Facebook Craters 16% To 6 Year Low On Dismal Earnings, Warns Of "Revenue Challenges"

Image Source: Pixabay

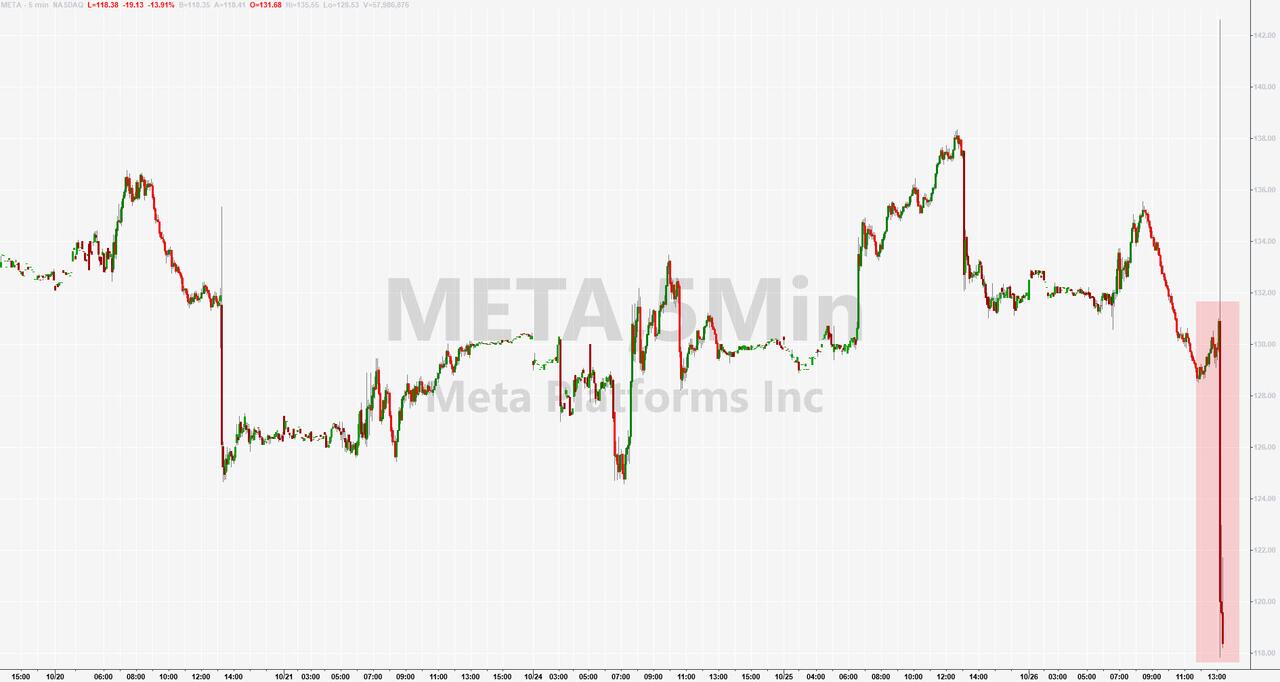

Heading into today's earnings from Facebook, which still has the bizarro ticker META (Ok, Zuck, we got the joke, time to change the name and the ticker), the option-implied move was for a staggering 12% swing in the stock price as nobody had any idea what to expect: yes, the recent results from SNAP and GOOGL were ugly, but sentiment was so beaten down that it was unlikely Facebook could really surprise to the downside.

Well, moments ago the company reported earnings, and it appears that the options market was correct, because after first surging almost 10% higher, the stock has since tumbled almost 10% all in the span of a few seconds as traders digest what the world's largest social network reported for Q3, which is the following: a beat on revenue and a miss on EPS.

- EPS $1.64, missing the estimate of $1.89, down 49% from a year ago.

- Revenue $27.71BN, beating the consensus estimate of $27.41BN, but down 4% from a year ago.

