AMD Bold Move: The OpenAI Deal That’s Shaking Up Wall Street

Image Source: Pixabay

AMD’s latest partnership with OpenAI is making big waves on Wall Street – and for good reason. This bold, multi-year AI chip deal marks a major turning point for the once-underdog chipmaker, now emerging as a serious force in the artificial intelligence space. Under the agreement, AMD will provide powerful chips to support OpenAI’s next-generation AI systems – a deal that could bring in huge new revenue starting in 2026 and even gives OpenAI the option to buy a small ownership stake in AMD.

Combined with strong progress in its Instinct MI300, MI350, and upcoming MI400 chip series, expanding partnerships with IBM and IREN, and a growing ROCm 7.0 software platform, AMD’s long term growth story looks stronger than ever.

But every bold move comes with risks. Optimists believe this deal proves AMD’s rise as a true AI contender, supported by analysts raising their growth expectations and price targets. Skeptics, however, point out that the rollout won’t begin until 2026, meaning it will take time for the revenue to show up, while the massive power needs of AI systems could slow progress.

There are also concerns about potential share dilution from OpenAI’s ownership option and a possible manufacturing tie-up with Intel, which could bring added costs and production challenges.

For now, AMD’s stock has bounced back strongly, showing renewed investor confidence and excitement about what this deal could mean for the company’s future. Still, the pressure is on – after shaking up Wall Street with one of the biggest AI announcements of the year, AMD must now prove it can deliver. The next couple of years will be critical in showing whether this bold move will secure AMD’s place as a long-term AI leader or reveal that market enthusiasm moved faster than results.

IDDA Point 1 & 2: Capital & Intentional

Before investing in AMD, ask yourself:

Do you want exposure to a top-tier AI chipmaker now securing billion-dollar partnerships and expanding its footprint across cloud, enterprise, and data-center markets?

Are you comfortable with potential volatility and delays as the company scales up production and navigates power-intensive AI infrastructure demands?

Do you believe AMD’s innovation pipeline – from MI350 to MI400 and beyond – will sustain its edge against Nvidia and drive long-term market share gains?

For long-term investors, AMD offers a powerful case built on breakthrough partnerships, strong product execution, and rising credibility in the AI ecosystem – a once-underrated chipmaker now stepping into a leadership role.

Before investing in AMD or any asset, one should understand their unique risk tolerance and strategy, as this will determine how they navigate potential volatility and time their entries. For short-term investors, however, timing and patience will be key for taking short-term profits. The near term runway before revenue realization, along with lingering execution and cost risks, may spark fluctuations along the way. Still, as the AI boom expands and demand for compute power accelerates, AMD’s next act could mark its most transformative chapter yet.

IDDA Point 3: Fundamental

AMD’s new multi-year deal with OpenAI marks a major turning point for the company’s future growth and position in the tech world. Under this agreement, AMD will provide advanced chips and hardware to power OpenAI’s growing AI systems starting in 2026. The deal is expected to bring in massive yearly revenue, with management hinting it could become one of AMD’s biggest income drivers ever. As part of the partnership, OpenAI will also have the right to buy a small ownership stake in AMD, making it one of the company’s biggest potential shareholders. This collaboration not only confirms the strength of AMD’s technology but also highlights its arrival as a key player in the global AI infrastructure space, standing alongside Nvidia.

The partnership gives AMD a strong boost in confidence and strengthens its position in the high-performance computing market. Analysts have become more optimistic about AMD’s growth potential, raising their estimates for both earnings and company value. While Nvidia still leads the AI chip market, AMD’s steady progress, reliable product execution, and expanding partnerships suggest that its share of the AI industry could grow faster than many expected. This deal also highlights AMD’s growing advantage in powerful chip design and its improving software tools that make its products more accessible to developers and businesses.

AMD’s product development continues to move forward quickly. Its line of Instinct GPUs, including the MI300, MI350, and next-generation MI400 models, shows impressive performance improvements with each release. The company expects its next chips to be many times faster than current versions, helping it compete more effectively with Nvidia. At the same time, the launch of ROCm 7.0, AMD’s open source software platform for AI, is making it easier for developers to use AMD’s hardware in both large data centers and smaller devices, building a stronger, more complete ecosystem around its products.

Beyond the OpenAI deal, AMD is also expanding through new partnerships that broaden its exposure in the AI space. Recent collaborations with companies like IBM and IREN demonstrate rising customer confidence and steady demand for AMD’s hardware. Its recent financial performance also shows solid growth, supported by strong sales in both consumer and enterprise markets. Together, these achievements point to continued revenue expansion and improved profitability as the demand for AI technology grows across industries.

