Exxon Mobil: Great 5-Year Growth Plan But Beware Of Some Caveats

Photo by Raymond Kotewicz on Unsplash

Exxon Mobil (XOM) released its 5-year growth plan last week. This plan is undoubtedly promising, as the company expects to grow its production significantly, reduce its average production cost and double its earnings per share vs. 2019. In addition, the oil giant is thriving right now, as it is on track to post record earnings per share this year thanks to an exceptionally favorable business environment. Nevertheless, investors should be aware of some caveats. In this article, we will analyze the promising aspects of its ambitious growth plan of Exxon, but we will also discuss some points of concern.

Business Overview

Exxon Mobil is the second-largest oil company in the world, with a market capitalization of $437 billion, behind only Saudi Aramco (ARMCO). In 2021, Exxon generated 62% of its total earnings from its upstream segment, while its downstream and chemical segments generated 8% and 30% of its total earnings, respectively.

Like the vast majority of oil producers, Exxon incurred material losses in 2020 due to the unprecedented lockdowns implemented in response to the pandemic. However, global oil consumption has now recovered to pre-pandemic levels.

Even better for oil producers, the sanctions imposed by the U.S. and Europe on Russia for its invasion of Ukraine have greatly tightened the global energy market. Before the invasion, Russia produced approximately 10% of global oil output and one-third of the natural gas consumed in Europe. Thus, it is easy to understand the impact of Western countries’ sanctions on the global energy market.

Due to these sanctions, oil and gas prices rallied to 13-year highs earlier this year and remained above average. This is an exceptionally favorable business landscape for all oil majors, including Exxon.

In the second quarter, the oil giant posted nearly all-time high earnings per share of $4.14 thanks to the rally of oil and gas prices. In the third quarter, the price of oil dipped 12% sequentially, but the price of natural gas skyrocketed thanks to a record number of LNG cargos exported from the U.S. to Europe. These exports helped Europe compensate for the reduced gas quantities received from Russia, but they rendered the U.S. gas market extremely tight. Thanks to the extremely high gas prices and the nearly all-time high refining margins, which resulted from the reduced exports of oil products by Russia, Exxon grew its earnings per share 7% sequentially, from $4.14 to an all-time high of $4.45, and exceeded the analysts’ estimates by an impressive $0.65. The oil giant is on track to post record earnings per share of at least $13.00 this year.

The Growth Plan

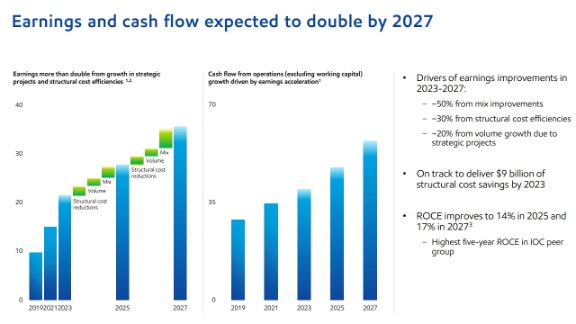

Last week, Exxon analyzed its growth plan for the next five years. The company expects to spend $20-$25 billion per year on capital expenses and double its earnings by 2027 vs. 2019.

(Click on image to enlarge)

Source: Investor Presentation

Exxon expects to achieve such a great performance primarily thanks to a steep reduction in its average cost of production, which will result from the addition of low-cost barrels to its asset portfolio. The other growth contributors will be a reduction in structural costs and meaningful production growth.

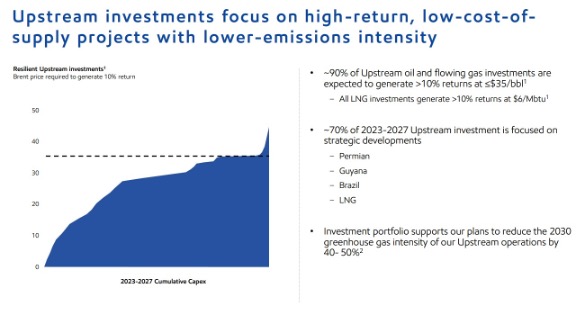

According to its growth plan, Exxon will allocate about 70% of its investments in areas with low-cost barrels, namely the Permian Basin, Guyana, and Brazil.

