Equities Recover

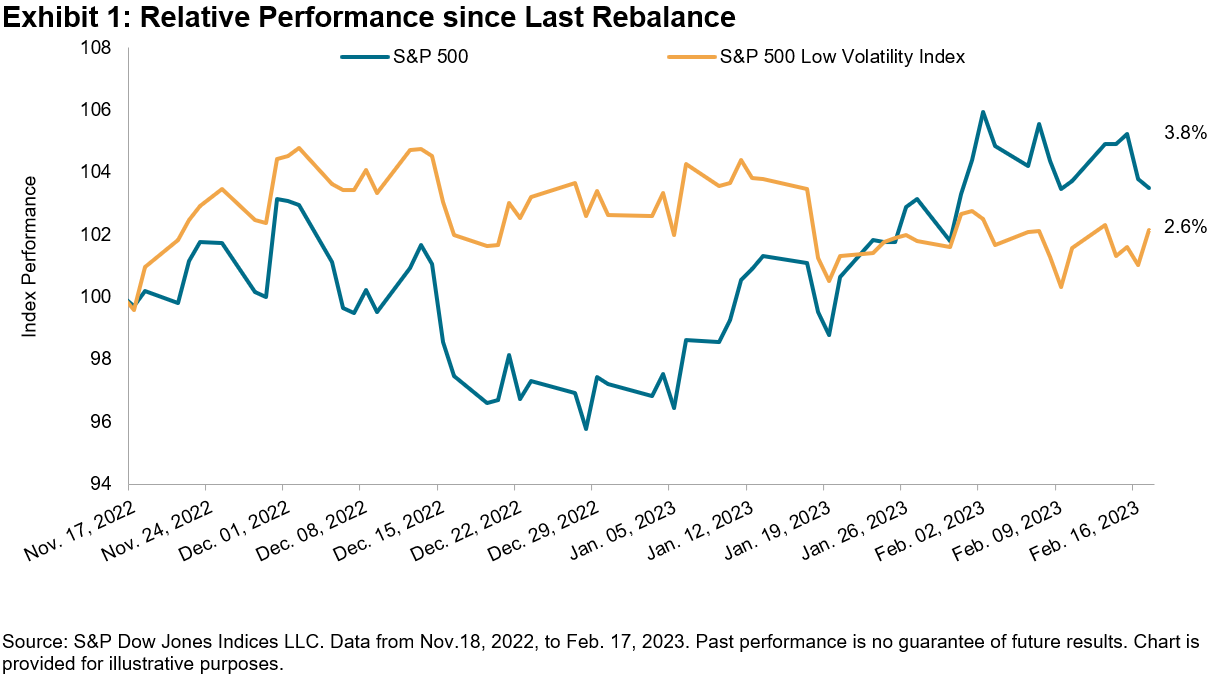

In the first seven weeks of 2023, U.S. equities regained a third of the ground lost in 2022 (down 18.1% in 2022 and up 6.5% YTD through February 17, 2023). Exhibit 1 shows that since its last rebalance, the S&P 500® Low Volatility Index, which seeks to mute the gyrations of the market in both directions, underperformed the market by 1.3%.

(Click on image to enlarge)

