Ferrari Stock Plunged Hard. Is It A Short-Term Drop Or A Long-Term Decline?

Image Source: Unsplash

Ferrari (RACE) - A name that evokes speed, luxury, and precision. But lately, its stock has been running into some rough turns.

After hitting record highs earlier this year, Ferrari’s share price took a sharp dive following its Capital Markets Day. Investors were caught off guard. Expectations were sky-high, and the company’s updated targets didn’t quite match the market’s adrenaline.

Yet here’s the thing—when a stock like Ferrari falls this hard, it’s rarely just about the numbers.

Is this a sign of deeper cracks ahead, or a rare chance to own one of the most iconic brands at a discount?

Let’s find out.

The IDDA Analysis framework is used to analyze companies and determine which are right for you. There are five steps to the process:

- Capital Analysis – Your personal risk tolerance.

- Intentional Analysis – Your unique financial goals and timelines based on your age, health, and lifestyle.

- Fundamental Analysis – The viability of the asset based on company performance, financial health, and market position.

- Sentimental Analysis – The current emotions of Wall Street and other market participants.

- Technical Analysis – Historical price action to identify key psychological levels and market patterns.

Let’s dive into the IDDA analysis to assess Ferrari’s fundamental, sentimental, and technical outlook.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

Financial performance

Ferrari reported Q2 2025 revenue of about €1.79 billion, a 4.4 percent increase from last year. EBITDA reached €709 million with a 39.7 percent margin, while EBIT was €552 million. Profitability remains exceptional in the auto industry, thanks to pricing power, personalization, and disciplined production levels.

Order book strength

Demand remains strong across most models. The company’s order book is nearly full, with the new Ferrari Amalfi and 296 Speciale generating solid interest. The strategy of scarcity continues to work, protecting both margins and brand prestige.

Product and innovation pipeline

Ferrari recently launched the Amalfi, a more versatile model that broadens appeal without diluting exclusivity. Its first fully electric model, the Elettrica, is expected by late 2026, supported by a new dedicated EV facility in Maranello. However, the company’s focus remains balanced, with hybrids leading the lineup over the next several years.

Performance over electrification

At the October Capital Markets Day, Ferrari reduced its 2030 target for fully electric vehicles from 40 percent to 20 percent. This disappointed investors who wanted a faster EV shift, but the decision aligns with the company’s DNA. Full EVs are heavier, less agile, and can compromise the sound and feel Ferrari drivers value most. By emphasizing hybrids, Ferrari aims to meet emissions goals without sacrificing the driving experience that defines the brand.

Strategic partnerships

Partnerships with Qualcomm and AWS continue to strengthen Ferrari’s technology ecosystem. Qualcomm’s digital cockpit improves in-car experience, while AWS supports artificial intelligence and data analysis for customization, performance optimization, and faster innovation.

Growth guidance disappointment

Ferrari’s long-term guidance at the Capital Markets Day called for revenue of around €9 billion and EBIT of €2.75 billion by 2030. This represents steady but slower growth than what the market expected, which triggered much of the recent sell-off.

External headwinds

A strong US dollar remains a headwind for reported revenue, and macro uncertainty in luxury demand, especially in China, adds short-term pressure.

Fundamental risk: Medium.

Ferrari’s fundamentals remain resilient, supported by high margins, strong demand, and disciplined supply. The main challenge lies in balancing investor expectations for faster growth and electrification with the company’s commitment to preserving performance, exclusivity, and brand identity.

IDDA Point 4: Sentimental

Overall sentiment is bearish for Ferrari.

Strengths

Ferrari continues to command deep emotional loyalty from both investors and customers. Its brand power, heritage, and exclusivity create long-term confidence even during volatile markets.

The company’s management has stayed calm despite the sell-off, signaling internal stability and a long-term view. Plans for four new premieres per year reinforce steady product momentum.

The hybrid strategy reassures core Ferrari fans who prioritize emotion, sound, and control behind the wheel. For many buyers, this approach feels truer to the brand than an aggressive EV rollout.

