Is Kratos Stock Becoming The Dark Horse Of The AI Arms Race?

Image Source: Pexels

Kratos Defense & Security Solutions (KTOS) is not your typical defense contractor. While giants like Lockheed Martin (LMT) and Northrop Grumman (NOC) dominate the headlines, Kratos quietly focuses on the next generation of warfare—unmanned drones, hypersonic systems, and space-based defense tech.

The company’s strength lies in innovation. Its Valkyrie drone, for example, is designed to fly alongside fighter jets at a fraction of the cost, reshaping how modern air combat could look. At the same time, Kratos is building software and satellite infrastructure through its OpenSpace platform, aiming to connect the dots between defense, space, and AI.

With global defense budgets rising, AI being integrated into weapon systems, and Kratos forming new partnerships with companies like Airbus, the question becomes: could this underdog be quietly positioning itself for something much bigger?

The IDDA Analysis framework is used to analyze companies and determine which are right for you. There are five steps to the process:

- Capital Analysis – Your personal risk tolerance.

- Intentional Analysis – Your unique financial goals and timelines based on your age, health, and lifestyle.

- Fundamental Analysis – The viability of the asset based on company performance, financial health, and market position.

- Sentimental Analysis – The current emotions of Wall Street and other market participants.

- Technical Analysis – Historical price action to identify key psychological levels and market patterns.

Let’s dive into the IDDA analysis to assess Kratos Defense & Security Solutions’ fundamental, sentimental, and technical outlook.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

Strong Revenue Growth and Upbeat Guidance

Kratos reported solid Q2 2025 results with revenue up 17% year over year and raised full-year guidance to 1.29–1.31 billion dollars. The company’s mix of drones, hypersonics, and space systems continues to drive top-line growth, proving that demand for low-cost, high-impact defense tech is accelerating.

Expanding Drone and Hypersonic Programs

Its Valkyrie drone keeps advancing in testing and demonstration, showing real-world potential for teaming with fighter jets. The new 50 million dollar hypersonic facility in Indiana supports growing work on test beds and propulsion systems, putting Kratos in a strong position for future contracts as hypersonic defense becomes a national priority.

Growing Presence in Space and Satellite Infrastructure

The OpenSpace platform, a cloud-based satellite ground system, is gaining traction with both government and commercial clients. It is already being used in U.S. Space Development Agency projects and partnerships with major cloud players, expanding Kratos’ reach beyond defense into space and AI networks.

Strategic Partnerships with Global Giants

A new partnership with Airbus to bring Valkyrie drones to the German Air Force opens doors to Europe and NATO markets. This collaboration validates Kratos’ tech and provides access to international defense budgets that could significantly scale revenue in coming years.

Valuation and Margin Pressure

After a strong run in the stock price, some analysts downgraded Kratos citing high expectations and potential near-term margin pressure from new facility investments and workforce expansion. Scaling production while maintaining profitability remains a key challenge.

Long Lead Times and Program Risks

Many of Kratos’ biggest opportunities, such as hypersonics and international drone sales, have long development and approval cycles. Delays or budget changes could affect short-term growth and create volatility in revenue flow.

Fundamental Risk: Medium

IDDA Point 4: Sentimental

Overall sentiment is bullish for Kratos Defense & Security Solutions.

Strengths

Investors like the growth in drones, hypersonics, and space

Raised guidance lifts confidence after recent results

New multi-phase U.S. Navy radar sustainment contract adds credibility and stable recurring revenue