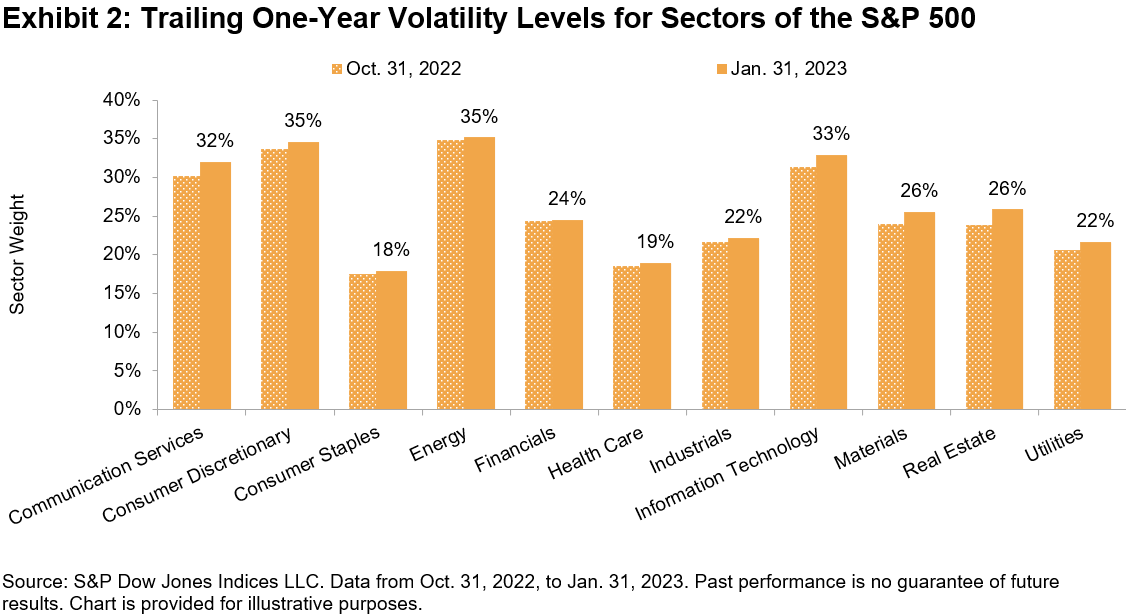

Exhibit 2 shows that volatility has remained meaningfully flat since November 2022, with a 2% increase at the high end for Communication Services, Materials and Real Estate. Consumer Discretionary and Energy hold their places as the most volatile sectors of the S&P 500.

(Click on image to enlarge)

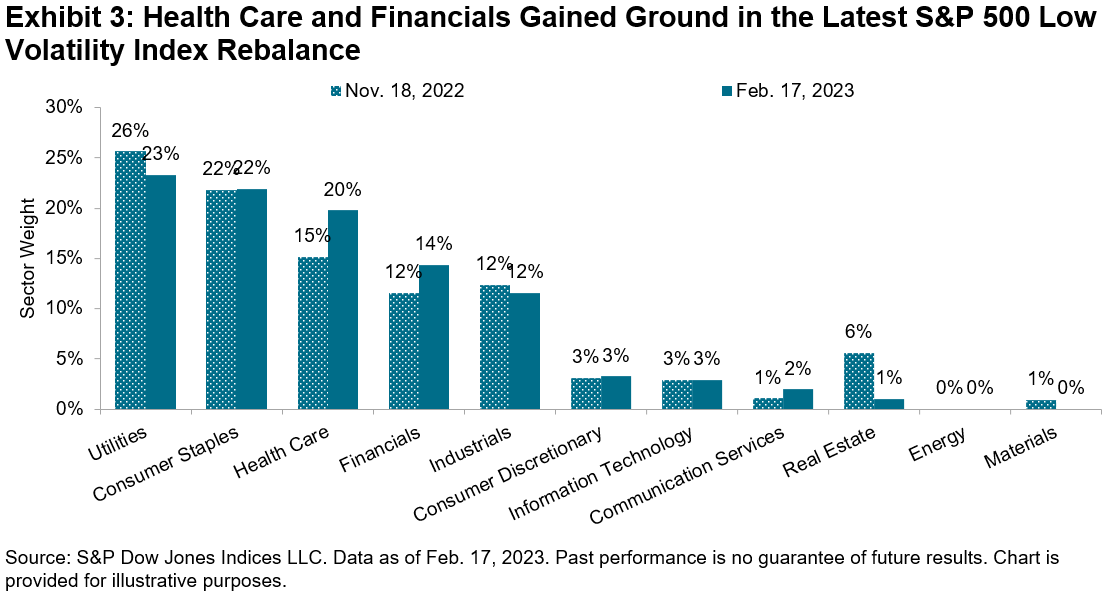

Despite the relative calm in the risk landscape, Low Volatility’s latest rebalance, effective after the market close on Feb. 17, 2023, brought some significant changes.

Real Estate has never quite regained its pre-COVID presence, but as Exhibit 3 shows, this rebalance reduced Low Volatility’s allocation to the sector to 1%. Utilities also pared back its weight by 3%. The slack went mainly to Health Care and Financials, which added 5% and 2%, respectively. Given the minimal changes in volatility at the sector level, the shifts in sector allocations for the low volatility index indicate there might be more going on idiosyncratically within the sectors.

(Click on image to enlarge)

More By This Author:

Active Ability Versus Active Outperformance

Peak Passive And Market Efficiency

The S&P Technology Dividend Aristocrats Index: A Legacy of Dividend Increases In Technology

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.