Despite these strong fundamentals, AMD still faces some challenges. A possible manufacturing partnership with Intel could come with production risks, especially since Intel’s newer technology has faced delays. Another factor to watch is the amount of power needed to run OpenAI’s large-scale infrastructure, which could affect how quickly the project moves forward. Still, a slower rollout could help prevent overheating in the AI market and allow AMD to scale more sustainably. Overall, this partnership marks a powerful step forward for AMD – one that strengthens its position in the AI revolution and reinforces its reputation as Nvidia’s most credible challenger.

Fundamental Risk: Medium

IDDA Point 4: Sentimental

Strengths

Transformative OpenAI Deal:

AMD’s multi year partnership with OpenAI confirms the strength of its AI chip technology and could bring in major new revenue. This deal puts AMD in a strong position as one of the key suppliers powering the global AI infrastructure.

Strong Product Roadmap:

AMD’s next-generation MI400 chips promise huge performance gains, while its ROCm 7.0 software platform makes its technology easier to use for AI developers. Together, these help AMD compete more effectively with Nvidia and attract new business clients.

Improving Growth Outlook:

Experts have become more positive about AMD’s future, raising long-term growth targets and showing greater confidence in its ability to capture a bigger share of the AI chip market.

Risks

Execution and Timing Risks:

The OpenAI deal won’t start generating results until 2026, meaning it will take time for the benefits to appear. The large power needs for AI data centers could also slow down the rollout.

Competition from Nvidia:

Even with AMD’s progress, Nvidia still leads the AI chip market thanks to stronger software and deeper customer relationships, which makes it harder for AMD to take a big share quickly.

Manufacturing and Ownership Risks:

A possible partnership with Intel for manufacturing could bring cost and production challenges, while OpenAI’s right to buy AMD shares could slightly dilute existing investors’ ownership over time.

AMD’s overall outlook has improved significantly after the OpenAI deal, which strengthens its position as a major player in the fast-growing AI hardware market. The partnership confirms that AMD’s chips can compete directly with Nvidia’s top models and marks a big step forward in the company’s growth story.

With OpenAI’s potential ownership stake and growing partnerships with other tech leaders like IBM and IREN, investor confidence in AMD has surged. While there are still challenges around execution, timing, and competition, market sentiment remains positive. Overall, AMD appears to be entering a strong new growth phase driven by rising AI demand, solid performance, and renewed investor belief in its long-term potential.

Sentimental Risk: Medium – High

IDDA Point 4: Technical

On the weekly chart:

Future cloud is bullish, suggesting ongoing upward momentum

Candlesticks are sitting on top of the cloud, acting as a support zone

We can see on the weekly timeframe that AMD was in an uptrend until November 2021, before retracing around 61% in 2022. It then recovered and reached a new high of $227 in March 2024, followed by another retracement of about 78% before climbing again.

We can see a sharp surge in AMD’s share price, coming out of consolidation, following the positive market reaction to the OpenAI news, with the stock climbing as high as $227, nearly retesting its previous highs.

However, the bearish candlestick formation suggests that this spike may be short lived, potentially indicating profit taking or a short term pullback before the next move. That said, it’s still too early to confirm whether this signals a temporary pause or the start of a larger reversal.

(Click on image to enlarge)