- Advertising rev. $27.24 billion, beating estimates of $26.86 billion

- Family of Apps revenue $27.43 billion, beating estimates of $27.07 billion

- Reality Labs revenue $285 million, missing estimates of $406.3 million

- Other revenue $192 million, in line with the est. $193.9 million

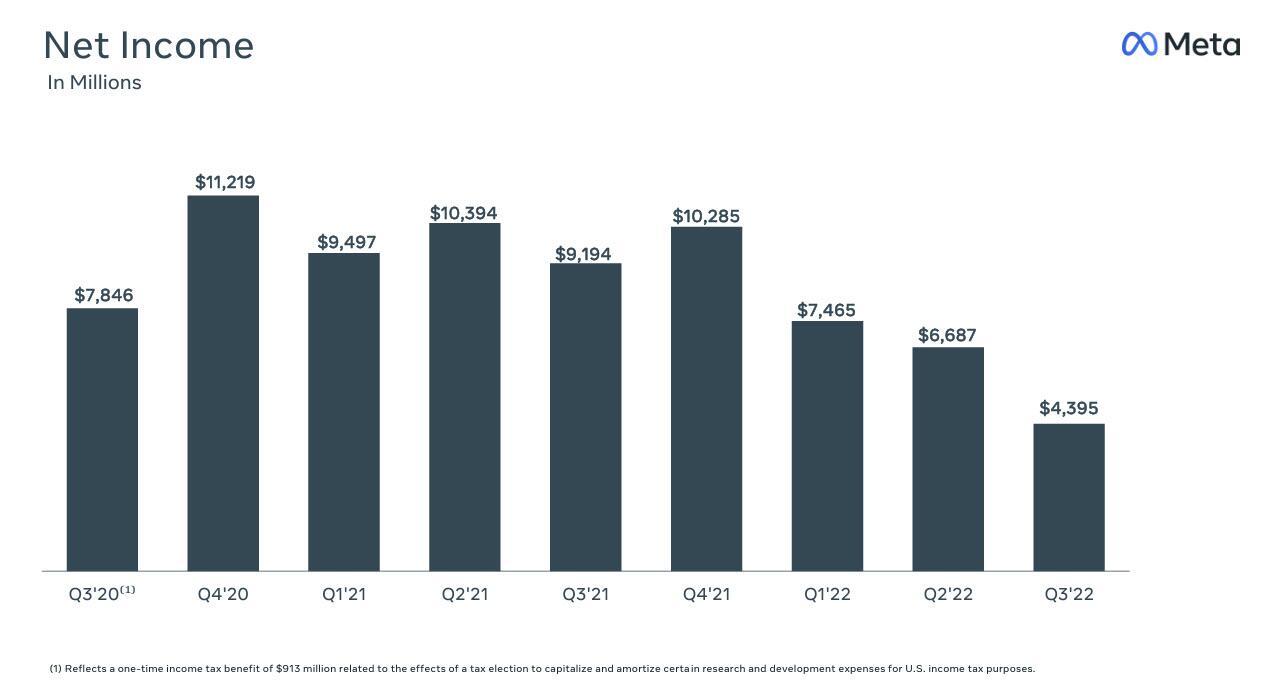

Despite the revenue beat, this was the second straight quarter of revenue declines from the year earlier (after the first decline ever last quarter). As for Net Income, forgetaboutit...

(Click on image to enlarge)

