Is Delta Air Lines Flying Too High? The Premium Strategy Wall Street Can’t Stop Talking About

Image Source: Unsplash

After a period of steady recovery, Delta Air Lines (DAL) is flying high again – and Wall Street is taking notice. Once viewed as a traditional airline, Delta has rebuilt its reputation as a premium travel leader with a focus on high-end customer experiences, strong cash flow, and disciplined debt reduction.

This post-pandemic strategy has made Delta one of the most profitable airlines in a sector that still faces turbulence. But as investors celebrate its rise, a question remains: is Delta flying too high for its own good?

Delta’s recent results show its premium strategy is paying off. Profitability has improved thanks to stronger demand for premium cabins and better cost management, supported by lower fuel expenses. Its Monroe refinery business also helped boost profits by offsetting fuel price fluctuations. With reduced debt and a reinstated dividend, Delta is demonstrating renewed financial strength – a milestone few airlines have reached since the pandemic.

Still, the airline industry remains highly cyclical. Bulls see Delta as a standout carrier with strong brand loyalty, an industry leading frequent flyer program, and the ability to consistently outperform peers. Bears, however, warn that slower business travel, higher labor costs, and normalizing demand could weigh on results, especially as the stock already trades near or above fair value.

This balance between optimism and caution is what makes Delta’s story so interesting. The company’s fundamentals are solid, its premium model continues to perform, and management has executed its strategy well. But the key question is whether Delta can maintain this altitude once economic tailwinds weaken – or if turbulence ahead will pull it back toward more realistic levels.

For now, investors are watching closely as Delta’s premium strategy keeps the stock in focus, fueling debate over whether this high flyer still has more room to climb – or if it’s already approaching its cruising ceiling.

Let’s dive into it using the IDDA (Capital, Intentional, Fundamental, Sentimental, Technical):

IDDA Point 1 & 2: Capital & Intentional

Before investing in Delta, ask yourself:

Do you want exposure to a cyclical but improving airline that’s focused on premium travel and balance sheet strength?

Are you comfortable investing in a capital-intensive industry where fuel costs, labor contracts, and travel demand heavily influence earnings?

Do you believe Delta’s premium positioning and brand loyalty can continue to generate superior margins even as the industry normalizes?

For long term investors, Delta offers a blend of cash flow recovery, operational excellence, and dividend reinstatement, underpinned by a proven premium strategy. For shorter term investors, however, volatility may persist as the market weighs cyclical risks against improving fundamentals.

Every investor should carefully consider their own risk tolerance and investment strategy to determine whether DAL aligns with their portfolio goals. With stronger financials, a clear strategic focus, and a disciplined management team, Delta may be quietly charting its next phase of sustainable altitude – one built on consistency rather than turbulence.

IDDA Point 3: Fundamental

Delta Air Lines continues to strengthen its financial position, showing solid profit growth driven by its premium travel strategy. The shift toward higher paying customers has helped boost margins and offset rising labor costs and fluctuating fuel prices. While salaries have increased, savings from lower fuel expenses and improved efficiency have supported profitability and operational stability.

The company has also generated stronger free cash flow thanks to higher revenue and disciplined spending. With a healthier cash position and reduced long-term debt, Delta’s financial recovery appears steady. Management remains focused on debt reduction and sustainable growth, signaling confidence in the airline’s long term health and resilience.

Delta’s premium strategy continues to give it a competitive advantage, allowing it to earn more per seat than most rivals. Its Monroe refinery plays an important role in managing fuel costs, providing an internal hedge that helps stabilize margins. However, analysts note that while the premium model supports strong earnings, profit margins may normalize as travel demand and industry capacity return to balance.

From a valuation perspective, Delta’s stock has seen moderate upward revisions as analysts acknowledge its improved fundamentals. Even so, the shares may be slightly ahead of fair value, given that the airline’s current profitability is unlikely to stay elevated forever. The balance sheet, however, is much stronger than during the pandemic, and the reinstated dividend highlights management’s confidence in future performance.

Overall, Delta’s fundamentals are improving – with better cash flow, lower debt, and stable profits fueled by strong demand for premium travel. Still, the airline industry is cyclical and sensitive to external factors like fuel prices, labor costs, and global travel trends. While Delta’s financial base is stronger and its strategy well executed, investors should recognize that current results may represent the peak of the cycle, not the new normal.

