Coca-Cola Stock Is Quietly Making A Move Most Investors Are Missing

Image Source: Pixabay

Coca-Cola (KO) has been around for over 130 years and is one of the most recognizable brands on Earth. With more than 200 beverage brands across 200 countries, it’s not just about sodas anymore—Coke owns names like Fanta, Sprite, Minute Maid, Powerade, Costa Coffee, and even premium water and energy drinks.

So why are investors suddenly paying attention again?

Because beneath its predictable, dividend-paying surface, Coca-Cola has been quietly shifting gears. It’s not only raising prices and expanding its zero-sugar portfolio but also stepping into new profit zones like ready-to-drink alcohol. Add to that the potential outcome of its massive IRS tax case, and you have a company that’s setting itself up for a major shake-up—one way or another.

Whether this move turns into a breakout opportunity or a missed moment depends on how well you understand the full picture.

The IDDA Analysis framework is used to analyze companies and determine which are right for you. There are five steps to the process:

- Capital Analysis – Your personal risk tolerance.

- Intentional Analysis – Your unique financial goals and timelines based on your age, health, and lifestyle.

- Fundamental Analysis – The viability of the asset based on company performance, financial health, and market position.

- Sentimental Analysis – The current emotions of Wall Street and other market participants.

- Technical Analysis – Historical price action to identify key psychological levels and market patterns.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

Earnings and Revenue Growth

Coca-Cola continues to deliver steady growth even in a high-cost environment. In its latest quarter, organic revenue rose about 6 percent, while unit case volume grew 1 percent. Management reaffirmed its full-year outlook, expecting 5 to 6 percent organic revenue growth and around 8 percent earnings growth in 2025. This steady rhythm shows pricing power and consumer loyalty despite inflation pressures.

Product Diversification

Coca-Cola is expanding far beyond soda. Its zero-sugar portfolio, smaller portion sizes, and premium options like cane-sugar Coke are driving higher margins. The company is also moving into new categories with ready-to-drink alcohol such as Jack Daniel’s & Coke, Bacardi & Coke, and Minute Maid Spiked Lemonade, giving it access to higher-margin segments.

Global Footprint

With operations in over 200 countries, Coca-Cola benefits from global scale and distribution strength. Emerging markets such as Latin America and Africa continue to provide growth, while developed markets like the U.S. show resilience through strong brand loyalty and flexible pricing strategies.

Tax Case Uncertainty

The $18 billion IRS dispute remains a cloud over the company. A loss could limit buybacks and dividend growth, while a win could free billions for shareholders. The case is now on appeal and could stretch into 2026. Investors should watch this carefully because it can swing sentiment in either direction.

Regulatory and Environmental Costs

New EU packaging and reuse rules are pushing Coca-Cola to invest heavily in recyclable and refillable packaging. These initiatives are positive for long-term sustainability but can pressure margins in the short term due to higher production and logistics costs.

Financial Strength and Dividends

Coca-Cola generates around 10 billion dollars in annual free cash flow and maintains one of the strongest balance sheets in consumer staples. It has increased its dividend for more than 60 consecutive years, proving its commitment to shareholders.

Fundamental Risk: Low to Medium

Coca-Cola faces legal and regulatory hurdles, but its global brand strength, pricing power, and consistent cash flow keep its fundamentals solid.

IDDA Point 4: Sentimental

Overall sentiment is cautiously bullish for Coca-Cola.

Strengths

Investors continue to see Coca-Cola as a defensive play during market volatility. Its stable earnings, global dominance, and strong dividend history make it a safe haven when uncertainty rises.

Analysts remain optimistic. Major banks such as JPMorgan, Deutsche Bank, and Wells Fargo have target prices between 75 and 83 dollars, with most rating the stock as overweight or buy.

Consumer sentiment around Coca-Cola’s zero-sugar and mini-can strategy is positive. The company has successfully aligned with healthier lifestyle trends while maintaining brand loyalty.

CEO James Quincey continues to emphasize long-term innovation and brand evolution. His confidence in new revenue streams, including ready-to-drink alcohol, reassures investors that Coca-Cola is not staying stuck in the old soda model.

Dividend investors remain emotionally attached to Coca-Cola’s consistency. The brand represents reliability, and that loyalty shows up in both consumer behavior and shareholder trust.

Risks

Some investors worry that the IRS tax case could become a headline drag, causing hesitation until the issue is fully resolved.

The global trend of GLP-1 drugs like Ozempic has sparked concerns that reduced calorie consumption could hit beverage demand. So far, data shows minimal impact, but fear still lingers in the background.

ESG and environmental activists continue to pressure the company over plastic waste and sustainability targets. Reputational risk could affect public sentiment if progress is slow.

The broader consumer staples sector faces rotation risk, as investors sometimes move toward growth or tech stocks when interest rates drop. That could limit near-term enthusiasm even if fundamentals remain strong.

Sentimental Risk: Medium

Coca-Cola maintains positive investor sentiment thanks to its defensive reputation and strong leadership, but lingering legal issues and shifting global trends create some hesitation in the short term.

