Finding 20 Dividend Growth Stocks In A Bad Market

Dividend Growth Stocks

Starting in 2012, it became more and more difficult for prudent dividend growth stock investors looking for income. The stock market was trading at excessive valuations, and interest rates were at all-time lows. Consequently, there was little to no income to be achieved from fixed-income instruments, and the highest quality blue-chip dividend growth stocks were overvalued and therefore risky.

Looking back, the stock market was peaking in the fall of 2021. As a result, most premium dividend growth stocks were available at current yields significantly below historical norms. Building a dividend growth stock portfolio for either income, total return, or a combination of both was treacherous at best. Although best-of-breed dividend aristocrats still promised a growing dividend income stream, the current yield was so low as to be unattractive. All in all, 2021 was a prudent value investors’ worst nightmare, because they clearly understood that price is what you pay, value is what you get. Unfortunately, there was very little value to be found which discouraged many investors seeking safety along with their income.

(Click on image to enlarge)

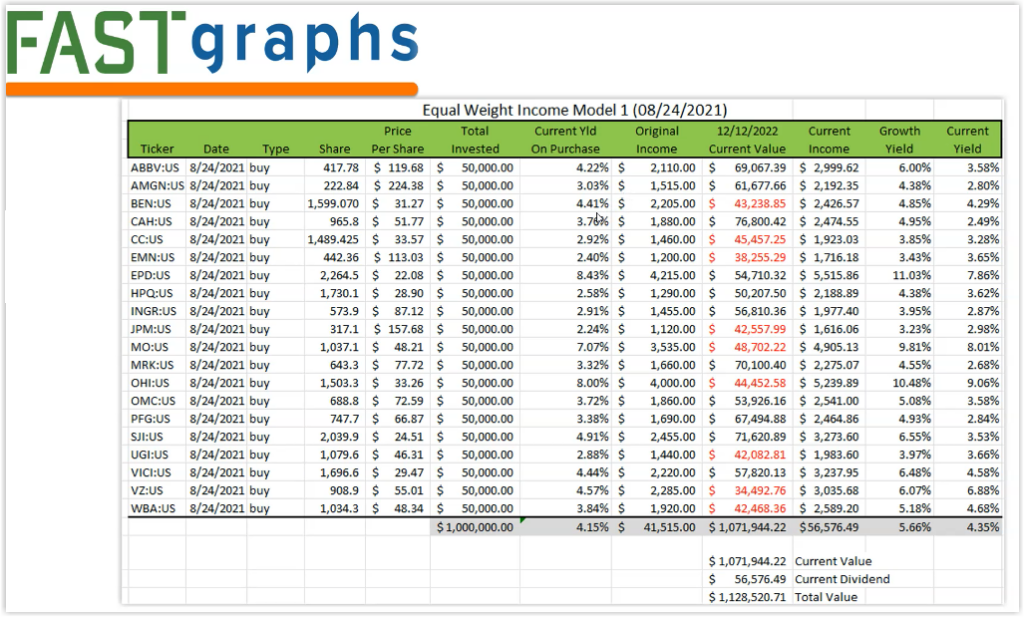

Model 1 Dividend Growth Stocks

Nevertheless, it truly is “a market of stocks and not a stock market.” Accordingly, if the value investor was willing to look deep enough, although rare, good value and income could be found. To prove that point, three model portfolios were constructed on August 24, 2021, the worst possible market for a value investor. Since one size does not fit all, three separate strategies were employed each implementing sound value investing principles. One portfolio was equally weighted and focused on above-average yet growing current yield. The second portfolio was also equally weighted and focused more on growth of future income and capital. Finally, the third portfolio was overweighted with a focus on maximizing yield while nevertheless controlling risk.

It’s important to recognize and acknowledge that these are but three of the many strategies that can be implemented. To be clear, nuances of the same strategies are options that some prudent value investors may prefer. For example, more stocks could have been utilized, different yield parameters could also have been employed, and there are numerous other options that could’ve been used. Nevertheless, the primary point that needs to be understood is that sound and prudent principles value investing were the common denominators for all three.

Finally, this is the first of follow-up videos to come reviewing the performance of these portfolios originally built on August 24, 2021. However, intelligent value investors recognize that one year and four months is too short a timeframe to judge whether these portfolios are working or not. Prudent value investors understand that performance is best judged over a market cycle. Generally speaking, this would be timeframes of 3 to 5 years or longer. Nevertheless, continuous monitoring should be part and parcel of every value investor’s investing management process, and policies. By being diligent, portfolios can be tweaked (managed) over time, but caution is offered on not to be too active. Remember, “portfolios are like a bar soap, the more they are handled the smaller they get.”

Video Length: 00:23:58

More By This Author:

5 Dividend Stocks With Yields Of 2.25% To 9.5%

Technology On Sale: NetApp 3% Dividend Yield Attractive Valuation

GPN: Recession Resistant Consistent Growth Stock At Attractive Value

Disclosure: Long ABBV, AMGN, CAH, CC, EMN, EPD, INGR, MO, MRK, OHI, OMC, UGI, VZ, WBA.

Disclaimer: The opinions in this article are for informational and educational purposes only and should not ...

more