General Electric Healthcare Spinoff: How Should Shareholders Proceed?

For decades, General Electric was considered one of the most trustworthy blue-chip stocks, featuring a strong dividend that was highly praised for its growth prospects and overall safety.

We feel that blue chip stocks are among the safest dividend stocks investors can buy.

General Electric’s days of glory began when Jack Welch assumed the role of CEO in 1981. Between 1981 and 2001, when Welch stepped down, the company executed tons of useful acquisitions that were being successfully integrated with the overall business, resulting in accretive returns for shareholders.

By 2008, the picture had completely changed, with the conglomerate having become oversized and largely indebted. As ridiculous as it may sound, in Q2 of 2008, General Electric’s balance sheet featured more than half a trillion dollars of total debt.

Since then, General Electric has been on an ever-lasting journey toward deleveraging and restructuring. A countless number of dealings have occurred over the past decade in an effort to reinvent the company, simplify operations, and shift General Electric’s focus on the competitive advantages its core businesses have to offer.

With management yet aiming to unlock incremental value for shareholders, General Electric just announced a major plan that is set to fundamentally transform the company. Specifically, General Electic is about to split into three industry-leading, international, investment-grade public companies, each of which will be focused on the sectors of healthcare, energy, and aviation, respectively.

The question that now arises for shareholders is how the spinoff will actually play out and in which of the three separate publicly-traded companies investors will be better off staying invested. This article will attempt to answer this question.

General Electric’s Multi-Stage SpinOff Overview

Up until now, General Electric’s innumerable subsidiaries were bundled into four core reporting segments: GE Aerospace, GE HealthCare, Renewable Energy, and Power.

The first action that the company implemented is to simplify this structure even further. The healthcare business will now be named GE HealthCare. Additionally, the company’s portfolio of energy businesses, including GE Renewable Energy and GE Power, will come together as GE Vernova. Finally, the Aviation business is to be named GE Aerospace. Thus, General Electric will now consist of three core businesses.

As part of General Electric’s plan to split these three core businesses into separate publicly-traded companies, management announced the first part of this multi-stage spinoff process. Particularly, shares of GE HealthCare are expected to trade under the ticker “GEHC” starting January 4th, 2023.

For every three shares of General Electric stock shareholders own, they will obtain one share of the spun-off GE HealthCare. In total, shareholders will be allotted 80.1% of the equity in GE HealthCare, while General Electric will keep the remaining 19.9%.

Source: Investor Presentation

Therefore, the parent company likely aims to remain invested in GE HealthCare over the long run, which should encourage shareholders to remain invested in the business as well. Think of it as a vote of confidence in the spinoff.

The parent company will also have the ability to sporadically unload its remaining 19.9% stake in the business if it needs to raise additional capital at points, which is also great, assuming shares of GE HealthCare don’t plummet.

Then, in early 2024, General Electric intends to execute the tax-free spinoff of GE Vernova into another separate publicly-traded company that will operate its energy assets. GE Vernova will focus on accelerating the path to reliable, affordable, and sustainable energy.

Following these scheduled spinoffs, the parent company will have automatically been transformed into an aviation-focused company called GE Aerospace. GE Aerospace will retain ownership of the GE trademark and will continue to provide long-term licenses to the other two companies. The company will also likely maintain an equity stake in each of GE HealthCare and GE Vernova.

How Should General Electric Shareholders React?

It’s still quite early to form a strong argument regarding where investors will be better off staying invested. We still don’t know the specifics of the GE Vernova spinoff, which will also decide how the parent company will look post-2024.

Nevertheless, management has now provided pro forma financial data regarding the new standalone GE HealthCare for the past three years and the first nine months of 2022 as if GE HealthCare were a separate business already. These numbers should help investors assess the separate business more accurately.