IDDA Point 5: Technical

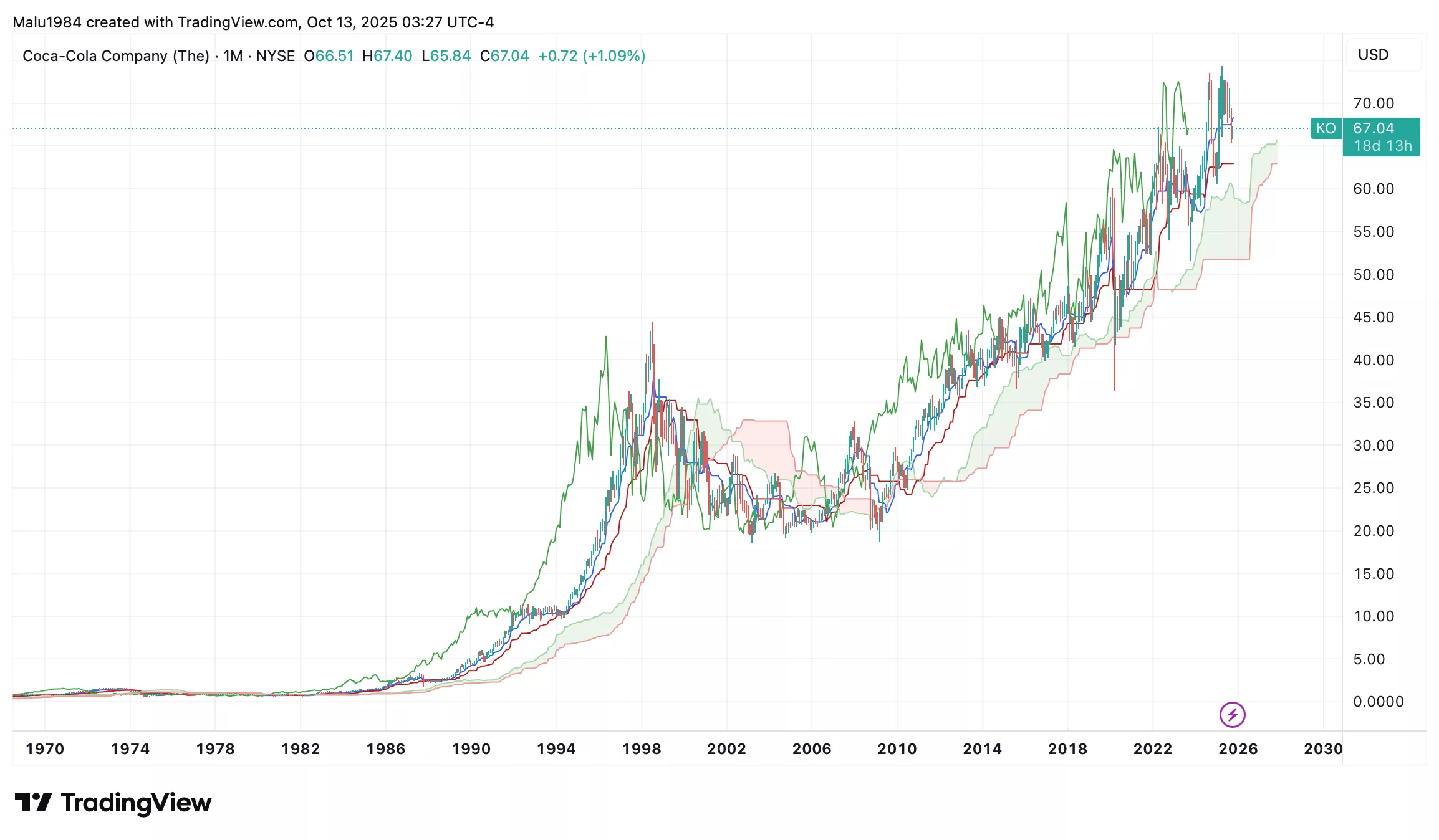

Monthly Chart

The long-term trend for Coca-Cola remains bullish. The Ichimoku Cloud is green, and the candles sit comfortably above it, showing strong support from long-term investors.

The conversion line is above the baseline, which confirms continued upward momentum and a solid bullish structure.

Price action shows consistent growth over the years, supported by steady higher lows, reflecting strong long-term confidence in the stock.

