Has Qualcomm Finally Woken Up? The AI Breakout Wall Street Didn’t See Coming

Image Source: Unsplash

After months of flying under the radar, Qualcomm (QCOM) has finally jolted back to life – and investors are starting to notice. Once known mainly for powering smartphones, Qualcomm is now stepping into the spotlight as a serious player in the AI revolution, with growing opportunities across AI PCs, cars, wearables, and smart devices. Its latest chip launches and partnerships with major brands like Google and BMW show a clear shift toward becoming a more diversified and innovative technology leader.

What’s driving this comeback isn’t just hype. Qualcomm still has solid financials, strong cash flow, and a healthy balance sheet, all while trading at a much lower price than some of its bigger-name competitors.

For long term investors, that combination of strength and undervaluation could make Qualcomm one of the more interesting AI opportunities on the market right now.

Of course, the story isn’t without challenges. Optimists believe Qualcomm’s expanding reach and innovation give it a strong foundation for future growth. Skeptics, however, worry about competition from companies like Apple and Samsung, which are developing their own chips, and whether Qualcomm’s new growth areas will take time to fully pay off.

This back-and-forth, between caution and renewed excitement, captures the mood around Qualcomm today. After years of being overlooked, the company’s move into AI could finally be the turning point that reignites investor confidence. The big question now is: has Qualcomm truly woken up for good, or is this just another short-lived rally Wall Street didn’t see coming?

Let’s break it down using the IDDA Framework (Capital, Intentional, Fundamental, Sentimental, Technical):

IDDA Point 1 & 2: Capital & Intentional

Before investing in Qualcomm, ask yourself:

Do you want exposure to a diversified semiconductor leader expanding across AI PCs, automotive, IoT, and data-center markets?

Are you comfortable investing in a company that’s transitioning beyond smartphones and may require patience for growth to fully materialize?

Do you believe in Qualcomm’s ability to leverage its AI expertise and partnerships to drive the next decade of innovation in computing and connectivity?

For long term investors, Qualcomm presents a rare mix of strong fundamentals and deep value, backed by growth across multiple sectors and its transformation into an AI driven technology leader. For short term investors, the recent breakout could still bring volatility and pullbacks before a clear trend is confirmed.

No matter which camp you fall into, it’s important to remember that every investor should know their unique risk tolerance, goals, and strategy before making any decisions. With a solid foundation, attractive valuation, and growing momentum, Qualcomm now stands at a pivotal point in its journey – one that could redefine its role from a traditional mobile chipmaker to a key enabler of the AI era.

IDDA Point 3: Fundamental

Qualcomm (QCOM) is going through a big transformation. It’s expanding beyond smartphones into fast-growing areas like AI-powered computers, cars, smart devices, and data centers. Its new Snapdragon platform puts it in the race for AI PCs, while partnerships with Google and BMW are helping it grow in automotive tech. Together, these moves show Qualcomm’s clear shift from being just a phone chipmaker to a multi-industry tech leader.

The company’s long-term growth plan is bold. Qualcomm aims to grow its business outside of smartphones through innovation in AI chips, wearables, automotive systems, and data centers. Its recent acquisitions and collaborations – including work with Nvidia – are opening doors in the booming AI and cloud markets, giving it new ways to grow in the years ahead.

Financially, Qualcomm is solid. It’s generating strong cash flow, keeping healthy profit margins, and managing debt wisely. This allows the company to keep investing in research while also rewarding shareholders through steady dividends and stock buybacks. In short, it has the resources to keep building for the future while staying resilient through market ups and downs.

From a valuation point of view, Qualcomm still looks undervalued. The stock trades much cheaper than many of its peers like Nvidia, AMD, and Broadcom – even though it’s competing in similar high-growth markets. For long-term investors, this gap could mean a potential opportunity if the market starts to recognize Qualcomm’s growth story.

While competition from Apple and Samsung remains a challenge, Qualcomm’s progress in cars, IoT, and AI-enabled devices shows that its diversification plan is paying off. With expanding partnerships, strong execution, and clear momentum in AI, Qualcomm stands out as a well-positioned tech leader that could still be in the early stages of a much bigger comeback.

Fundamental Risk: High.

IDDA Point 4: Sentimental

Strengths

Diversified Growth:

Qualcomm is expanding beyond smartphones into AI PCs, cars, smart devices, and data centers, giving it more ways to grow and less dependence on phone sales.