Collaborations with Qualcomm and AWS reinforce Ferrari’s reputation as a modern, tech-forward company without losing its soul.

Risks

Investors were disappointed by Ferrari’s slower EV transition and lower long-term growth targets. Many expected a stronger commitment to electrification, viewing it as essential for future market relevance.

The gap between what investors want (EV acceleration) and what drivers want (performance and emotion) has created tension in market sentiment.

The recent sharp drop in stock price shows how sensitive the market remains to growth narratives and perceived innovation speed.

Broader concerns around luxury demand, geopolitical tension, and global interest rate trends continue to weigh on investor confidence.

Sentimental risk: Medium High.

The brand’s emotional power keeps sentiment from collapsing completely, but disappointment over slower growth and limited EV ambition has hurt confidence. The company’s challenge now is to rebuild trust by proving that prioritizing performance and brand identity over pure electrification will still drive long-term value.

IDDA Point 5: Technical

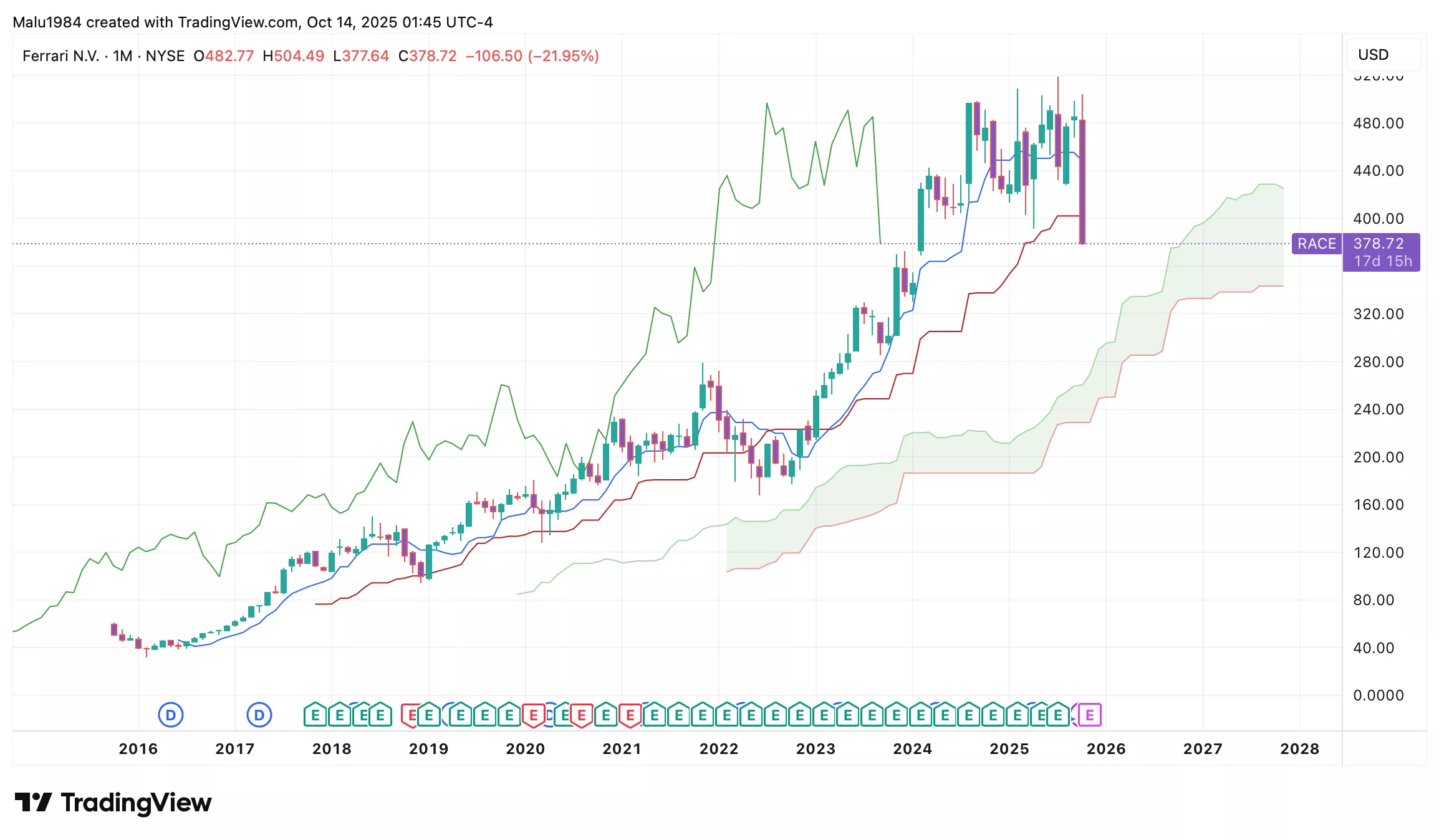

Monthly Chart

The long-term trend remains bullish. Ferrari (RACE) has shown steady price appreciation over the years, supported by strong fundamentals and brand resilience.

On the Ichimoku Cloud, the candles are well above the cloud, indicating that the long-term uptrend remains intact.

The conversion line (Tenkan-sen) is above the baseline (Kijun-sen), confirming bullish momentum over the broader timeframe.

No major reversal patterns are visible on the monthly chart, suggesting that despite the recent correction, Ferrari’s structural uptrend is still valid.

(Click on image to enlarge)

