Fixed Income Looks Appealing

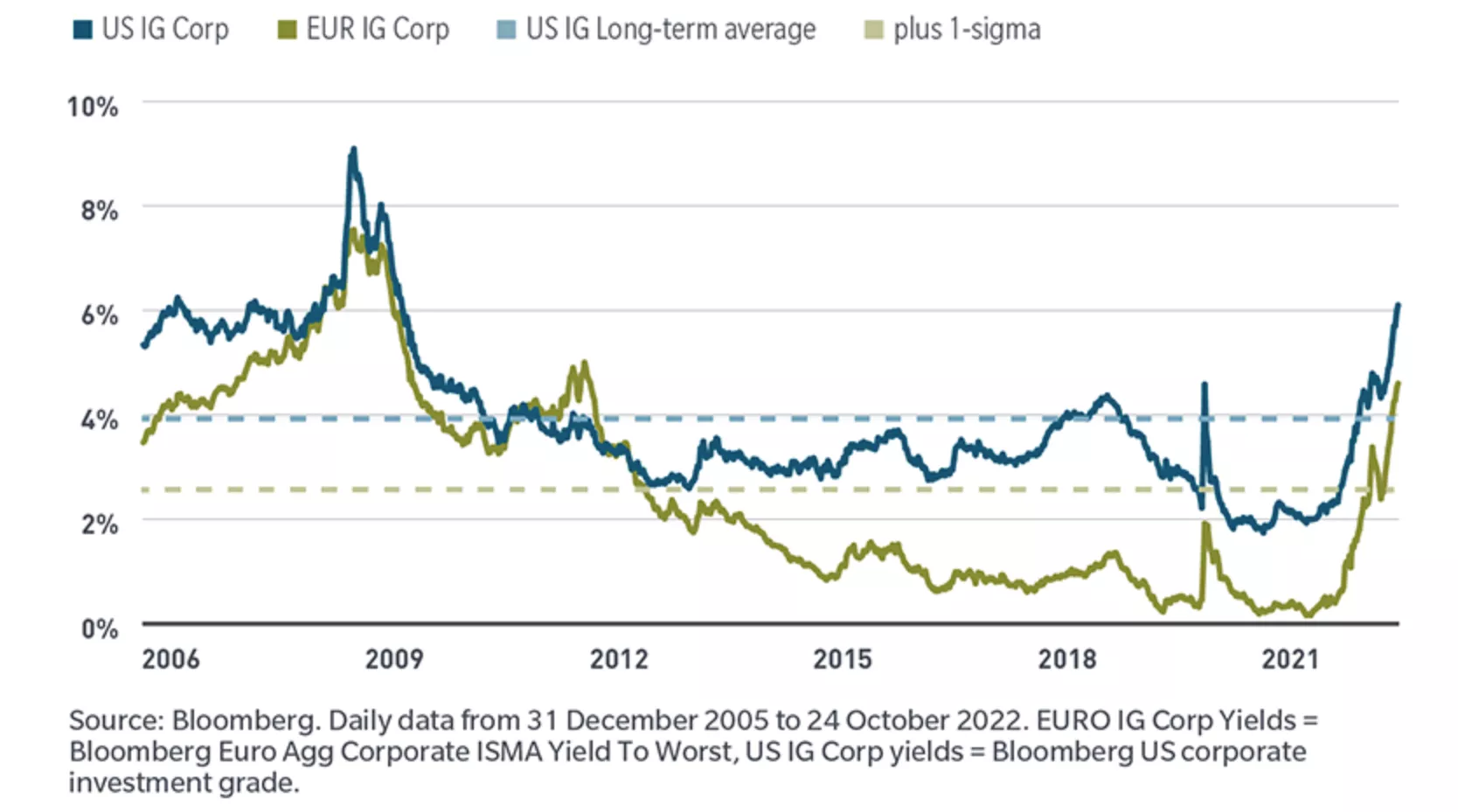

In the past, one of the biggest problems for fixed income was that yields were too low, partially due to the effects of multiyear monetary policy easing and low. The situation has now drastically altered, and fixed income is once again showing higher yields, which could produce lucrative income.

This is true not only for the safer subsectors of global fixed income, such as high yield or developing market debt, which now have yields of around 10% to offset the higher credit and default risks, but also for the riskier developed market government bonds.