Attractive Value:

The stock trades at a much lower price than most of its competitors, offering strong

long-term upside

as the market recognizes its AI and growth potential.

Solid Finances:

Qualcomm has steady cash flow, strong profits, and regular dividends and buybacks, allowing it to keep investing while rewarding shareholders.

Risks

Still Tied to Phones:

Qualcomm still relies partly on Apple and Samsung, which are making their own chips – this could affect near term sales and profits.

Timing Uncertainty:

Growth from new areas like AI, automotive, and data centers may take time to show results, requiring patience from investors.

Tough Competition:

Rivals like Nvidia, AMD, and MediaTek are pushing hard in AI and chipmaking, which could pressure Qualcomm’s prices and market share.

Investor sentiment toward Qualcomm (QCOM) has shifted from caution to cautious optimism as confidence grows in its long term transformation. After a period of underperformance tied to smartphone reliance and customer concentration, renewed buying momentum and excitement around AI chips have reignited interest in the stock.

The company’s steady progress in automotive, AI PCs, and data centers is helping rebuild trust that earlier pessimism was overdone. Although short term growth remains modest, investors are beginning to recognize Qualcomm’s stronger fundamentals and broader opportunities in the AI era. Sentiment briefly dipped after reports of a Chinese antitrust probe into its Autotalks acquisition, but this appears to be a temporary setback rather than a threat to Qualcomm’s overall growth story.

Sentimental Risk: High

IDDA Point 5: Technical

On the weekly chart

Future Ichimoku cloud has turned bullish – indicating a shift toward upward momentum.

Recent candlesticks are trading inside the cloud, testing its upper band as a potential resistance zone.

The latest candlestick is a long bearish one – suggesting that the resistance zone is still holding.

QCOM has shown rather choppy price action over the past few years. From the pre-COVID period to early 2022, it trended upward before retracing about 61% through the end of 2023. The stock then resumed its uptrend until June 2024, when it reached an all-time high of $224, before pulling back nearly 78%.

It now appears to be showing early signs of recovery, though it’s still too soon to confirm a clear reversal. At present, technical signals are mixed: while the future Ichimoku cloud has turned bullish, price action remains within the cloud, testing resistance at the upper band,with the most recent candlestick confirming that this zone continues to hold.

(Click on image to enlarge)

On the daily chart:

Future Ichimoku cloud is bullish, indicating upward momentum.

The last candlestick moved inside the cloud, testing its ability to hold as a support zone, which is currently still holding.

The most recent candlestick was a long bearish one, signaling a potential shift toward short-term bearish momentum.

The stock trended downward from June to August 2024, then consolidated until February 2025 before resuming another decline and beginning to recover in April 2025. While the future cloud remains bullish, the latest long bearish candlestick has tested the cloud’s support level. If price breaks below the cloud, it could confirm further downward momentum ahead.

(Click on image to enlarge)

Investors looking to get in QCOM can consider these Buy Limit Entries:

Current market price 153.59 (High Risk)

144.08 (Medium Risk)

199.08 (LowRisk)

Investors looking to take profit can consider these Sell Limit Levels:

171.83 (Short term)

184.51 (Medium term)

202.32 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: High

Final Thoughts on Qualcomm (QCOM)

Qualcomm’s transformation is gaining momentum as it moves beyond smartphones into AI-powered computers, cars, smart devices, and data centers – evolving from a mobile chipmaker into a diversified AI and connectivity leader. New partnerships with companies like Google, BMW, and Nvidia highlight its growing role in next-generation computing. Supported by solid financials and a disciplined growth strategy, Qualcomm is well positioned to benefit from the global shift toward AI and cloud technology.

Still, challenges remain: dependence on major customers like Apple and Samsung, strong competition from Nvidia and AMD, and regulatory scrutiny from China’s recent antitrust probe all add uncertainty. Technically, the stock is showing early signs of recovery, but it remains range-bound – with a breakout above resistance needed to confirm a sustained uptrend.

Key Takeaways:

The debate around Qualcomm (QCOM) is whether it’s entering a new phase of steady, diversified growth or if competition and regulation could slow it down. Optimists see strong long-term potential as Qualcomm expands into AI and connectivity, while skeptics point to execution risks, smartphone reliance, and global pressures that may limit short-term gains. For long term investors, Qualcomm offers an appealing mix of value and innovation, but short term investors may need patience as volatility and mixed signals play out.

