Could Trump Be Deflationary?

The baseline assumption from markets in the aftermath of the Trump victory is that the economy will be modestly more inflationary than otherwise expected. But what if the market has this one exactly wrong? What if Trump could be more deflationary than not? That’s the conclusion I am now considering, as I mentioned to Oliver Renick in an interview today on Schwab TV (watch here). Here’s the logic.

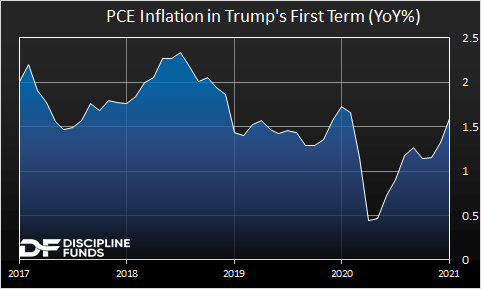

First, Trump’s first term was not remotely inflationary. In the pre-Covid years, headline PCE inflation averaged just 1.7%. That’s despite persistent worries about tax cuts, deficits and tariffs. It just never materialized.

Second, I suspect that the worries over Trump’s tariffs are overblown. Trump is an expert negotiator and what better tool could he use than the threat of tariffs? We saw this consistently during his first term where he would visit domestic companies and foreign countries with threats of tariffs. We never got the full scope of tariffs that he often threatened and he used them mostly as a negotiating tool. I think we’re on the verge of something similar here.

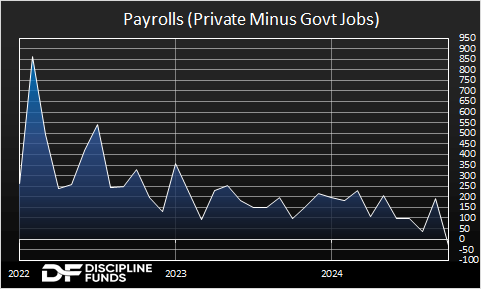

Third, it’s looking like Trump could take a hatchet to government employment and regulations. These are meaningful deflationary policy moves. Vivek Ramaswamy has said that there’s 1-2MM government jobs that are low-hanging fruit. That’s a lot of jobs. Will they actually cut that many? If they cut 1MM government jobs that would reduce payrolls by 83K jobs per month over a year. Heck even if they don’t cut any jobs we know that the tailwind of government jobs is gone.

Over the last 3 years, the government accounted for 1.5MM jobs. That’s 42K jobs per month. If you back out government jobs from the last 6 months of payroll reports you end up with an average of 100K jobs per month. Last month’s report would have been -30K jobs without government employment.

Importantly, the U1 rate, people unemployed for 15+ months, has been ticking higher for the last 6 months. This is a sign of slack in the labor market as people remain unemployed for longer. So we’re not going to see all these government jobs get absorbed quickly by the private sector.

This is a big deal, especially when you consider that the Fed is increasingly concerned about the state of the labor market. So, going forward you have to assume at least a modest headwind to payroll reports. If they actually cut 1-2MM jobs then you’re looking at a very significant headwind to payrolls, growth, and inflation.

When you add it all together I don’t think it’s such a sure thing that inflation is likely to move higher under Trump. In fact, using the baseline assumption from Trump’s first term and the potential for government employment cuts I think the baseline assumption is that Trump could end up being more disinflationary or deflationary than many expect.

More By This Author:

Three Things – Election Autopsy EditionChart Of The Day – Ignoring Political Noise

The Employment Report And Future Inflation

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more