Airbus partnership hints at Europe demand and NATO pull

CEO tone is confident on scaling and backlog growth

Defense budgets are rising across the U.S. and Europe

OpenSpace gains mindshare as satellite operations move to the cloud

Risks

One broker downgrade cooled momentum after a strong run

Long export and test timelines may delay recognition of wins

Margin pressure could increase as new facilities and staff ramp up

Dependence on government budgets adds political risk

Investors may take profits if growth slows or contract news quiets down

Sentimental Risk: Medium

IDDA Point 5: Technical

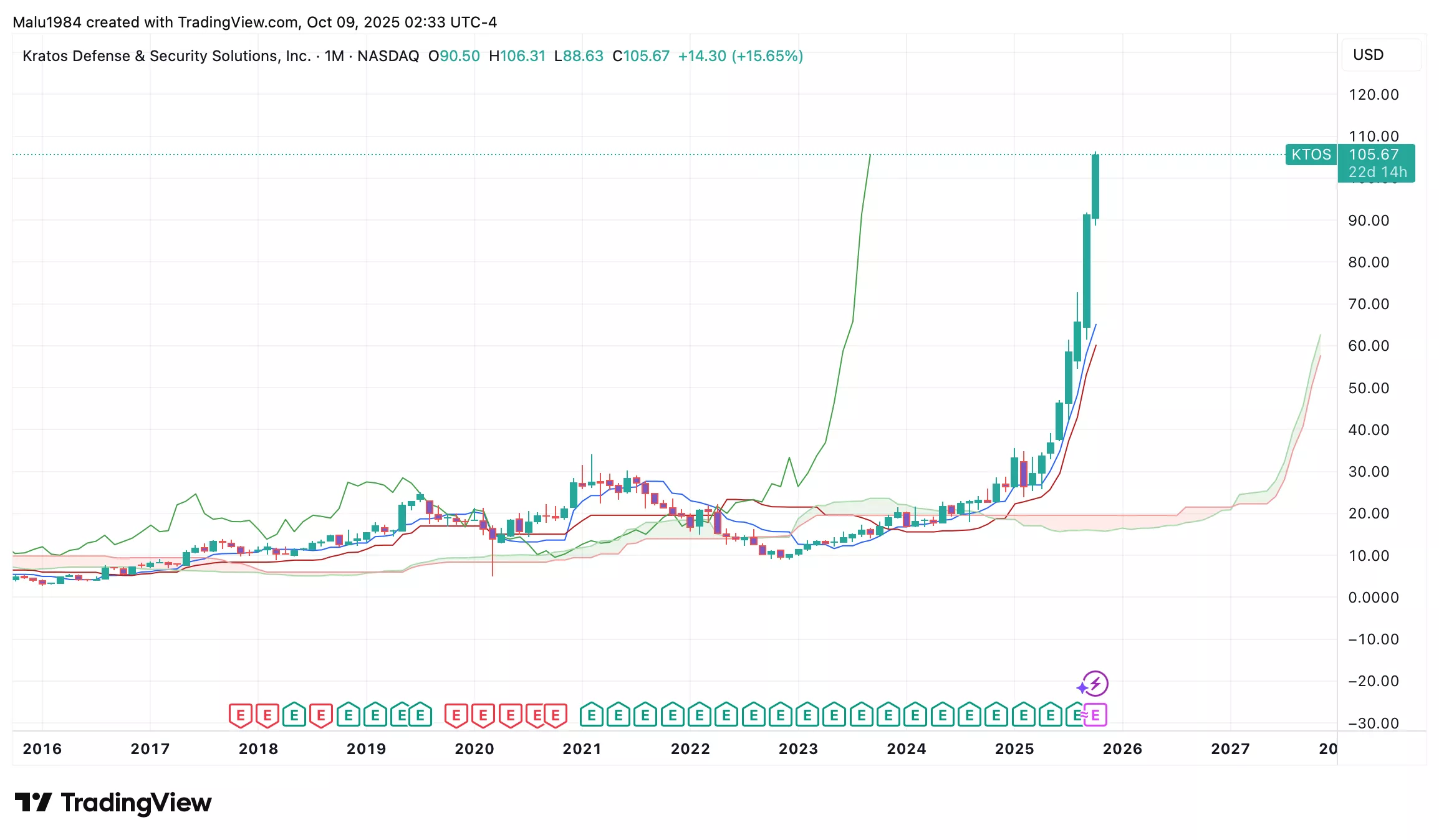

Monthly Chart

After more than 20 years of being flat, KTOS has been in a steady uptrend since December 2022.

Candles sit well above the Ichimoku Cloud, showing strong bullish momentum.

The cloud is green and narrow, hinting that the trend is still young and gaining strength.

The conversion line is above the baseline, confirming continued buyer control.

(Click on image to enlarge)