(Click on image to enlarge)

Source: Investor Presentation

It is impressive that about 90% of investments of Exxon will be directed to reserves that are expected to yield an annual return of more than 10%, even at oil prices of around $35. This means that the oil giant will high-grade its asset portfolio drastically in the upcoming years.

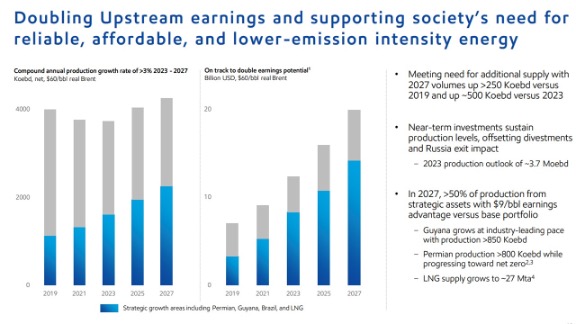

Thanks to its good growth plan, Exxon expects to grow its production by 3% per year on average until 2027 and double its earnings potential at a given oil price of $60.

(Click on image to enlarge)

Source: Investor Presentation

In this way, the oil major will offset the effect of the exit of its operations from Russia and some other divestments. In addition, more than half of its output will come from reserves with an advantage of $9 per barrel vs. its current asset portfolio.

The strategic plan of Exxon is undoubtedly promising. The company expects to grow its production significantly while it will drastically reduce its average cost of production, primarily thanks to the addition of exceptionally low-cost barrels in the Permian and offshore Guyana. The latter is currently the most exciting growth project in the entire oil industry. During the last five years, Exxon has more than tripled its estimated reserves in the area, from 3.2 billion barrels to about 11.0 billion barrels. Overall, thanks to its investment plan, Exxon expects to reduce its breakeven price of oil from $40 in 2022 to about $30 in 2027.

The growth plan of the oil major also includes a share repurchase program of up to $35 billion in 2023-2024. This amount is sufficient at the current stock price to reduce the share count by 8%. However, it is important to realize that the stock of Exxon has rallied 74% over the last 12 months to an all-time high level. Given the high cyclicality of the oil industry, the share repurchases executed around all-time high stock prices are likely to hurt shareholder value instead of enhancing it.

Exxon has made the same mistake in the past. It spent excessive amounts on share repurchases during boom years, and thus it came under great pressure in 2020 when the coronavirus crisis struck. While the company did not face liquidity risks, it leveraged its balance sheet significantly in that year, thus leading many analysts to predict a dividend cut. Fortunately, Exxon did not cut its dividend thanks to the strong recovery of the energy market from the pandemic, but the lesson remains the same. It is not prudent to spend excessive amounts on share repurchases near the peak of the cycle of this highly cyclical industry.

Moreover, oil exploration and production have so many parameters that investors should not take the guidance of Exxon for granted. Of course, the strategic plan of Exxon is as precise as it can be right now, but many factors could somewhat derail the plan.

To provide a perspective, Exxon issued a similar 7-year growth plan in early 2018. According to that growth plan, the oil giant expected to grow its production by 25%, from 4.0 million barrels per day in 2018 to 5.0 million barrels per day in 2025, primarily thanks to its hefty investments in the up-and-coming regions of the Permian Basin and Guyana.

However, the actual performance of Exxon deviated remarkably from the plan. The company decided to curtail its investments due to the pandemic in 2020-2021 to preserve funds and thus defend its generous dividend. In addition, the natural decline of its existing oil fields, which is inevitable, took its toll on the production of the oil major. As a result, the production of Exxon has decreased by approximately 7% since 2018, a much worse outcome than the expected increase of 25%. As a side note, the natural decline of oil fields, which is almost always material, is sometimes underestimated in the growth plans of oil producers.