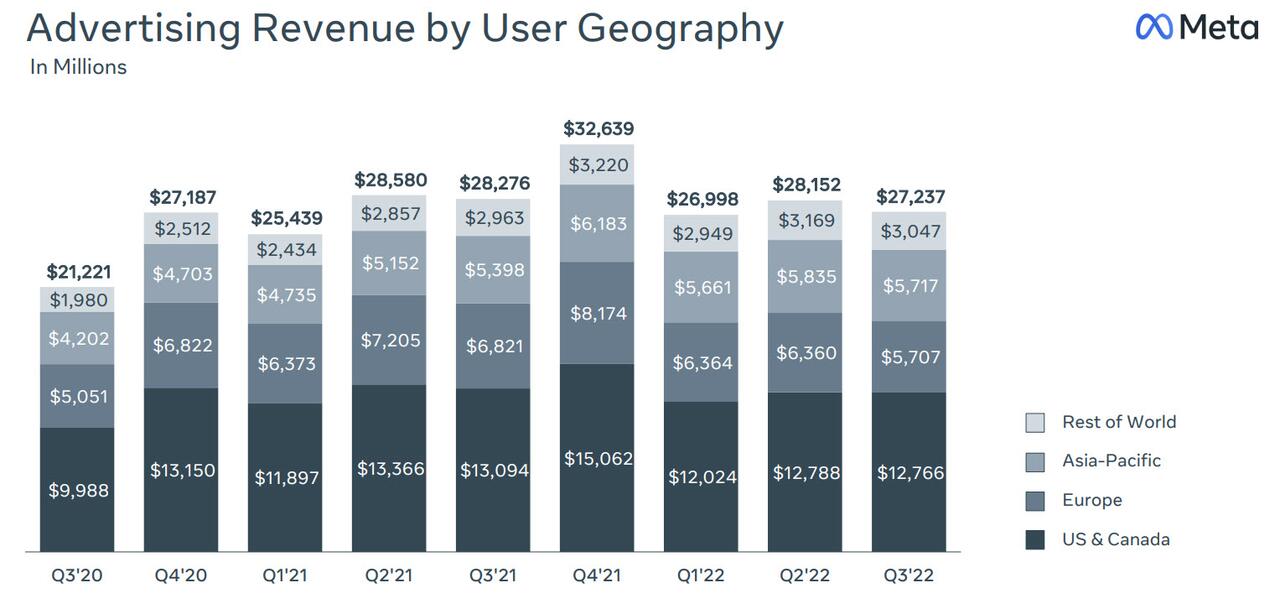

... As Bloomgerg notes, this is a company that got so used to growing with no end in sight, that they now have to adjust to a period of intense prioritization. Needless to say,a mixed picture at best, especially since the number of total ad impressions rose by a higher than expected +17% (est. +11.8%) and yet the average price per ad tumbled -18%, much worse than the estimate -15.3%. In fact, ad revenue was so ugly, it dropped in every user geography.

(Click on image to enlarge)