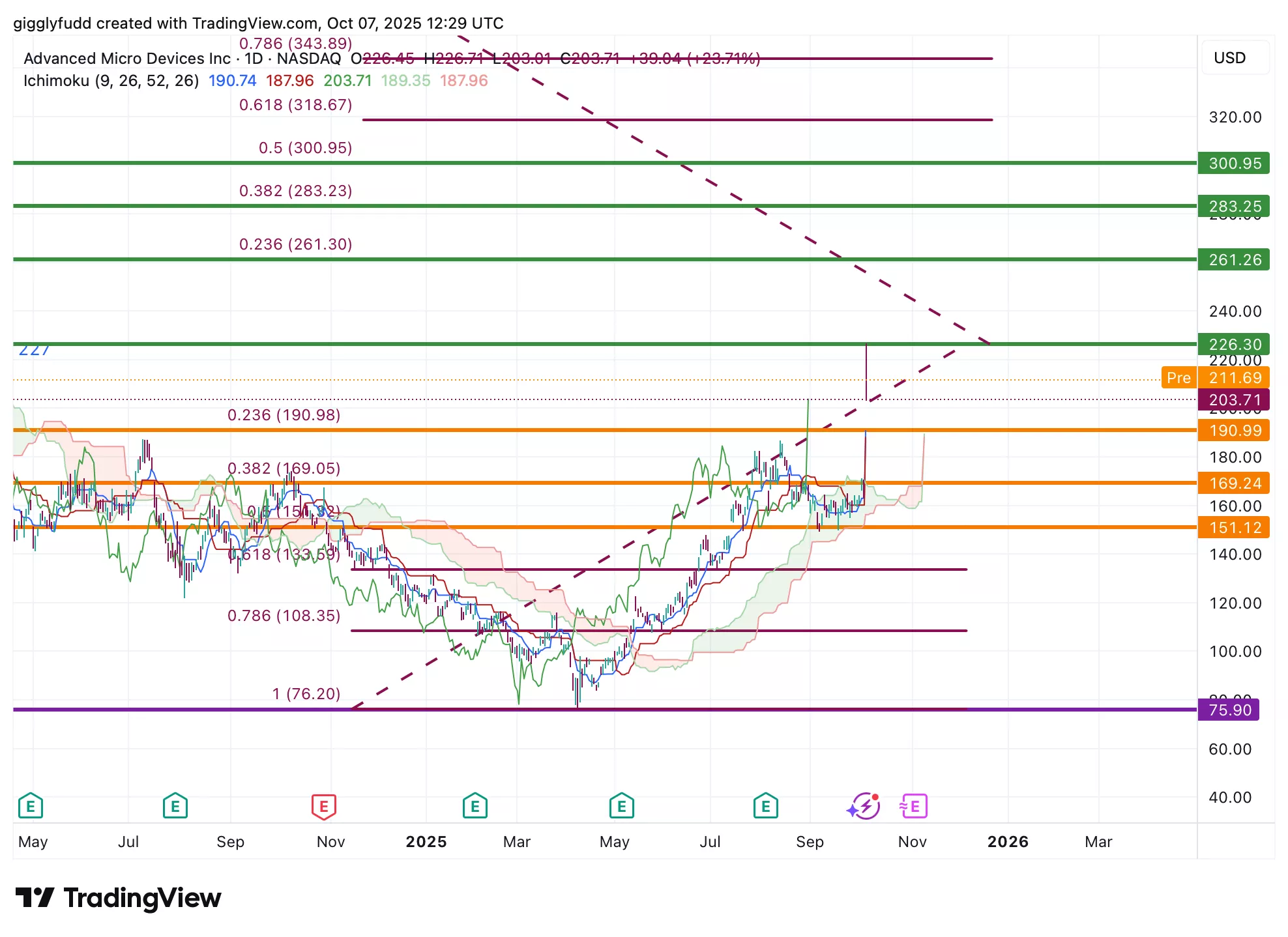

On the daily chart:

The pattern has been in an uptrend since April 2025, with a sharp breakout that surpassed the previous high of 188.

Despite the strong rally from 190 to as high as 226, the latest candlestick closed bearish, suggesting the spike may be short-lived as traders lock in profits.

The bearish Ichimoku cloud has now closed, indicating a potential end to the prior downward momentum and a possible shift toward stabilization or a new bullish phase.

The pattern has been in an uptrend since April 2025, with a sharp breakout that surpassed the previous high of 188. Despite the strong rally from 190 to as high as 226, the latest candlestick closed bearish, suggesting the spike may be short-lived as traders take profits.

However, the bearish Ichimoku cloud has now closed, indicating a potential end to the prior downward momentum and signaling the possibility of stabilization or the beginning of a new bullish phase.

(Click on image to enlarge)

Investors looking to invest in AMD can consider the following Buy Limit entries:

203.71 (High Risk – FOMO entry)

190.99 (High Risk)

169.24 (Medium Risk)

151.12 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

261.26 (Short term)

283.25 (Medium term)

300.95 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Medium – High

Final Thoughts on AMD (AMD)

AMD’s bold partnership with OpenAI has transformed it from a gaming and PC chipmaker into one of the most exciting players in the global AI revolution. Once the underdog to Nvidia, AMD is now emerging as a serious contender in artificial intelligence hardware.

The multi-year deal not only validates its technology but also positions AMD as a key supplier for the next wave of AI infrastructure. With rapid progress in its Instinct GPU lineup, expanding partnerships, and new software innovations, AMD is gaining strong momentum in high-performance computing.

While the company still faces challenges such as execution risks and infrastructure demands, its improving track record and growing leadership make these manageable. Technically, the stock shows renewed investor confidence after the OpenAI announcement, and though short-term pullbacks may occur, the long-term trend remains strong –making AMD a promising opportunity for those seeking exposure to the accelerating AI market.

Key Takeaways:

AMD is no longer just a traditional chip company –it’s emerging as one of the most credible challengers to Nvidia in the AI era. While near term risks and timing challenges remain, its expanding partnerships, improving technology, and growing role in AI infrastructure make it one of the most compelling long-term stories in the semiconductor space. For patient investors, AMD’s bold move with OpenAI could mark the start of its next major growth chapter.

Overall Stock Risk: Medium – High

More By This Author:

Could Intuitive Surgical Stock Be Sitting On A Quiet Revolution?Netflix Stock Takes A Hit After Elon Musk’s Comments – Time To Buy The Dip Or Brace For A Bigger Drop?

Could Bitcoin Break $200K This Cycle? What Investors Need To Know After Its $124K Peak