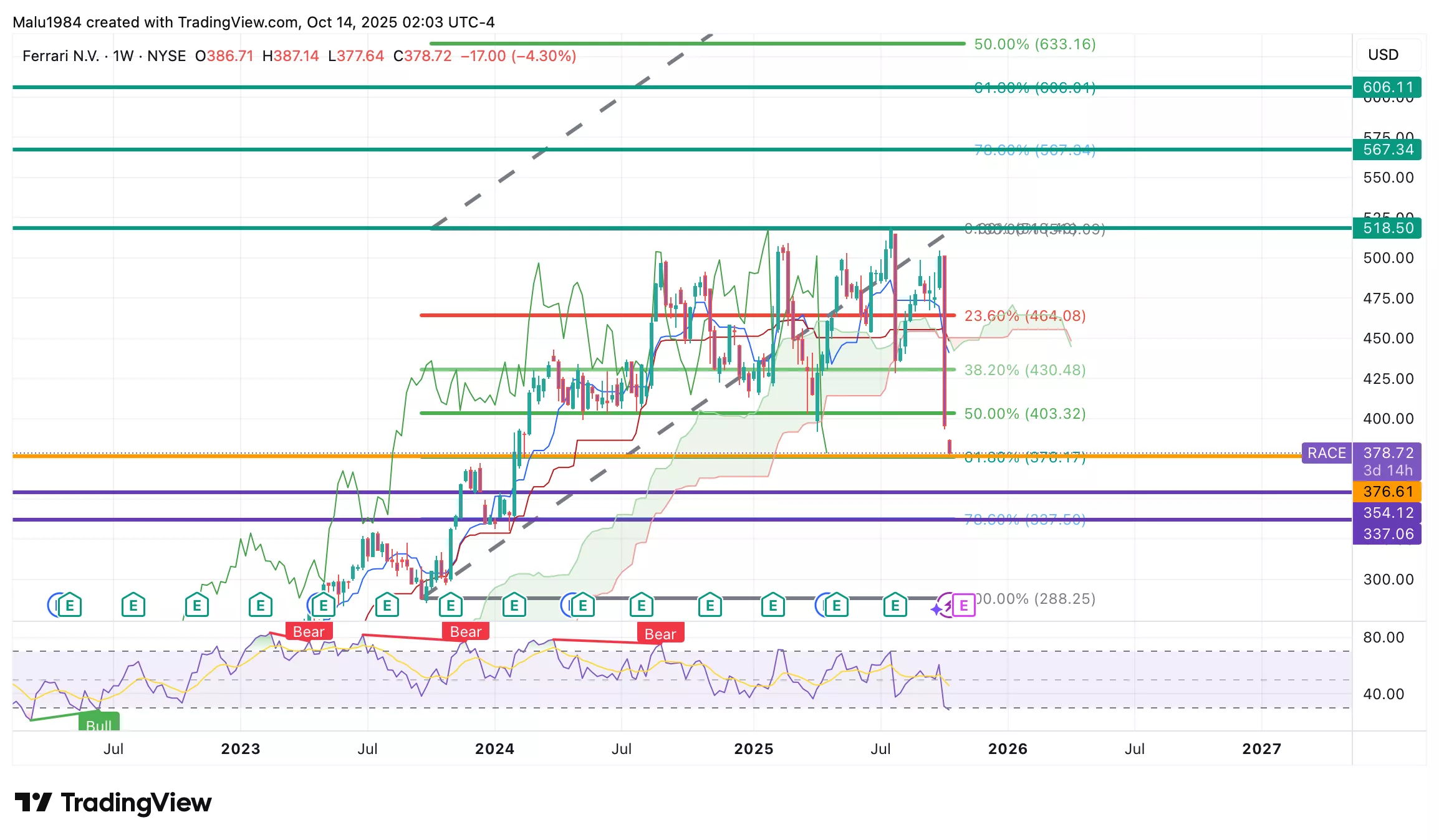

Weekly Chart

The weekly trend for Ferrari (RACE) has turned bearish following the sharp post–Capital Markets Day sell-off. Price is now trading well below the Ichimoku Cloud, confirming short-term downside momentum.

The Tenkan-sen (conversion line) has crossed below the Kijun-sen (baseline), a bearish crossover that typically signals continued weakness unless price quickly recovers above the cloud.

The RSI sits around 28, deep in oversold territory. This level suggests that selling pressure is stretched, but there is no confirmed bullish divergence between price and RSI. For a true reversal setup, traders would need to see RSI form a higher low while price makes a lower low.

(Click on image to enlarge)

The overall technical outlook for Ferrari (RACE) shows a clear short-term downtrend within a long-term bullish structure. The recent sell-off pushed the stock below key support levels, confirming bearish momentum on the weekly chart.

However, RSI readings near 28 indicate oversold conditions that could trigger a relief bounce if buying volume returns. The long-term trend on the monthly chart remains intact, but in the near term, Ferrari will need to reclaim the 403–430 zone to signal stabilization and shift momentum back toward recovery.

Buy Limit (BL) levels:

$376.61 – High Risk

$354.12 – Moderate Risk

$337.06 – Low Risk

Investors looking to take profit can consider these Sell Limit Levels:

518.36 (Short term)

567.34 (Medium term)

606.11 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical risk: Medium High.

