Could Intuitive Surgical Stock Be Sitting On A Quiet Revolution?

Image Source: Pexels

Intuitive Surgical (ISRG) is the pioneer of robotic-assisted surgery and the creator of the da Vinci system. With over 8,000 systems installed worldwide, the company dominates a fast-growing industry that’s transforming how surgeries are performed — making them less invasive, more precise, and faster to recover from.

But here’s where it gets interesting. While most investors see Intuitive as a steady healthcare play, behind the scenes, a new wave of innovation is unfolding. The da Vinci 5 system introduces next-level computing power and real-time software upgrades, creating a shift that could redefine surgical robotics — and potentially the company’s future growth trajectory.

Add to that new product approvals, expanding global markets, and rising competition from Medtronic and Johnson & Johnson, and you’ve got a company quietly entering its next phase of evolution. Whether this becomes a massive growth story or a pressure test for its dominance is what makes Intuitive Surgical (ISRG) one of the most fascinating stocks to watch right now.

The IDDA Analysis framework is used to analyze companies and determine which are right for you. There are five steps to the process:

- Capital Analysis – Your personal risk tolerance.

- Intentional Analysis – Your unique financial goals and timelines based on your age, health, and lifestyle.

- Fundamental Analysis – The viability of the asset based on company performance, financial health, and market position.

- Sentimental Analysis – The current emotions of Wall Street and other market participants.

- Technical Analysis – Historical price action to identify key psychological levels and market patterns.

Let’s dive into the IDDA analysis to assess Intuitive Surgical’s fundamental, sentimental, and technical outlook.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

Strong procedure growth

Intuitive expects 2025 procedure growth between 15.5% and 17%. This steady increase supports recurring revenue from instruments and services and confirms the continued adoption of robotic-assisted surgery worldwide.

Next-gen platform rollout

The da Vinci 5 system brings major computing and software upgrades, including Force Gauge and In-Console Video Replay. Hospitals benefit from better precision, safety insights, and performance data, which makes upgrades more valuable and less frequent.

Global expansion and ecosystem strength

Da Vinci 5 recently earned its CE Mark, opening the European market. Hospitals usually keep each robotic system for 5–6 years, and once installed, it becomes central to their surgical operations, training, and marketing. This creates sticky, long-term relationships and predictable revenue.

Category king advantage

Within the surgical robotics space, Intuitive Surgical is viewed as the undisputed category leader. As one Mastermind member from the medical industry described, “da Vinci is the Ferrari, not the Porsche.” In other words, it’s the top-performing, most prestigious system in its class — trusted for precision and results, not price. Competitors may emerge, but they’re still years behind in data, brand power, and clinical trust.

Training moat and software ecosystem

Every da Vinci 5 now includes integrated simulation software through Surgical Science. This standardizes training and strengthens surgeon loyalty. Combined with Network CCM (remote software updates), Intuitive is turning its installed base into a smart, upgradeable ecosystem.

Leadership continuity

Dave Rosa took over as CEO in July 2025, with former CEO Gary Guthart becoming executive chair. This smooth handover ensures consistent vision and execution as the company scales globally.

Tariff headwinds manageable

Management guided 2025 gross margins to 66–67%, slightly below last year. While tariffs were cited as a headwind, insiders believe the real impact will be limited. The technology is largely U.S.-based and hospitals buy these systems for performance, not cost savings, making demand relatively inelastic.

Competition heating up

Medtronic’s Hugo robot is advancing toward U.S. approval, and Johnson & Johnson’s Ottava is entering late-stage trials. Although competition could bring pricing pressure, most analysts see Intuitive maintaining its lead due to brand dominance and clinical data.

Reimbursement and budget constraints

Hospitals face tighter budgets after Medicare’s 2.8% physician fee cut. However, premium centers continue investing in da Vinci systems as they attract patients and offer measurable surgical advantages.

China exposure and local competition

China’s procurement programs and rising local competitors remain risks. Price caps or tenders could pressure margins in that region.

Consistent financial execution

Intuitive continues to outperform Wall Street expectations with double-digit revenue and earnings growth. Recurring income from procedures and service contracts adds stability even in volatile markets.

Fundamental risk: Medium.

Intuitive Surgical remains the clear category king in robotic surgery with a deep moat built on technology, training, and reputation. Its Ferrari-like positioning, long product life cycles, and growing global adoption outweigh short-term tariff or budget risks.

IDDA Point 4: Sentimental

Overall sentiment is bullish for Intuitive Surgical. Investors view the company as a steady long-term growth play in a niche with high barriers to entry. Market optimism remains supported by continued innovation, loyal hospital relationships, and its dominance in the surgical robotics field.

Strengths

Strong brand loyalty among surgeons and hospitals. The da Vinci system is considered the gold standard in robotic surgery and carries prestige similar to Ferrari in the auto world. Hospitals proudly promote having a da Vinci system as a mark of excellence in patient care.

