Alphabet Plunges After Missing Across The Board, Drags Nasdaq Lower After Hours

The tech earnings train has gotten derailed on the very first stop and it's looking uglier by the minute: moments after Microsoft slumped after reporting otherwise solid earnings, and Texas Instruments guided below expectations again, it was Google's turn to disappoint and it did just that when it reported earnings that missed on revenue and EPS for the second consecutive quarter, sending GOOGL's stock sharply lower after hours (hardly a shock after the catastrophic Snapchat earnings last week).

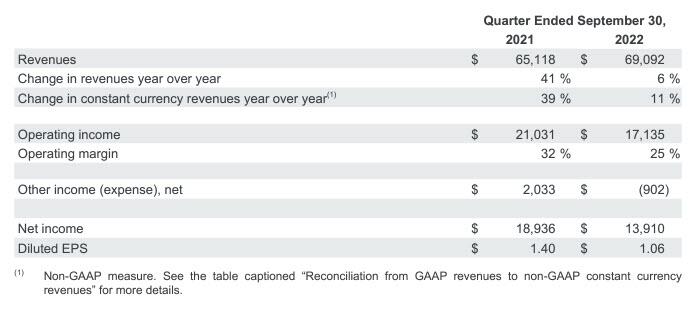

Let's dig into what was another mediocre at best (if perhaps not as ugly as some had expected) quarter for Alphabet:

- EPS $1.06, missing estimates of $1.25, down from $1.40 Y/Y

- Revenue $69.09 billion, up 6% Y/Y and 11% in constant currency, and missing consensus estimates of $70.76 billion

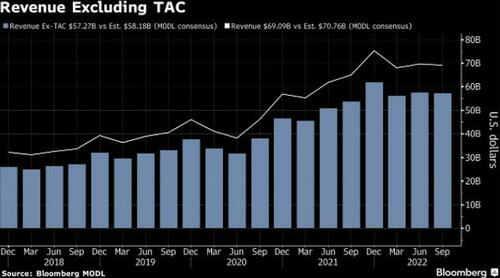

- Revenue ex-TAC $57.27 billion, missing estimates of $58.18 billion

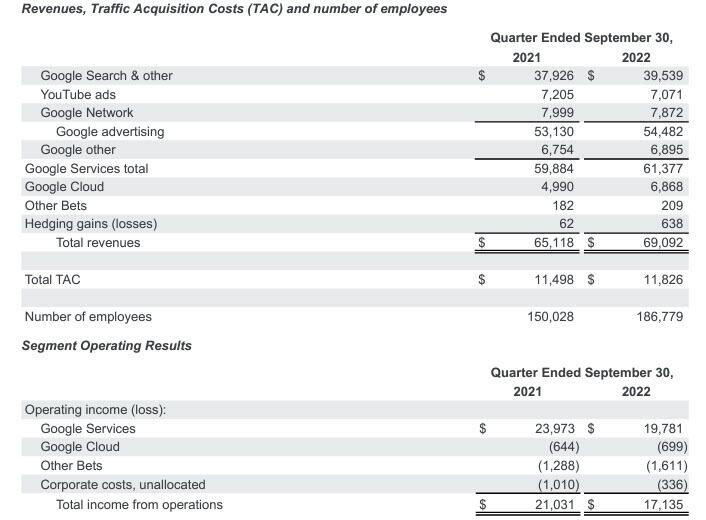

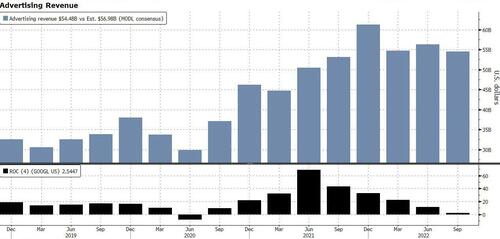

- Google advertising revenue $54.48 billion, missing estimates of $56.98 billion

- YouTube ads revenue $7.07 billion, missing estimates of $7.46 billion

- Google Services revenue $61.38 billion, missing estimates of $63.98 billion

- Google other revenue $6.90 billion, beating estimates of $6.84 billion

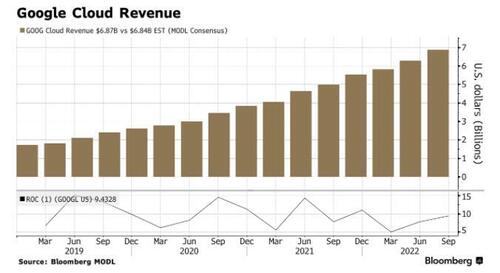

- Google Cloud revenue $6.87 billion, beating estimate $6.61 billion

- Other Bets revenue $209 million, beating estimates $204 million

- Operating income $17.14 billion, missing estimates of $19.71 billion

- Google Services operating income $19.78 billion, missing estimates of $23.03 billion

- Google Cloud operating loss $699 million, beating the estimated loss of $814.2 million but worse than the $644 million a year ago.