Fundamental Risk: Medium – High

IDDA Point 4: Sentimental

Strengths

Delta’s premium travel strategy continues to attract customers and deliver higher revenue per seat than competitors.

The airline’s frequent-flyer program is the largest among U.S. network carriers, generating high-margin revenue from bank partnerships.

Leisure, business, and international travel have nearly returned to pre-pandemic levels, supporting strong passenger demand and traffic growth.

Risks

Business travel recovery remains slower than overall economic recovery, limiting premium demand growth.

With high demand and limited capacity, Delta risks overcrowding and reduced customer satisfaction in premium cabins and lounges.

Delta could be vulnerable to price wars if struggling competitors cut fares to win back market share.

Investor sentiment toward Delta Air Lines is cautiously optimistic, showing confidence in the company’s strong execution and premium strategy, while still recognizing the cyclical nature of the airline industry. Management’s positive outlook and higher cash flow guidance have strengthened trust in Delta’s recovery, supported by steady travel demand and easing recession concerns.

Both investors and analysts see Delta as a leading airline with solid fundamentals, an improving balance sheet, and a well executed strategy that keeps it ahead of peers. However, they also acknowledge that airline profits usually normalize over time as supply and pricing pressures return. Overall, sentiment remains positive but measured – viewing Delta as a well-managed, financially sound airline, even if the stock no longer appears undervalued at current levels.

Sentimental Risk: Medium

IDDA Point 5: Technical

On the weekly chart:

Current pattern is in an uptrend, indicating strong bullish momentum.

The future Ichimoku cloud is also bullish, with candlesticks positioned above the cloud – reinforcing the continuation of upward momentum.

On the weekly chart, DAL’s price pattern appears cyclical and choppy, moving through alternating uptrends and downtrends roughly every 3 to 8 months. In January 2025, the stock reached a new high of $69. Currently, it remains in an uptrend, with the future cloud still showing bullish signals and candlesticks holding above the cloud, suggesting that the upward bias is intact.

(Click on image to enlarge)