Positive Wall Street outlook. Analysts continue to highlight Intuitive as a category king with recurring revenue resilience. Even during market pullbacks, many institutions see dips as buying opportunities rather than reasons to sell.

Expanding product narrative. The launch of da Vinci 5 and upgrades like Force Gauge and Video Replay have reignited investor excitement. These upgrades are viewed as the start of a new multi-year replacement cycle across hospitals.

Predictable growth story. Procedure volume growth around 15–17% offers visibility for future earnings. Investors appreciate the reliability and consistent revenue mix from instruments and service contracts.

Emotional confidence from industry insiders. Healthcare professionals working with Intuitive describe its products as irreplaceable and incomparable. This insider trust reinforces investor confidence that competitors will struggle to match the company’s quality and data moat.

Defensive play in uncertain markets. Healthcare robotics is seen as less cyclical than other tech sectors. Investors often rotate into ISRG for stability when broader markets turn volatile.

Risks

Valuation premium. The stock trades at a higher multiple than peers, reflecting high expectations. Any earnings miss or margin pressure could lead to short-term corrections.

Rising competition. Medtronic and Johnson & Johnson are closer to launching robotic platforms that could introduce pricing pressure or slow system sales growth over time.

Macro and policy risks. While tariffs may have limited operational impact, headlines around trade policy or healthcare reimbursement can still shake sentiment temporarily.

Market rotation effects. If investors move toward high-yield or cyclical sectors, healthcare growth stocks like ISRG may underperform temporarily despite strong fundamentals.

Sentimental risk: Low to medium.

Market confidence in Intuitive Surgical remains high thanks to its leadership position, strong emotional brand equity, and ongoing product innovation. Short-term fluctuations may occur due to valuation and macro headlines, but long-term sentiment remains firmly positive.

