Stellar 5Y Auction, With Huge Foreign Demand Sparks More Buying Across The Curve

After yesterday's ugly 2Y auction, which many had expected would come in far stronger than it actually did, bond pundits were not excited about the prospects of today's $43 billion 5Y auction. Of course, that's probably why the just concluded sale of 5Y paper was one of the strongest ones this year.

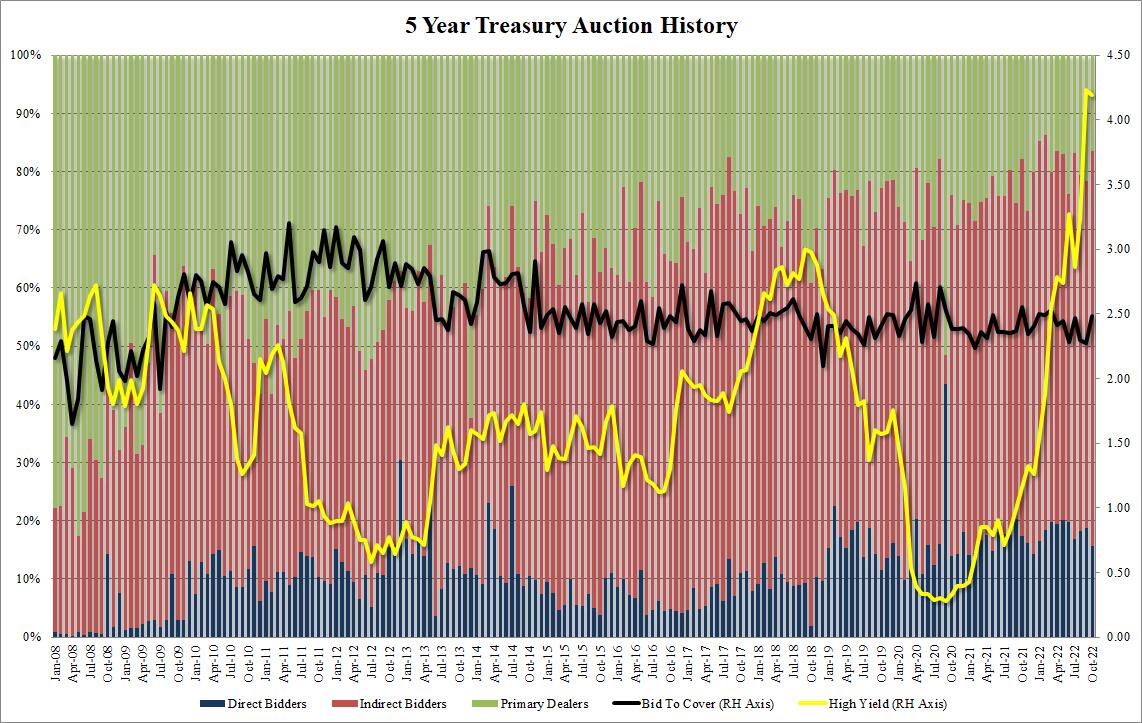

The high yield of 4.192% not only stopped through the When Issued 4.210% by 1.8bps, the first stop through since July, and the biggest one since October 2021, but was also the first time a 5Y auction has yielded less than the prior month (September was 4.202%) since July.

The Bid to Cover, unexpectedly surged from 2.27 to 2.48, the highest since March, and clearly well above the 6-auction average.

The internals were also solid with foreign buyers (i.e., Indirects) taking down 67.8%, the most since January 2022 (when it was 68.72%). And with Directs awarded just 15.6%, the lowest since Dec 2021, meant that Dealers were left with 16.5%, the lowest since April 2022.

(Click on image to enlarge)

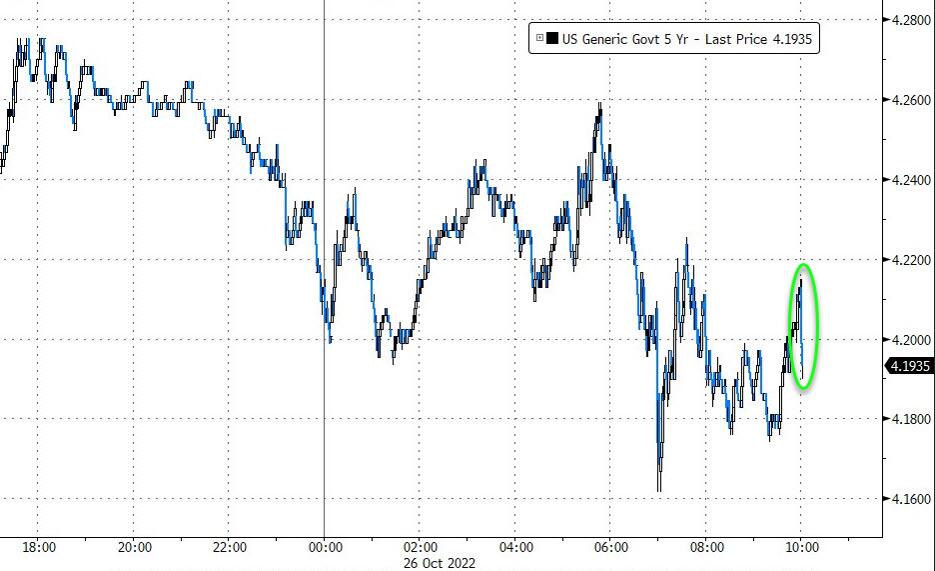

Overall, this was an unexpectedly impressive 5Y auction and one which sent yields across the curve even lower on the day, with the 10Y straddling 4.000% as of 1:15 pm.

(Click on image to enlarge)

More By This Author:

Alphabet Plunges After Missing Across The Board, Drags Nasdaq Lower After HoursGM Jumps 5% After Reaffirming EBIT Guide, Beating Q3 Estimates

US Gasoline Prices Go Haywire As Stockpiles Crater... But Here Comes China To The Rescue

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more