It is also worth noting that Exxon is the only oil major that has failed to grow its production over the last 14 years. During this period, the company incurred a 7% decrease in its production. This is in sharp contrast to the performance of the other oil majors, such as Chevron (CVX), BP (BP), and TotalEnergies (TTE), which have consistently grown their production over the last five years.

Overall, the aforementioned 5-year plan of Exxon is certainly promising, but it remains to be seen whether the oil giant will achieve the goals of its plan. The uncertainty should be attributed not to the performance of management but mostly to the factors beyond management’s control, i.e., the cycles of the oil industry and the natural decline of oil fields.

Finally, it is important to note that the price of oil has peaked and has probably entered it's next downcycle. While it is still above its historical average, it has recently fallen below its level just before the invasion of Russia in Ukraine. This is a strong bearish signal, which implies that the energy market has fully absorbed the impact of the war in Ukraine, mostly thanks to the global economic slowdown and a record number of renewable energy projects that are under development right now. When all these projects come online, they are likely to take their toll on the price of oil.

Competitive Advantages

The primary competitive advantage of Exxon is its unparalleled scale and admirable expertise in the energy sector. Exxon has written the standard technical procedures followed by most oil companies. It is also impressive that other oil companies drilled numerous dry holes in Guyana, whereas Exxon has exhibited a nearly 90% success rate in this area.

Moreover, thanks to its highly integrated business model, Exxon is one of the most resilient oil majors to recessions and downturns in the energy market. Exxon’s downstream and chemical divisions have provided a buffer to the total earnings whenever oil prices have plunged. This does not mean that Exxon is immune to recessions. It only means that Exxon is more resilient to downturns than most of its peers. For instance, when the price of oil collapsed from $100 in mid-2014 to $30 in early 2016, Exxon saw its earnings per share plunge 75%, but it remained profitable, whereas Chevron and BP incurred losses.

Dividend

Due to the dramatic swings in the price of oil, the oil industry is infamous for its high cyclicality. Its boom-and-bust cycles make it almost impossible for the sector companies to maintain multi-year dividend growth streaks. Exxon has proved exceptional in this aspect. It is the only oil company, along with Chevron, that has become a Dividend Aristocrat. Exxon has grown its dividend for 40 consecutive years, and thus it can boast of the longest dividend growth streak in the oil industry.

Moreover, the company currently has a payout ratio of only 28%. Furthermore, thanks to its record earnings this year, it has drastically reduced its debt and has a rock-solid balance sheet. As a result, Exxon can easily continue raising its dividend for many more years.

The only caveat is the nearly 8-year low current dividend yield of 3.4% of the stock, which has resulted from the steep rally of the stock to an all-time high. The low dividend yield of Exxon (compared to its historical yields) signals that the stock is probably somewhat richly valued from a long-term point of view. Exxon’s dividend growth rate has markedly slowed in recent years, from an average annual rate of 5.0% in the last decade to an average annual rate of 3.0% in the last five years. Income-oriented investors should probably wait for a more attractive entry point before purchasing Exxon.

Final Thoughts

The recently announced 5-year growth plan of Exxon is undoubtedly promising. The oil giant intends to fire on all cylinders. It expects to grow its production, reduce its average cost of production with the addition of low-cost barrels, and spend excessive amounts on share repurchases. Exxon expects to approximately double its earnings potential at a given oil price in five years thanks to all these growth drivers.

The oil giant will certainly do its best to accomplish this goal, but investors should be aware of some caveats. First of all, the dramatic cycles of the oil industry, which are inevitable, are beyond the company’s control. In addition, the company has repeatedly disappointed its shareholders with its business execution, as it has failed to grow its production over the last 14 years. Moreover, oil price peaked shortly after Russia’s invasion of Ukraine and has probably entered their next downcycle. Therefore, while the strategic plan of Exxon is certainly promising, investors should not be surprised if the results are different from the guidance.

More By This Author:

Analysis Of 3 High-Yield Monthly Dividend Stocks

General Electric Healthcare Spinoff: How Should Shareholders Proceed?

3 Electric Utility Stocks For Safe Dividends