IDDA Point 5: Technical

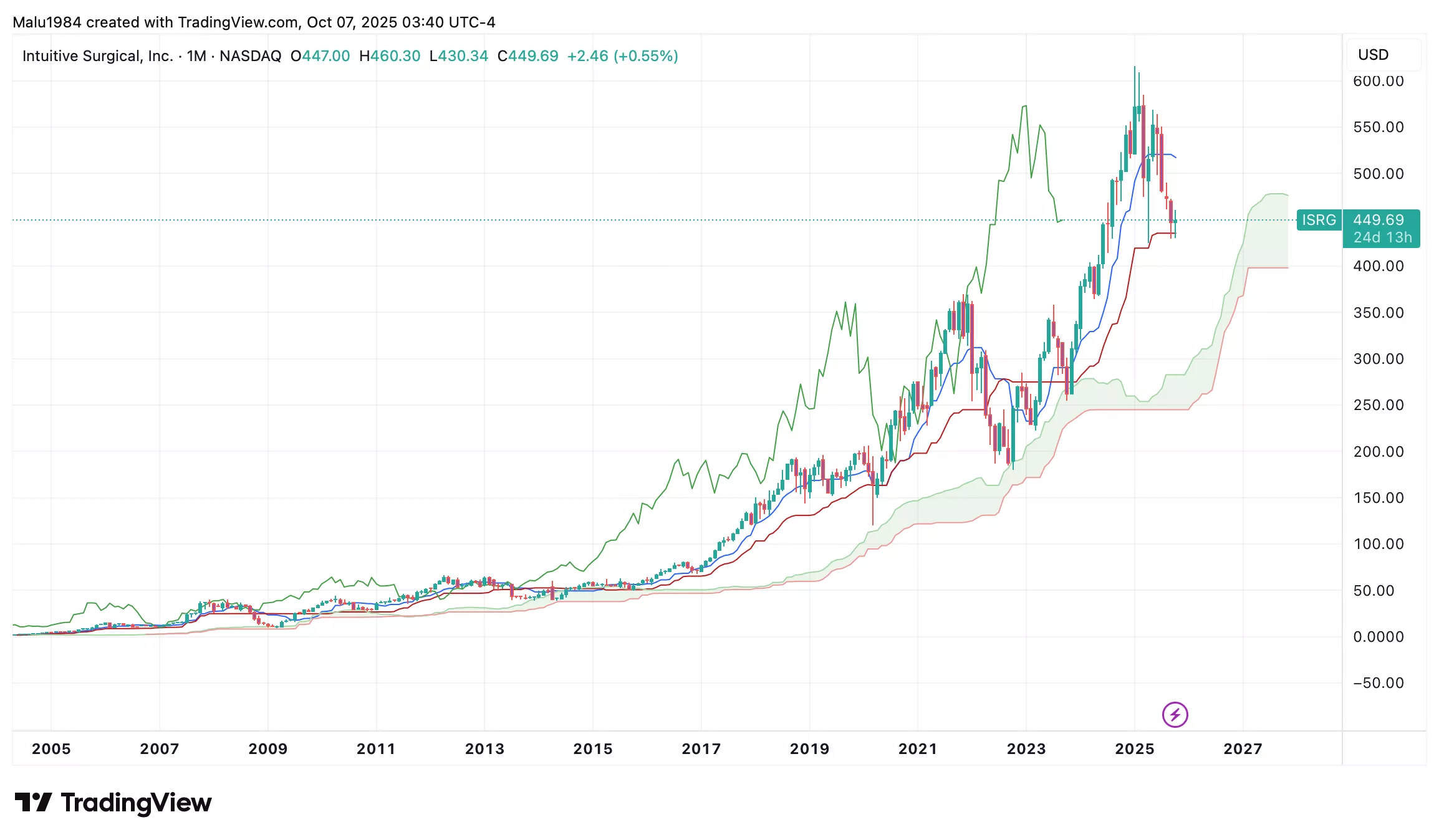

Monthly Chart

The long-term trend remains bullish. Since going public in the early 2000s, ISRG has consistently climbed, forming higher highs and higher lows over the years.

The Ichimoku Cloud on the monthly timeframe is green, showing a strong bullish structure. Candles remain above the cloud, and the conversion line is above the baseline, confirming that the long-term uptrend is still intact.

After hitting an all-time high of around $614 in January, the stock has pulled back to roughly $449, where the baseline is currently acting as support. As long as this level holds, the broader bullish trend remains valid.

(Click on image to enlarge)

Weekly Chart

On the weekly chart, short-term momentum has weakened. The Ichimoku Cloud is red, and candles are trading below the cloud. The conversion line has crossed below the baseline, signaling a short-term bearish phase.

The stock appears to have formed a potential double-top pattern, but the neckline around current price levels hasn’t broken convincingly. The inability to fall decisively below this neckline could mean the pattern fails and a rebound is possible.

RSI sits near 35, indicating the stock is in oversold territory. Historically, ISRG has tended to bounce when RSI dips to this range, similar to what happened in April when the stock rebounded after touching a similar level.

A small bearish RSI divergence has appeared between the last two weekly candles. While price moved slightly higher, RSI ticked lower, signaling weakening short-term momentum. This could lead to another retest of support near $437 before a stronger rebound develops.

Despite the short-term divergence, RSI remains above its previous low, meaning the larger bullish structure is still intact. If the RSI starts turning up again and price holds above the 50% Fibonacci level, the stock could attempt a bullish reversal pattern.

(Click on image to enlarge)

Overall technical outlook:

Intuitive Surgical remains in a long-term uptrend, supported by a strong green Ichimoku cloud on the monthly chart and a clear pattern of higher lows over time. In the short term, momentum is weaker, with price still trading below the weekly cloud and showing a mild bearish RSI divergence.

However, the RSI sits near oversold levels and strong support around $437 continues to hold, suggesting sellers may be losing steam. If the price stays above this key zone and RSI turns upward, a rebound is likely. Overall, the setup points to consolidation within a healthy long-term bullish structure.

Buy Limit (BL) levels:

$437.31 – High Risk

$395.64 – Moderate Risk

$335.70 – Low Risk

Investors looking to take profit can consider these Sell Limit Levels:

531.62 (Short term)

615.70 (Medium term)

691.73 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical risk: Medium.

The long-term trend remains bullish and well-supported, but short-term momentum signals are mixed. The mild bearish RSI divergence and candles below the weekly Ichimoku cloud suggest possible continued volatility before a clear reversal forms. However, strong historical support and oversold conditions reduce the likelihood of a major breakdown.

Summary: Final Thoughts

Intuitive Surgical (ISRG) stands out as the clear category leader in robotic-assisted surgery, combining advanced technology, strong financials, and an unmatched brand reputation. The company’s consistent double-digit procedure growth, expanding global footprint, and deep hospital relationships reinforce its long-term strength. The da Vinci 5 launch, new stapling approvals, and integrated training ecosystem further strengthen its competitive moat and recurring revenue potential.

From a sentimental perspective, investors and industry professionals alike view Intuitive as a high-quality, long-term compounder. Confidence in its innovation pipeline remains strong, and the market continues to reward its leadership and reliability.

The main risks lie in valuation, potential competition from Medtronic and Johnson & Johnson, and tariff or reimbursement pressures that could affect short-term margins — though insiders believe the impact will be limited given da Vinci’s unique position.

Technically, the long-term trend remains bullish, supported by a healthy monthly structure and strong support levels, even as short-term signals show consolidation. Momentum weakness appears temporary within an otherwise solid uptrend.

Overall view: Bullish.

Intuitive Surgical continues to demonstrate dominance in its field with sustainable growth drivers and loyal customers. The company’s innovation pace, brand power, and expanding ecosystem position it well for the next phase of growth in robotic surgery.

Overall risk: Medium.

More By This Author:

Netflix Stock Takes A Hit After Elon Musk’s Comments – Time To Buy The Dip Or Brace For A Bigger Drop?Could Bitcoin Break $200K This Cycle? What Investors Need To Know After Its $124K Peak

ishares Silver Trust ETF: Is This The Beginning Of A Mega Trend Or A Temporary Spike?