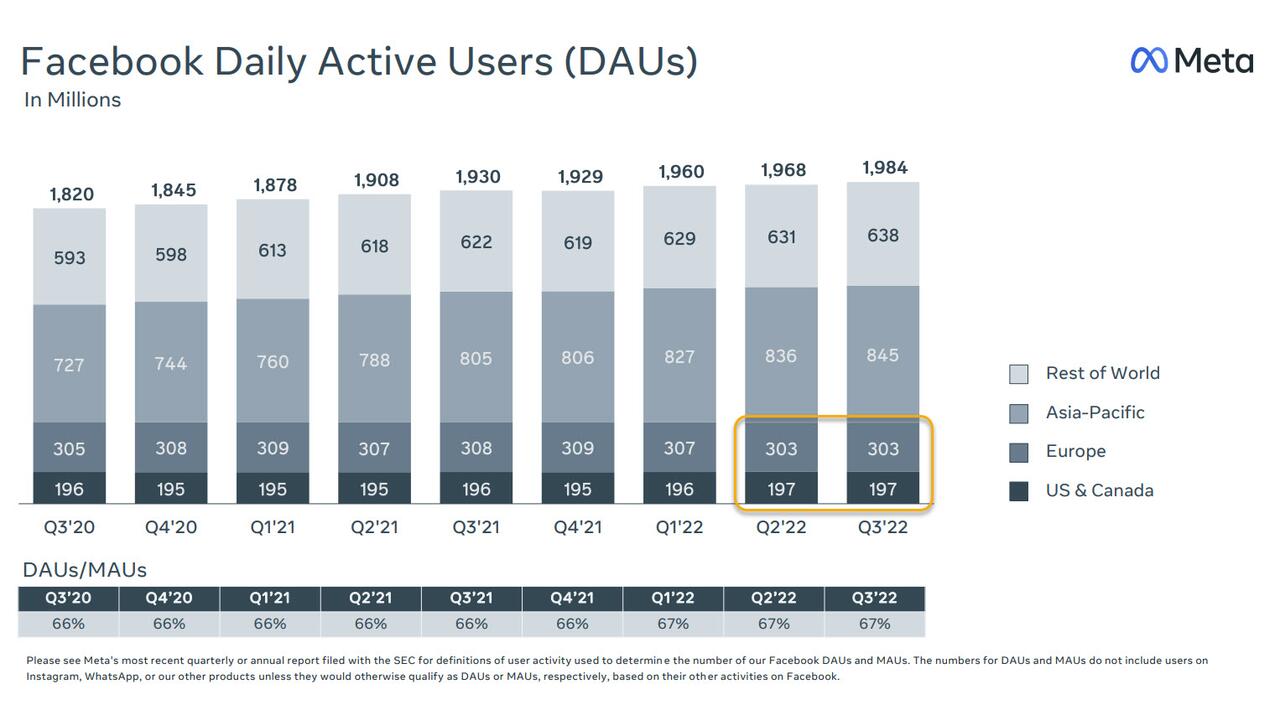

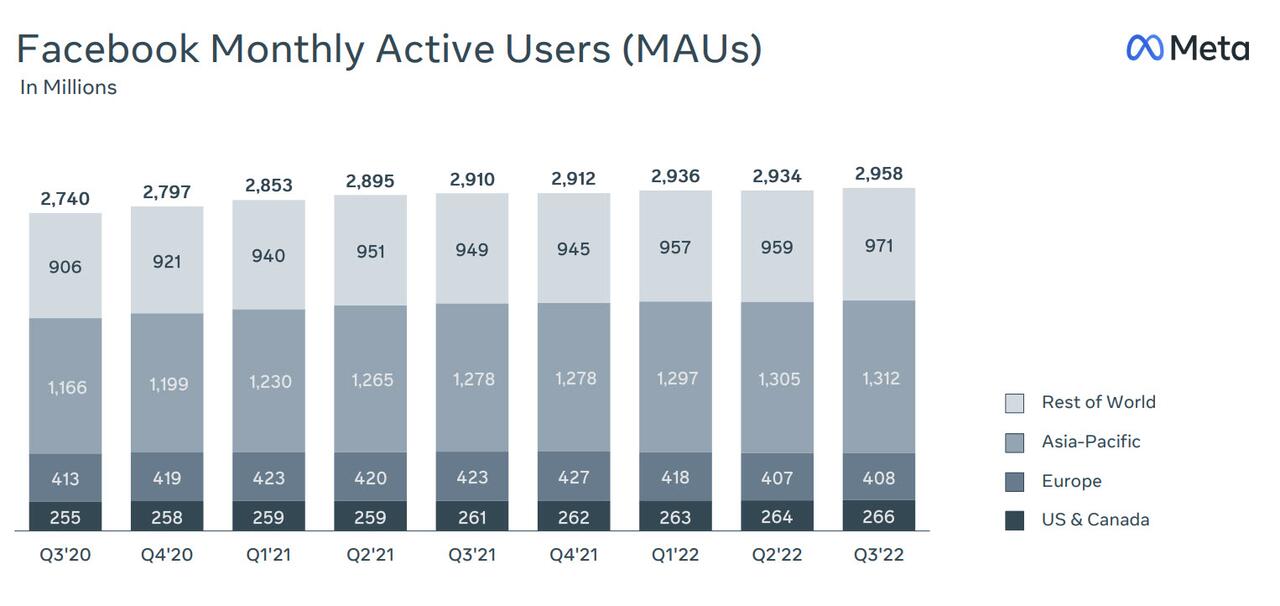

Looking at the number of users, we get more mixed results:

- Facebook daily active users 1.98 billion, beating the est. 1.86 billion

- Facebook monthly active users 2.96 billion, missing the est. 2.97 billion

Some more headlines from the quarter:

- Meta Sees Reality Labs Op Losses in 2023 Significantly Higher

- Meta Making Changes Across Board to Operate More Efficiently

- Meta Has Increased Scrutiny on All Areas of Operating Expenses

- Meta Holding Some Teams Flat in Headcount, Shrinking Others

- Meta: Beyond 2023 to Pace Reality Labs Investments

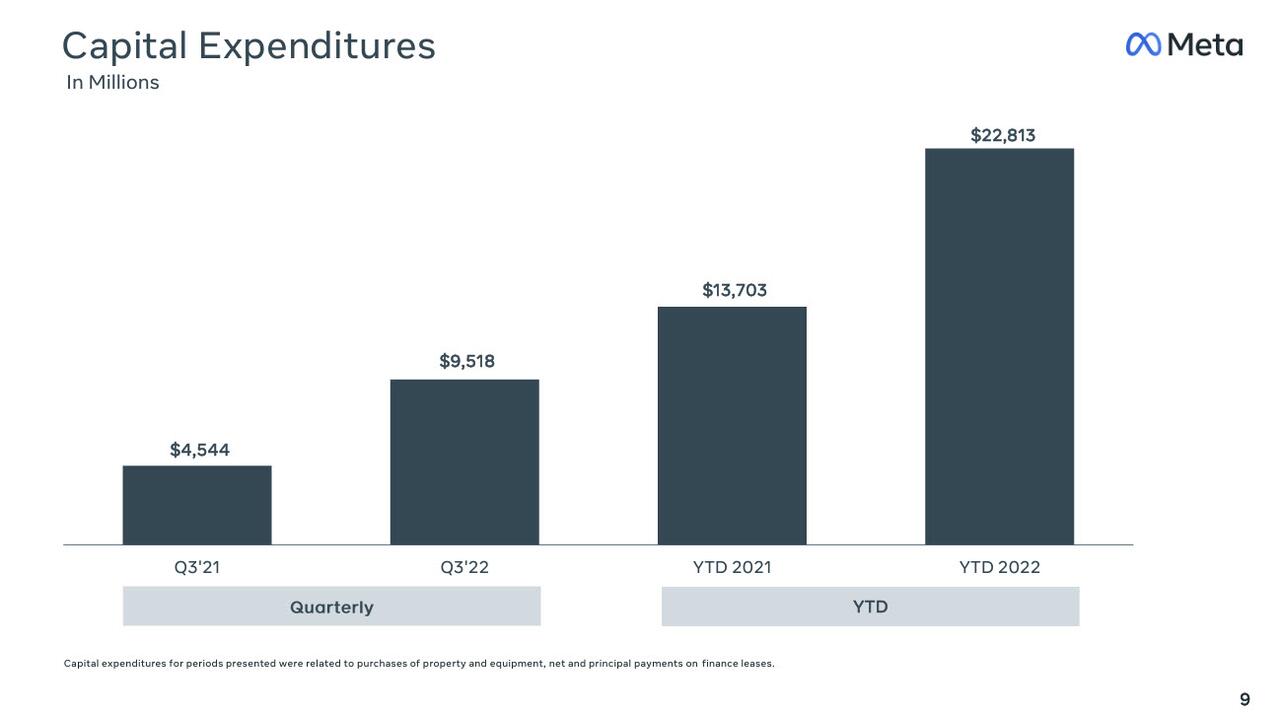

- Meta: Boost in AI Capacity Driving Capex Growth in 2023

But it was the company's guidance that prompted the after-hours reversal from high to low, as the company now sees:

- Revenue of $30 billion to $32.5 billion, on the weak side of the estimate $32.2 billion

