Energy Surges Without The S&P

Taking a glance across sector ETFs in our Trend Analyzer tool, performance last week through Friday’s close wasn’t fully lost as many sectors managed to hold onto their gains from earlier in the week while others like Real Estate (XLRE), Utilities (XLU), and Consumer Discretionary (XLY) finished more firmly in the red. As was the case earlier this year, the most standout sector has continued to be Energy (XLE). Although the sector has been pretty much trending sideways since the late spring and remains down double-digit percentage points from its 52-week high, short-term performance has been impressive. Last week the sector ETF rose 13.6% to move from one standard deviation below its 50-day to one standard deviation above. Meanwhile, every other sector remains oversold.

(Click on image to enlarge)

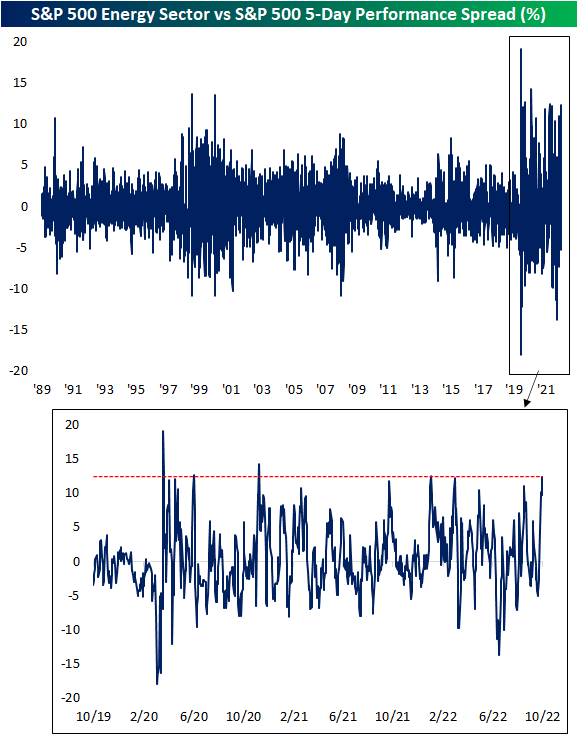

Compared to the S&P 500’s modest gains on the week, Energy’s outperformance has little precedence prior to the pandemic. Below we show the spread of the five-day performance of the S&P 500 Energy sector and the S&P 500. Rounding out last week with a high of 12.4 percentage points, the spread hit the highest level since the first week of January. Prior to that, March, June, and November 2020 were the only other recent occurrences with as large of a spread. In our data going back to 1990, the only other time that Energy has outperformed the broader market by as much in a one-week span was between October 2000 and April 1999.

More By This Author:

Bears Remain Above 50%

Big Bounce In Claims…Or Is It?

Oil And Stocks Mix It Up

Click here to learn more about Bespoke’s premium stock market research service.

See Disclaimer ...

more