Ferrari remains in a long-term uptrend, but short-term signals are weak. The stock is oversold yet still below key resistance levels, meaning further downside is possible before a clear reversal forms.

Summary: Final Thoughts

Ferrari’s recent stock plunge shook investor confidence, but the company itself remains fundamentally strong. Financial performance is solid, margins are exceptional, and demand across its lineup continues to outpace supply. The adjustment in long-term targets and the reduced EV ambition frustrated investors, yet these choices reflect Ferrari’s commitment to preserving the driving experience rather than chasing hype. From a brand perspective, this strategy reinforces authenticity, even if it slows short-term growth expectations.

Sentiment has turned bearish as the market digests slower growth and the shift away from aggressive electrification. Still, Ferrari’s long-term vision prioritizes exclusivity, innovation, and steady evolution, not dramatic pivots. The stock’s technicals show short-term weakness but also oversold conditions that could set the stage for a rebound if support levels hold.

Overall, Ferrari appears to be in a period of recalibration rather than decline. The fundamentals support long-term value creation, while current sentiment reflects temporary disappointment.

Overall risk: Medium.

More By This Author:

Coca-Cola Stock Is Quietly Making A Move Most Investors Are Missing

Has Qualcomm Finally Woken Up? The AI Breakout Wall Street Didn’t See Coming

Is Delta Air Lines Flying Too High? The Premium Strategy Wall Street Can’t Stop Talking About