Technology On Sale: NetApp 3% Dividend Yield Attractive Valuation

Dividend Yield – Attractive Valuation

On Wednesday, November 30, NetApp (NTAP) – formerly Network Appliance, reported earnings that beat analysts’ estimates. Nevertheless, the dividend-paying company lowered guidance for next year and the stock fell almost 6% for the day. This prompted a Citi analyst to state that the stocks pull back was what “investors were looking for.”

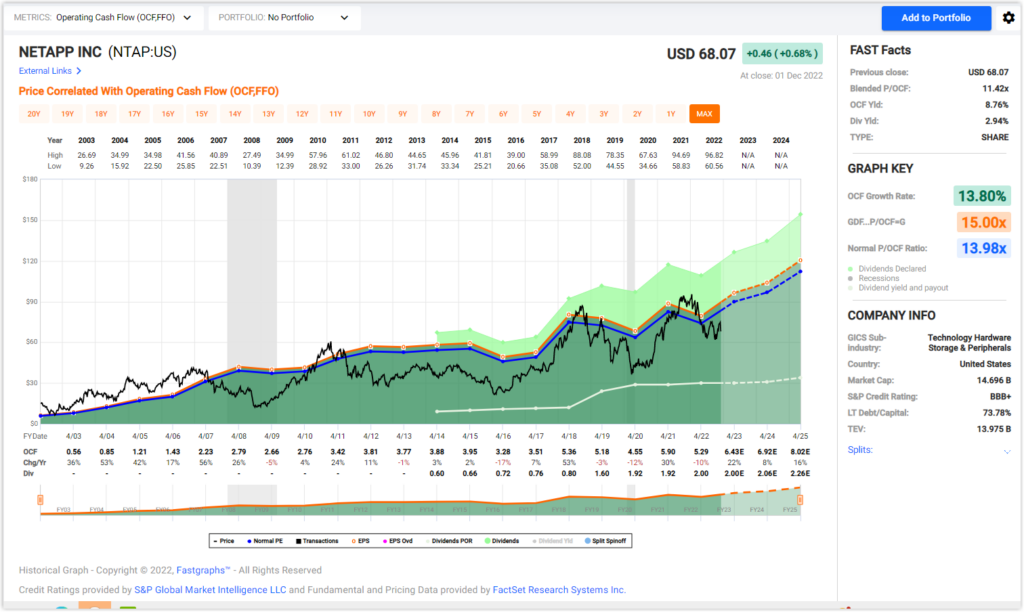

NetApp FAST Graphs

Consequently, I felt the stock was worth looking at since the current valuation looks extremely attractive. From a historical perspective the stock now trades at a very low P/E ratio offering a margin of safety and long-term growth potential. Therefore, the stock may appeal to investors looking for current income since it offers approximately a 3% dividend yield and reasonable growth going forward.

In this video, I will run NetApp through the FAST Graphs’ looking glass as I examine future growth, dividend safety, and fiscal fitness.

Video Length: 00:13:33

More By This Author:

GPN: Recession Resistant Consistent Growth Stock At Attractive Value

Skyworks Solutions Inc.: Market Overreaction Creates Opportunity Of A Lifetime

Blue-Chip Dividend Growth Stock Rarely In Value: Double-Digit Dividend Growth

Disclosure: No position.

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks ...

more