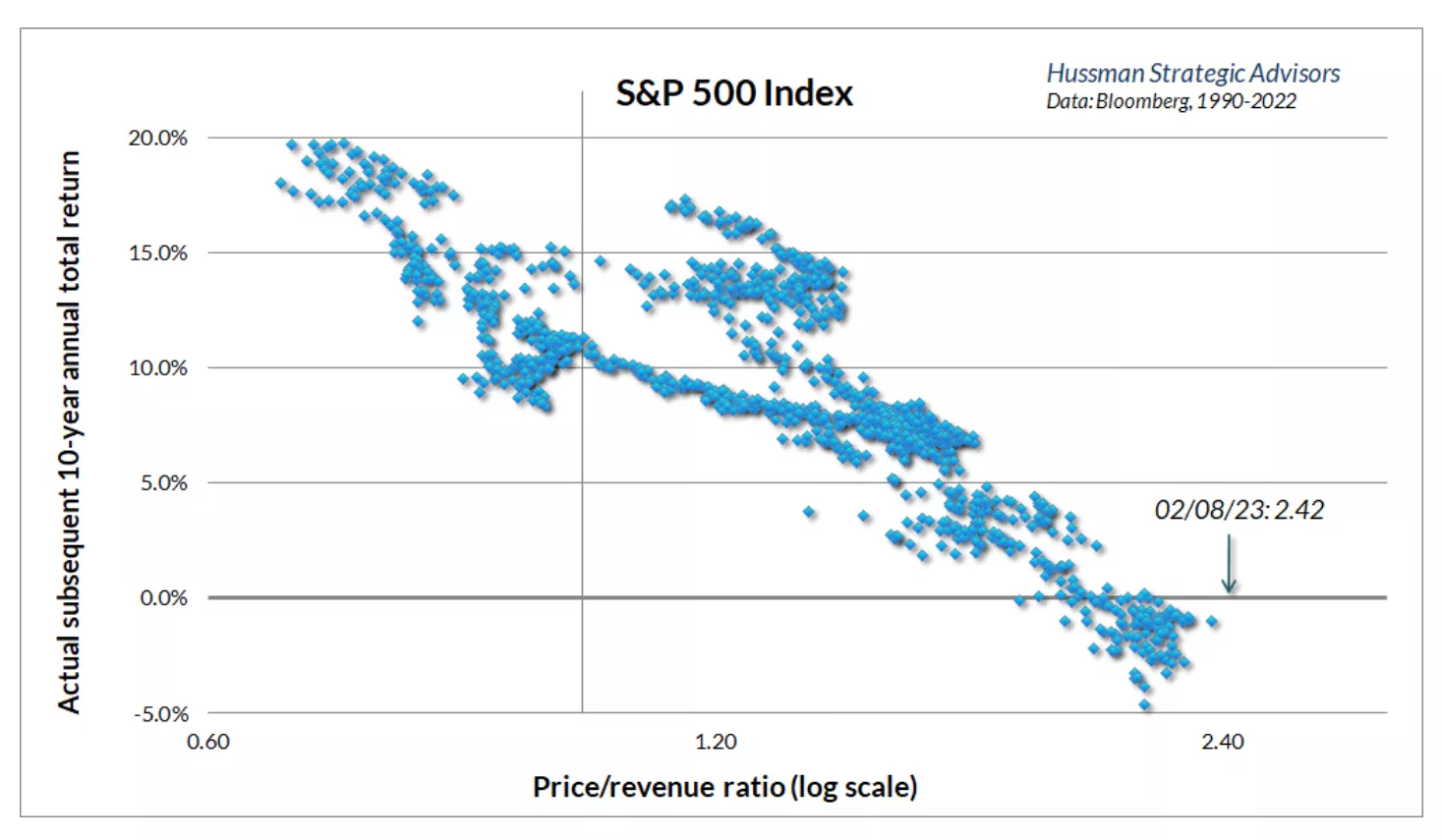

Again, fixed income is a desirable substitute for stocks. In asset allocation strategies, fixed income had lost popularity, particularly when compared to equities. TINA (There is no alternative) to equities was the most popular asset allocation method in recent years.

The situation has changed. Given that equity returns are low in today's environment due to valuations, fixed income has made a comeback as an appealing option to equities.

More By This Author:

Momentum, A Robust Hard To Overlook Factor

The Core PCE Measure Of Inflation Slips Again

The Relevance Of Copper To The Economy And Stocks

Disclaimer: These illustrations are not a solicitation to buy or sell any ETF. I am not an investment advisor/broker