GM Jumps 5% After Reaffirming EBIT Guide, Beating Q3 Estimates

General Motors shares are up about 5% in the pre-market session after the automaker reaffirmed its full-year adjusted EBIT guidance, which was higher than analyst expectations, after also reporting better-than-expected third-quarter results.

(Click on image to enlarge)

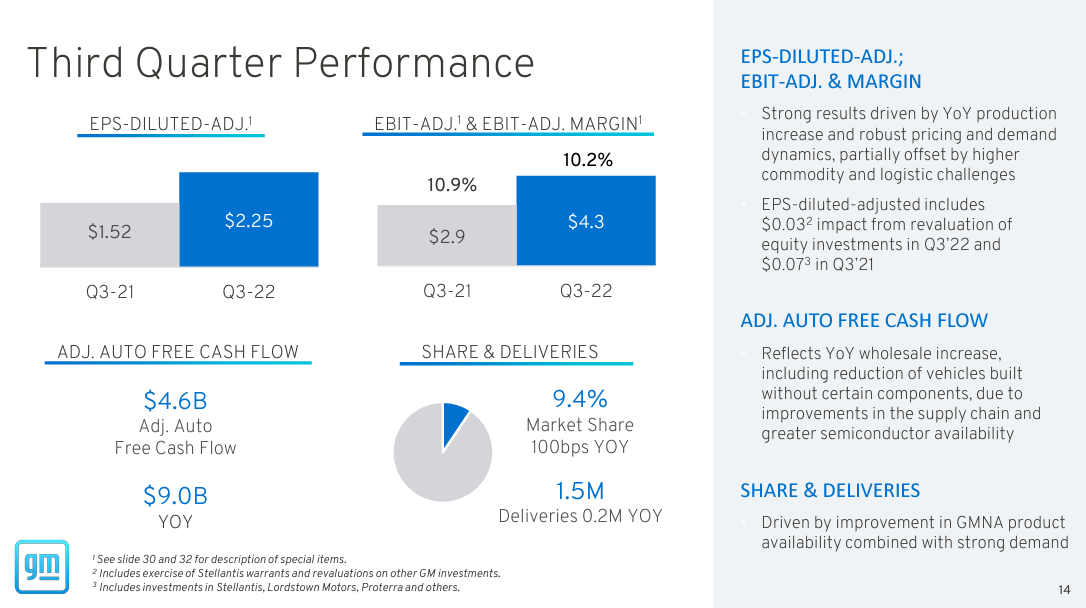

Per Bloomberg's wrap-up Tuesday morning, the company posted results for the quarter of:

- Adjusted EPS $2.25, estimate $1.89 (Bloomberg Consensus)

- Net sales and rev. $41.89 billion, estimate $42.37 billion

- Cruise net sales and revenue are $25 million, estimate $50.5 million

- Automotive net sales and revenue are $38.70 billion, estimate $39.76 billion

- GM Financial net sales and revenue $3.19 billion, estimate $3.37 billion

- Adjusted automotive free cash flow $4.59 billion

- GMNA vehicle sales are 784,000 units, estimate 783,992

- GMI vehicle sales 182,000 units, estimate 190,111

- Adjusted Ebit $4.29 billion, estimate $3.48 billion

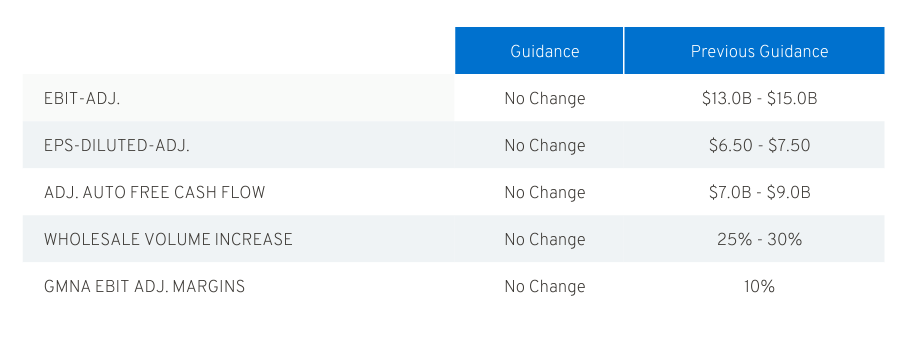

The company also maintained its adjusted EBIT guidance while keeping its EPS and cash flow guidance steady. GM said it sees full-year net income of between $9.6 billion and $11.2 billion, and EBIT-adjusted of between $13.0 billion and $15.0 billion. Adjusted EBIT estimates had been for $12.3 billion, so the reaffirmation came as a positive surprise to the street.

The company reaffirmed its EPS guidance of $6.50 to $7.50, with estimates at $6.75. It reaffirmed net income guidance of $9.6 billion to $11.2 billion, with Bloomberg estimates at $9.6 billion.

Company highlights for the quarter included:

- Highest ever quarterly GMNA revenue of ~$34.7B and EV sales of ~15.2K

- GMNA EBIT adjusted up $1.8B YoY due to ~85% increase in wholesale volume, including completing and shipping nearly 75% of vehicles built without certain components from Q2’22

- Reiterate confidence in our 2022 GMNA EBIT-adjusted margin full-year guidance of 10%

- Reinstated dividend and opportunistically bought back shares during the third quarter

- Solid GM Financial results in line with full-year expectations

- Cruise announced an expansion to two new markets, Austin and Phoenix, in addition to hundreds of AVs in concurrent operation within San Francisco by EOY

In her shareholder letter, CEO Mary Barra touted the company picking up significant ground in the EV market: "We also earned more than 8% of the U.S. electric vehicle market in the third quarter thanks to record sales of the Chevrolet Bolt EV and Bolt EUV. Our dealers and customers have embraced the Bolt because of its range, technology, and value, helping it outsell Ford’s Mach-E by more than two to one in September."

She continued: "The Chevrolet Equinox EV and the GMC Sierra EV that we revealed in recent weeks, along with the Chevrolet Silverado EV and Blazer EV, are cornerstones of our strategy to rapidly grow EV volumes by winning in high-volume segments. They have all been incredibly well received by customers and industry experts who see them driving rapid EV adoption and conquest sales for GM, including in coastal markets."

The company also touted the success of its Ultium platform: "The Chevrolet Bolt EV and Bolt EUV will continue to play an important role too. We’re increasing production from 44,000 units this year to 70,000 units next year, and we will leverage our industry-leading loyalty to move these customers into one of our new EVs for their next purchase. As we scale the Ultium Platform, we have been very intentional to position the company for volume growth with flexibility, efficiency, and increased EV profitability over time."

Finally, Barra touted an improving supply chain as a reason to be optimistic for the future:

A secure and integrated supply chain will be another competitive advantage for us as we scale. As I shared last quarter, we moved early and aggressively to secure commitments for all the battery raw material we need to reach more than 1 million units of annual EV capacity in North America in 2025.

For growth beyond 2025, we continue to secure our future with strategic supply agreements and direct investments in natural resource recovery, processing and recycling.

More By This Author:

US Gasoline Prices Go Haywire As Stockpiles Crater... But Here Comes China To The RescueAmazon Shares Dump After Reported Hiring Freeze In AWS Division

Tesla Tumbles After Price Cuts, Other EV Manufacturers In Focus

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more