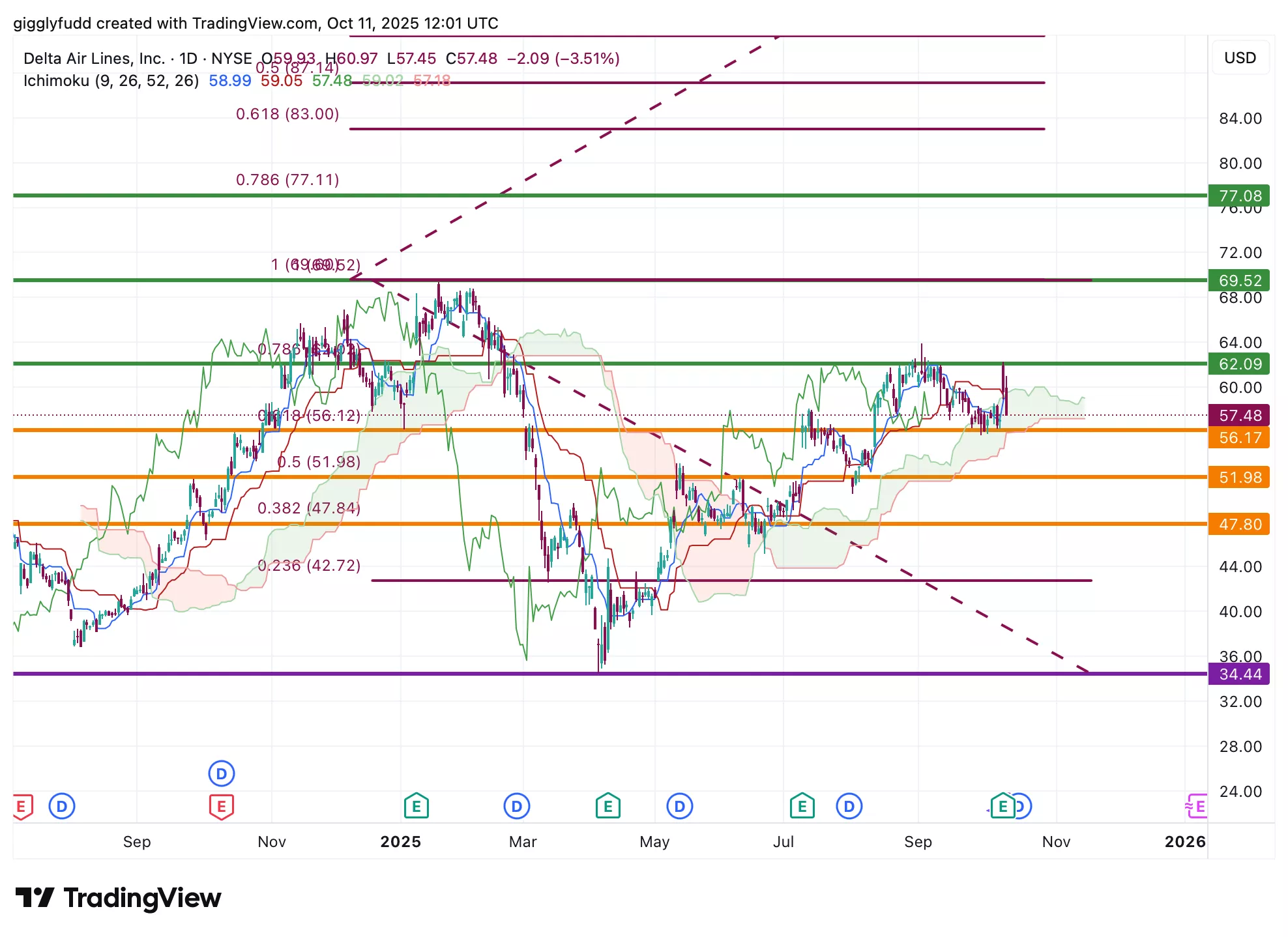

On the daily chart:

The future Ichimoku cloud remains bullish, but it has started to thin – indicating a potential weakening in bullish momentum.

Recent bearish candlesticks have dipped inside the cloud, testing its ability to hold as a support zone.

The Tenkan and Kijun lines have converged, suggesting a possible change in trend.

The overall pattern has been in an uptrend since April 2025, but it is now beginning to consolidate as the future cloud thins, signaling a slowdown in upward strength. The last two candlesticks were bearish, dipping inside the cloud and testing it as a support zone, which is currently still holding.

The convergence of the Tenkan and Kijun lines reinforces the possibility of a trend shift – if the Kijun line crosses above the Tenkan line to form a death cross, it would be an early bearish signal, suggesting short term downward momentum. Should the candlesticks break below the cloud, further downside movement can be expected.

(Click on image to enlarge)

Investors looking to get in DAL can consider these Buy Limit Entries:

56.17 (High Risk)

51.98 (Medium Risk)

47.80 (LowRisk)

Investors looking to take profit can consider these Sell Limit Levels:

62.09 (Short term)

69.52 (Medium term)

77.08 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Medium – High

Final Thoughts on Delta Air Lines (DAL)

Delta Air Lines continues to impress investors with its steady recovery and successful execution of its premium travel strategy. The airline has positioned itself as a top-tier carrier, supported by strong demand for premium cabins, improved margins, and a solid balance sheet strengthened by lower debt and healthy cash flow. Its Monroe refinery also provides a valuable cost advantage by helping offset fuel price swings.

However, as a cyclical business, Delta still faces challenges such as rising labor costs, slower business travel recovery, and potential margin pressure as competitors rebuild capacity. Technically, the long-term trend remains bullish, though recent price action shows signs of consolidation, suggesting possible short-term weakness if support levels fail to hold.

Key Takeaways:

The main question for Delta is whether it can maintain its strong profits as travel demand returns to normal, or if industry cycles will slow growth. Bulls see a strong, well-managed airline leading the sector with its premium strategy and solid financials. Bears warn that rising costs, competition, and market cycles could limit future gains. For long-term investors, Delta remains a reliable blue-chip airline with a proven business model and improving fundamentals. For short-term traders, however, the mixed technical signals and high risk suggest waiting for clearer entry points near key support levels.

Overall Stock Risk: Medium – High

More By This Author:

Is Kratos Stock Becoming The Dark Horse Of The AI Arms Race?Is Rubrik Stock The Quiet Bet You’re Missing?

AMD Bold Move: The OpenAI Deal That’s Shaking Up Wall Street