Overall Stock Risk: High

More By This Author:

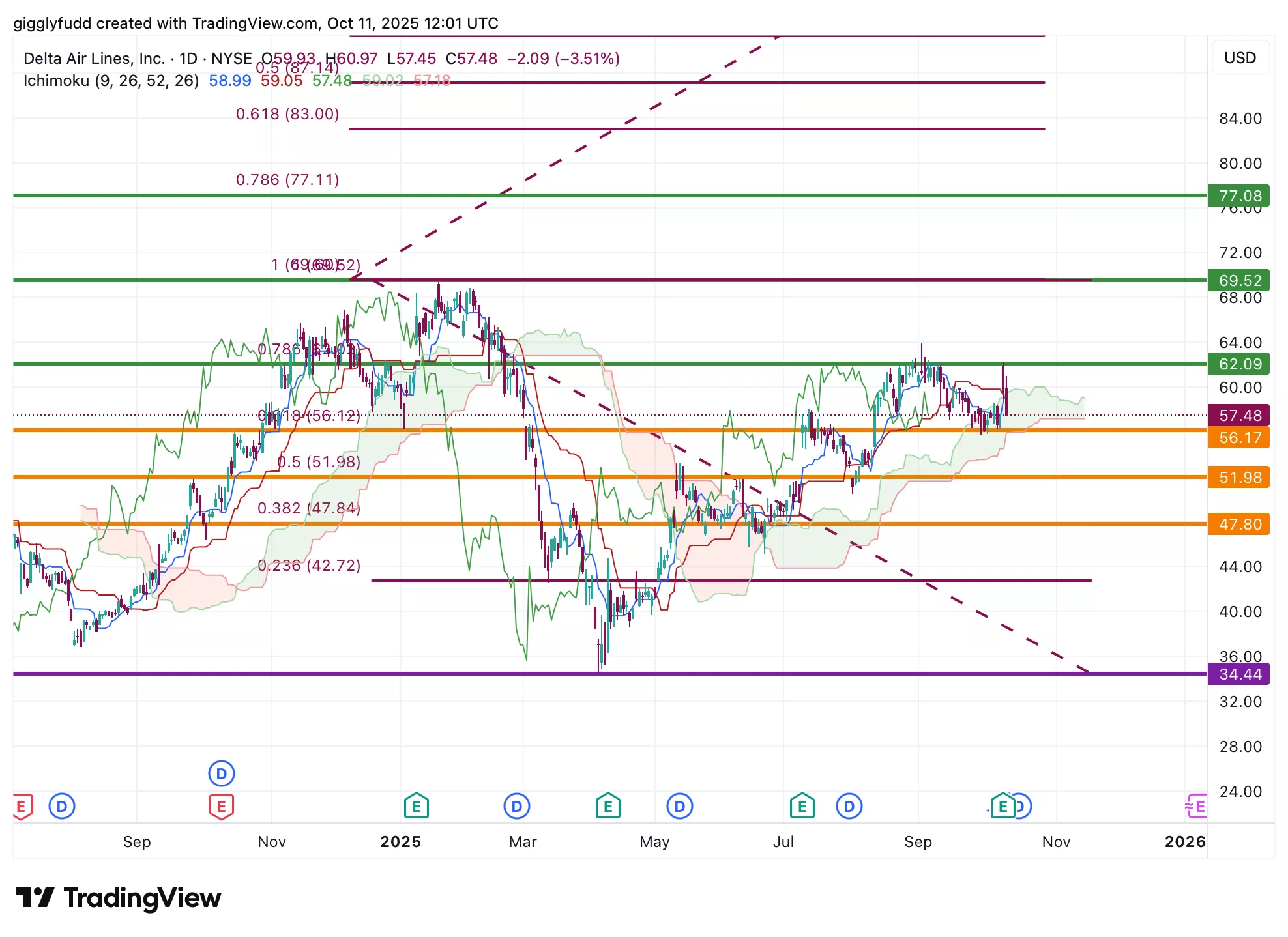

Is Delta Air Lines Flying Too High? The Premium Strategy Wall Street Can’t Stop Talking About

Is Kratos Stock Becoming The Dark Horse Of The AI Arms Race?

Is Rubrik Stock The Quiet Bet You’re Missing?