(Click on image to enlarge)

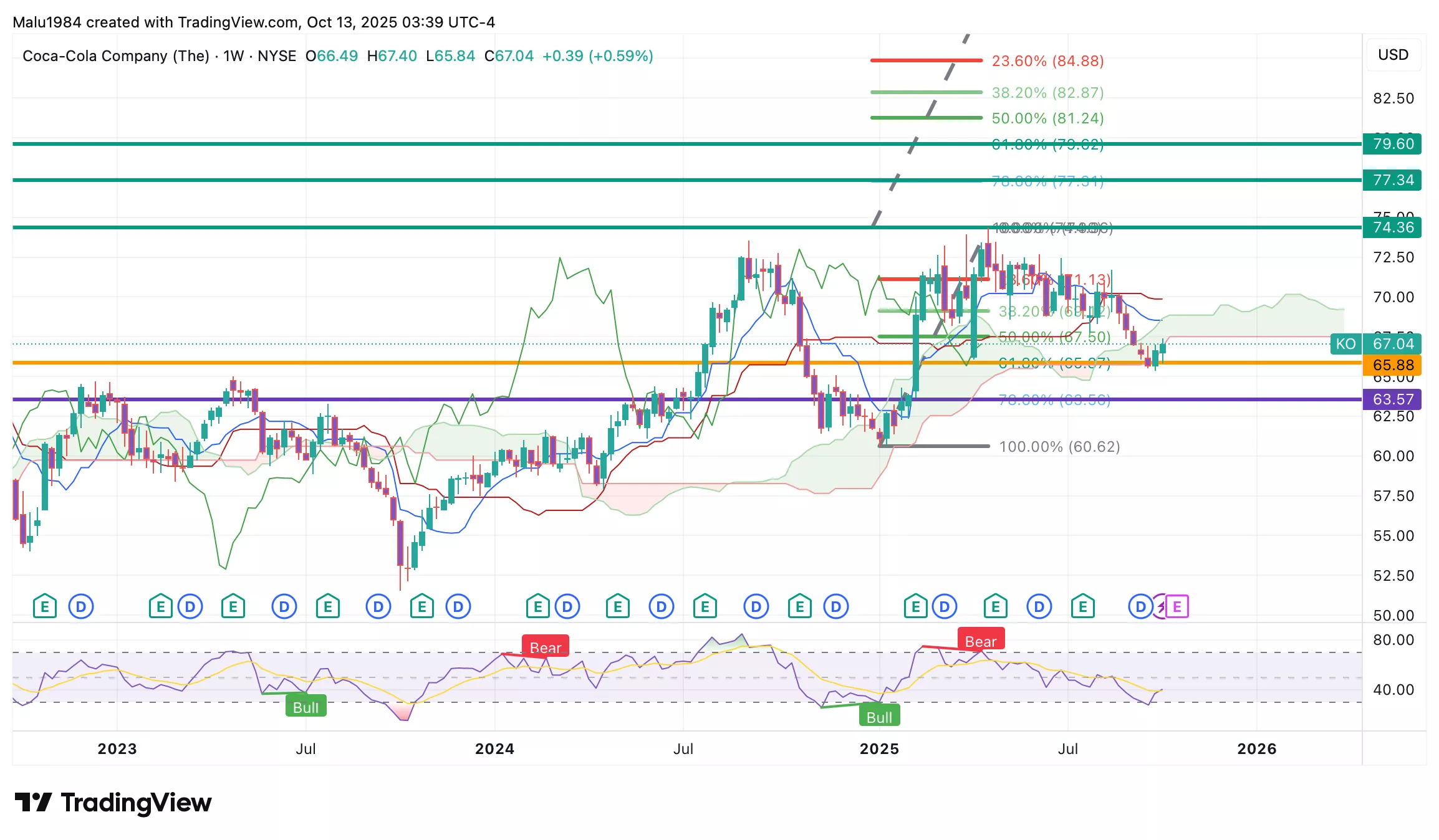

Weekly Chart

Since April, Coca-Cola stock has been in a mild downtrend, with prices moving lower toward the bottom of the Ichimoku Cloud.

The lower edge of the green cloud is now acting as a strong support area, and the last two weekly candles are bouncing from this level, forming a bullish engulfing pattern, which often signals the start of a reversal.

The conversion line is below the baseline, signaling that the short-term momentum is still weak and buyers have not fully regained control.

The RSI is around 40, showing that the stock is in a neutral-to-oversold zone, where a rebound could form if buying pressure increases.

Overall, Coca-Cola’s technical picture suggests a bullish long-term trend supported by strong fundamentals, while the short-term outlook remains cautious but stabilizing. The stock may consolidate near current levels before attempting a move higher.

(Click on image to enlarge)

Buy Limit (BL) levels:

$65.88 – High Risk

$63.57 – Moderate Risk

Investors looking to take profit can consider these Sell Limit Levels:

74.36 (Short term)

77.34 (Medium term)

79.60 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Low to Medium

Coca-Cola’s long-term bullish structure remains intact, supported by a green Ichimoku Cloud and strong historical trend. Short-term weakness has shown signs of stabilizing with a bullish engulfing pattern near support, suggesting limited downside risk unless the price breaks below the cloud.

More By This Author:

Has Qualcomm Finally Woken Up? The AI Breakout Wall Street Didn’t See Coming

Is Delta Air Lines Flying Too High? The Premium Strategy Wall Street Can’t Stop Talking About

Is Kratos Stock Becoming The Dark Horse Of The AI Arms Race?