- Other Bets operating loss $1.61 billion, missing the estimate loss $1.37 billion

- Operating margin 25%, missing the estimate 27.9%

- Capital expenditure $7.28 billion, missing the estimate $7.65 billion

- Number of employees 186,779, vs estimate 177,845

Needless to say, but Bloomberg says it anyway, “this is a really bad print" although to be fair, 5% of the impact was currency.

Bottom line: all of Google’s core ads business - search, YouTube, and the network division - fell short of analyst expectations. But Google’s cloud business did report $6.87 billion of revenue, slightly above estimates.

The result visually:

(Click on image to enlarge)

And a more detailed breakdown:

(Click on image to enlarge)

Here is Revenue ex-TAC:

Looking to the cash flow statement, Google continues to spend heavily, reporting $7.3 billion in capital expenditure. The other number Wall Street is worried about is TAC: the total amount paid to partners for the ads business. That only grew 3% to $11.8 billion, but it’s a figure Google executives have said they will eventually rein in.

Commenting on the quarter, CEO Sundar Pichai was laconic: “We’re sharpening our focus on a clear set of product and business priorities. Product announcements we’ve made in just the past month alone have shown that very clearly, including significant improvements to both Search and Cloud, powered by AI, and new ways to monetize YouTube Shorts. We are focused on both investing responsibly for the long term and being responsive to the economic environment.”

CFO Ruth Porat tried her pest to spin an otherwise ugly quarter and failed: "Financial results for the third quarter reflect healthy fundamental growth in Search and momentum in Cloud, while affected by foreign exchange. We’re working to realign resources to fuel our highest growth priorities."

Porat also said that results “clearly reflect the effect of foreign exchange" which is to be expected a time when the Bloomberg dollar index is at all time highs. She said the deceleration in growth is in part driven by lapping very strong performance last year, but there is a pullback in spending by some advertisers, which applies to both YouTube and Search.

In terms of YouTube, this is what she had to say about the unit's slowdown: "I would say the largest driver of deceleration in sequential year-on-year growth was a further pullback in spend by some advertisers that was across brand and direct response."

To the disappointment of some, there were no incremental stock buyback announcements but recall that just two quarters ago GOOGL announced plans to buy back an additional $70BN in Class A and Class C shares, and also unveiled the 20 for 1 stock split.

That said, Alphabet did repurchase another $15.4bn of stock in the quarter (the same as last quarter) , a sign of GOOGL management continued focus on capital allocation and balancing investments/margins in a post pandemic environment. That may explains why Alphabet’s cash hoard declined for a fourth straight quarter, falling to $116 billion from $125 billion in Q2, $134 billion at Q1, and $139.6 billion at the start of the year.

One reason the stock is getting punished especially hard is that Google ad revenue missed expectations again, just like last quarter, only unlike last quarter when GOOGL stock bounced on hopes that the ad revenue slump would be temporary, this time the market is becoming increasingly desperate especially after last week's SNAP cataclysm. And while the silver lining is that while ad revenues were not hammered as much as Snap, they just barely grew from the $53.1 billion last year to just $54.5 billion in Q3, 2002, not only missing expectations of $56.98 billion, but also the worst growth rate since Q2 2020.

As Bloomberg intelligence notes, "ad pricing probably puts more pressure on the YouTube segment than it does on core search."

Additionally, search advertising, Google’s core business that’s typically insulated from the economic swings of social-media advertising, grew 4% to $39.53 billion. But that’s still shy of analysts’ estimates of $40.87 billion, which likely disappoints investors.

While advertising was weak, at least Google Cloud came in modestly above expectations. That said, the business continues to burn money.

Remarkably, despite all of Google’s plans to limit hiring (and place hiring freezes across some divisions), the company still added more than 12,000 employees during the quarter. Alphabet-wide, that’s now more than 186,000 employees, doubling the company's headcount in 4 years.

In kneejerk reaction, the stock was not happywith the across the board miss, and GOOGLE stock is down some 5% after hours...

(Click on image to enlarge)

... and together with MSFT and TXN dragging the Nasdaq down by 1%, cutting today's gains in half.

And here is the big question posed by Bloomberg Intelligence: Search underperformed. “Is it temporary? Is it what Snap was saying about pricing or is it structural?” The answer will determine whether there is a + or a - before the next 50% move in the stock.

More By This Author:

GM Jumps 5% After Reaffirming EBIT Guide, Beating Q3 EstimatesUS Gasoline Prices Go Haywire As Stockpiles Crater... But Here Comes China To The Rescue

Amazon Shares Dump After Reported Hiring Freeze In AWS Division

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more