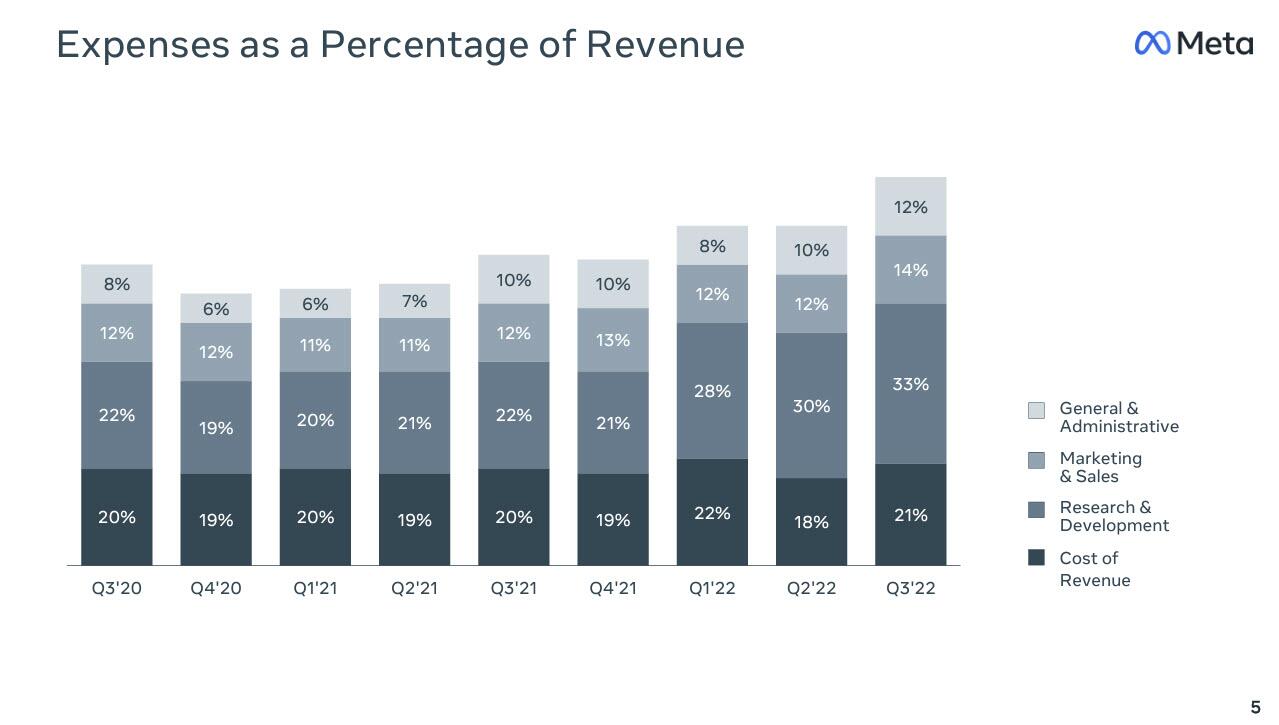

And while FB trimmed its expense forecast for full year 2022 to $85 billion-$87 billion, from $85 billion-$88 billion (est. 85.11BN), it was the company 2023 full year forecast that was ugly, as a result of far more spending than previously expected:

- Sees total expenses $96 billion to $101 billion, estimate $93.2 billion

(Click on image to enlarge)

- Sees capital expenditure $34 billion to $39 billion, estimate $28.99 billion

(Click on image to enlarge)

Finally, what assured that META stock would crater is the warning from CEO Mark Zuckerberg, who admitted that "we face near-term challenges on revenue".

And while he tried to walk it back by promising that "the fundamentals are there for a return to stronger revenue growth" and that he is "approaching 2023 with a focus on prioritization and efficiency that will help us navigate the current environment and emerge an even stronger company" all investors saw was "revenue challenges" and hammered the stock accordingly.

It gets worse: the company said that FX would be a ~7% headwind to Y/Y total revenue growth in 4Q.

Amazingly, despite the ugly results, Meta said it sees headcount end of 2023 about in-Line With 3Q 2022. Don't worry, after Zuck sees the crash in the stock he will change his mind.

Bottom line: what little good news there is, is that Facebook is still growing on both a DAU...

(Click on image to enlarge)

... and MAU basis.

(Click on image to enlarge)

As Zuckerberg has told his employees, once you have the attention, you can make money off of that. And that’s what’s going to fund this metaverse transition.

The bad news is that so far the transition is going from bad to worse, with the company plowing ever more dollars into its new strategic vision, and has nothing to show for it. Or rather it has a crashing stock price to show: remember what we said that META options were pricing in a 12% swing after earnings? Well, they got just that- first to the upside, and then down...

(Click on image to enlarge)

... with the stock plunging 70% from its recent highs, and tumbling to a fresh 2016 low of $114...

(Click on image to enlarge)

... and still dropping.

More By This Author:

Stellar 5Y Auction, With Huge Foreign Demand Sparks More Buying Across The Curve

Alphabet Plunges After Missing Across The Board, Drags Nasdaq Lower After Hours

GM Jumps 5% After Reaffirming EBIT Guide, Beating Q3 Estimates

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more