Global Diversification Is Still Working

When the stock market booms like this we inevitably start getting questions about why we shouldn’t be 100% stocks.1 More recently, the discussion has become even more concentrated as US stocks have outperformed international by a huge margin and now investors are wondering “why shouldn’t I be 100% stocks AND 100% US stocks?” Let’s dig into the data and get some perspective on this.

The purpose of diversification is to spread your bets out in such a way that you reduce the odds of the worst outcomes while still benefiting from good outcomes. But when you diversify you also reduce the odds of achieving the very best outcomes. In other words, diversification sacrifices the optimal outcome in order to achieve a good outcome.

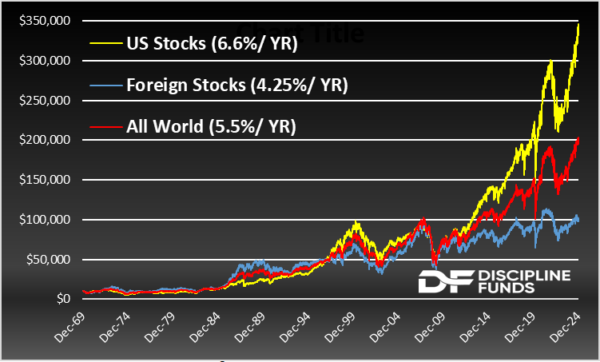

Over the last 50+ years global stocks have earned 5.5% after inflation. That’s a tremendously good result and if you’d invested $10,000 in 1970 you’d have over $200,000 today. If you’d invested only in foreign stocks you’d have about $100,000. And if you’d invested only in US stocks you’d have about $350,000. Now, put yourself in the shoes of the foreign-only investor. That person had a 10X return, which is a perfectly fine outcome, but they wish they’d diversified. And then you have the diversified investor who has $200,000 and they look at the US investor and wish they’d been more concentrated. But what you’ll never hear that diversified investor say is that they wish they’d been heavier in foreign. They can’t see the brown grass because they’re blinded by the beautiful green grass.

Our relative living standards in the world are biased to only seeing the places where the grass is greener instead of seeing how our decisions avoided all the places where the grass is browner. And that’s a huge problem because the grass will always be greener somewhere else. And the thing about green grass is that it’s green because it’s already gone through its brown phase and is now maturing before a new growth cycle. So, when we all decide to trample onto the green grass thinking we’re improving our living standards we’re really just moving to a new yard that looks better now, but might actually be dying.

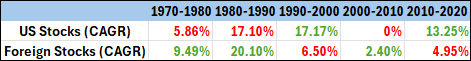

Look, I am about the most rah-rah-USA person you’ll ever meet. I think the US stock market outperformance is a sign that the USA has the best economy and best innovators in the world. But I also know these things tend to move in cycles and there’s an important fact that recent history ignores. The following graphic shows the nominal returns of US and foreign stocks by decade. As you can see, these things ebb and flow. There isn’t a single market that always outperforms in all decades.

Is this a new paradigm where the USA will perpetually outperform everything? Sure, I guess it could be, but why take the risk of being exposed to the future potential bad outcome when we know that diversification will help us achieve a good outcome that reduces the risk of being exposed to that bad outcome?

In short, the huge performance of the USA isn’t a sign that diversification is failing. It’s a sign that diversification is doing precisely what we expect it to. And that’s a good thing.

1 – I didn’t answer this question because I’m sure you know my answer. Stocks are long-term instruments that cannot provide the sort of near-term principal stability we all need to meet short-term expenses. There’s nothing wrong with being aggressive (100% stocks might even make perfect sense if you have a high income and long time horizon), but most of us need more balance in our lives, not just for managing our cash-flows, but also for managing our own behavior.

More By This Author:

Strategic Reserves And Stuff

Weekend Reading – BBB Edition

Could Trump Be Deflationary?

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more