consumer operators like Coke (KO - Free Report) and others.

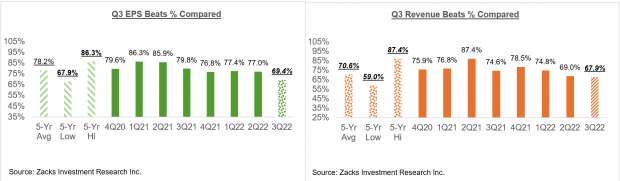

With respect to the earnings season scorecard, we now have Q3 results for 461 S&P 500 members or 92.2% of the index’s total membership. Total earnings for these companies are up +2.6% from the same period last year on +12.4% higher revenues, with 69.4% beating EPS estimates and 67.9% beating revenue estimates.

The comparison charts below put the EPS and revenue beats % for these 461 index members in a historical context.

Image Source: Zacks Investment Research

Contrary to pre-season fears of this earnings season prompting a lower reset for expectations, the tone and substance of management guidance has been good enough; not great, but not bad either.

More By This Author:

3 Things We Learned From The Q3 Earnings SeasonHow To Make The Most Of Today's Market

The Earnings Picture Is Good, But Not Great

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more