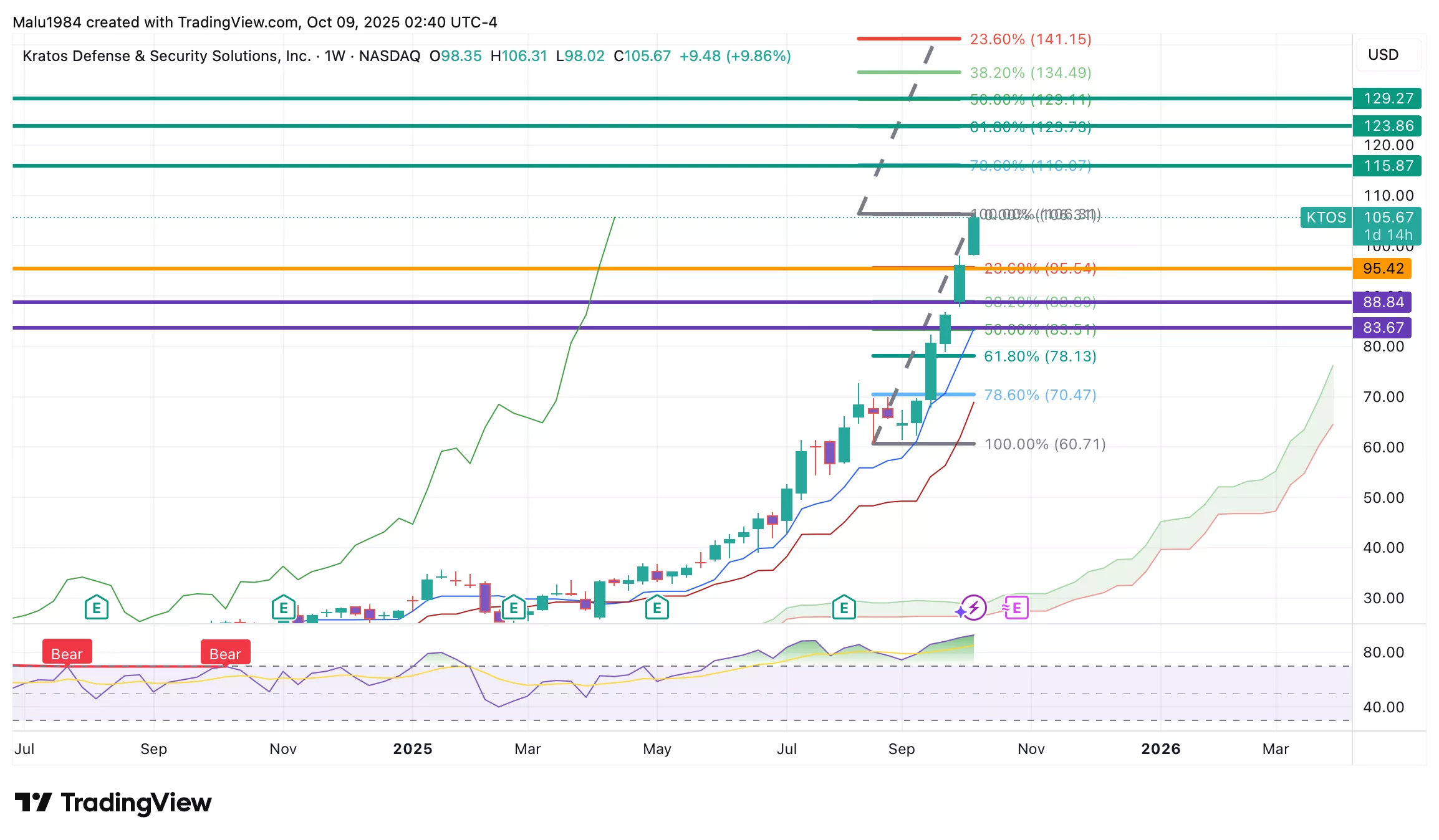

Weekly Chart

The bullish signals continue, with price action staying above the Ichimoku Cloud.

Both conversion and baseline lines point upward, supporting a strong short-term trend.

RSI is extremely high at 92, which shows strong momentum but also means the stock is very overbought.

RSI has stayed above 70 since June 2025, suggesting that a short-term pullback or consolidation could happen before the next leg up.

Overall, the technical picture for KTOS remains bullish across both timeframes. The long-term breakout is supported by strong momentum and positive Ichimoku signals, but the high RSI may trigger a short pause or correction before buyers step back in.

(Click on image to enlarge)

Buy Limit (BL) levels:

$95.42 – High Risk

$88.84 – Moderate Risk

$83.67 – Low Risk

Investors looking to take profit can consider these Sell Limit Levels:

115.87 (Short term)

123.86 (Medium term)

115.87 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Medium to High

KTOS shows strong bullish momentum, but the RSI above 90 signals the stock may be overheated. While the long-term trend is intact, short-term volatility or a healthy pullback is likely before the next move higher.

Summary: Final Thoughts

Kratos Defense & Security Solutions is no longer the quiet player it used to be. The company has evolved from a small defense contractor into a leader in affordable drone systems, hypersonic testing, and satellite communication software. Its recent contract with the U.S. Navy adds steady, recurring revenue, while the Airbus partnership gives it a path into European defense markets. Fundamentally, Kratos is executing well with rising revenue and expanding opportunities across multiple high-growth sectors.

Sentiment around the stock remains positive as investors grow more confident in its potential. However, valuation is stretched after a strong rally, and the stock could face pressure if margins tighten or government budgets shift. Technically, the uptrend is clear, but the overbought RSI hints at a possible pullback before any new climb.

Overall, Kratos looks well-positioned for long-term growth but may see short-term volatility as the market digests its recent gains.

Overall Risk: Medium to High

More By This Author:

Is Rubrik Stock The Quiet Bet You’re Missing?

AMD Bold Move: The OpenAI Deal That’s Shaking Up Wall Street

Could Intuitive Surgical Stock Be Sitting On A Quiet Revolution?