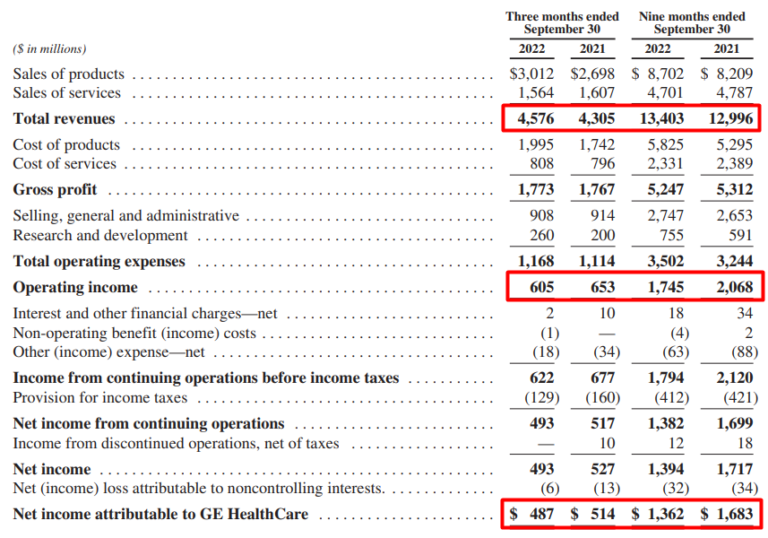

GE HealthCare revenue in Q3 came in at $4.58 billion, up 6% year-over-year, while for the first nine months of the 2022 fiscal year, revenue landed at $13.40 billion, up 3% against the prior-year period. Revenue was boosted by strong organic growth in several segments of GE HealthCare, including its Imaging, Ultrasound, and PDx operations.

Source: SEC filings

Most importantly, despite inflationary pressures and FX headwinds due to a strong dollar during 2022, GE HealthCare continues to generate relatively strong profits. The $1.36 billion in net income year-to-date implies a decent net margin of 10.1%, while interest expenses actually declined substantially year-over-year, which illustrates the deleveraging going on in GE HealthCare — a great development in a rising-rates environment.

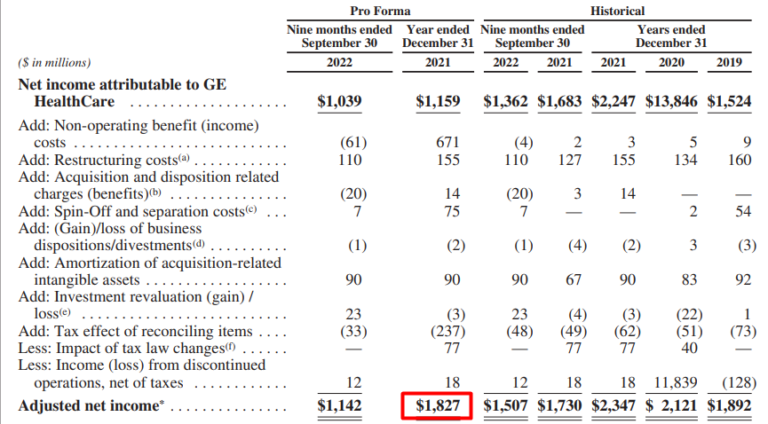

To value the business, let’s utilize GE HealthCare’s adjusted net income metrics, which exclude one-off items such as restructuring costs and investment revaluations. Last year’s pro forma adjusted net income of $1.83 billion should make for a useful earnings power indicator, as this year’s results will be affected by multiple extraordinary factors.

Source: SEC filings

Management expects that GE HealthCare’s key industries will grow at a CAGR of 4% to 6% between 2022 and 2025. Management thus expects organic growth in the mid-single digits in the coming years and its adjusted EBIT to improve and hover close between the high teens and 20%.

Source: Investor Presentation

Everything taken into account, we believe that GE HealthCare should be fairly valued at a P/E between 14 and 18, subject to several other factors, which will become known once the company actually gets listed separately.

Regardless, GE HealthCare appears to be worth roughly between $25 billion and $33 billion. Of course, the market may assign the stock a different multiple once it gets listed, especially during its early stage when speculation will be elevated.

Meanwhile, General Electric as a whole today is valued at around $91.4 billion. Thus, the spinoff will likely unlock considerable value for shareholders. GE Aerospace and GE Vernova are likely worth more than $60 billion. The aviation segment alone generated an operating income of $3.34 billion in the first nine months of 2022.

Accordingly, we believe that investors are likely better off holding General Electric through this spinoff. If GE HealthCare attracts an elevated multiple following its public listing, selling the stock might be worth it, but again, this remains to be seen. The same goes for the spinoff of GE Vernova, as General Electric has not made any pro forma data available. Regardless, we believe the spinoff of GE HealthCare will be beneficial for shareholders based on the current data available.

Final Thoughts

General Electric has taken many actions in an effort to simplify its operations and transform its underlying businesses. The scheduled spinoffs of GE HealthCare and GE Vernova appear to be another step in the right direction.

While the company will gradually share more information regarding its multi-stage transformation plan, so far, the spinoff GE HealthCare appears well thought out with the potential to unlock value for shareholders. This is because GE HealthCare will likely be able to attract a higher valuation multiple than what the business is currently within the whole conglomerate.

GE HealthCare, as a separate public company, should also help the parent company raise capital more easily while still retaining an upside potential via retaining a 19.9% shareholding in the business. Accordingly, we believe that investors who are already bullish on General Electric should hold their shares throughout the ongoing corporate shift.

More By This Author:

3 Electric Utility Stocks For Safe Dividends

Top 20 Highest-Yielding Dividend Aristocrats Now, Yields Up To 6.3%

3 Wide Moat Dividend Stocks To Buy Now