DeepSeek Is Not About To 'Deep-Six' The West's AI Technology.

Image Source: Pexels

DeepSeek is not going to dismantle the AI technology that the West has created, anymore than a slightly cheaper motor can dismantle the auto industry.

When it comes to the drop in the market, DeepSeek may have been the ‘trigger’, but it is not the fundamental reason for the dip in the market—our models have been predicting a temporary dip for more than a week now. And when it comes to the fear of recession and bear market, it would be the first time in 200-years of economic history that we see either event occur when there is a record level of money-creation like there is now.

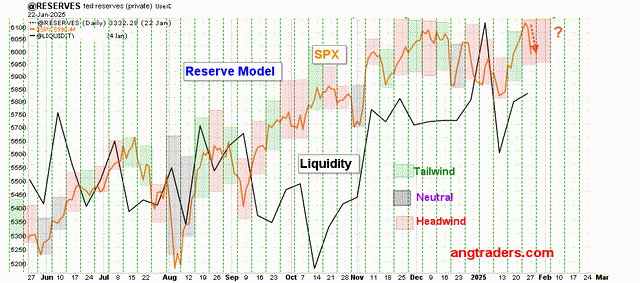

Our reserve model is in a "headwind" period (red-highlight below) until the middle of next week.

ANG Traders, stockcharts

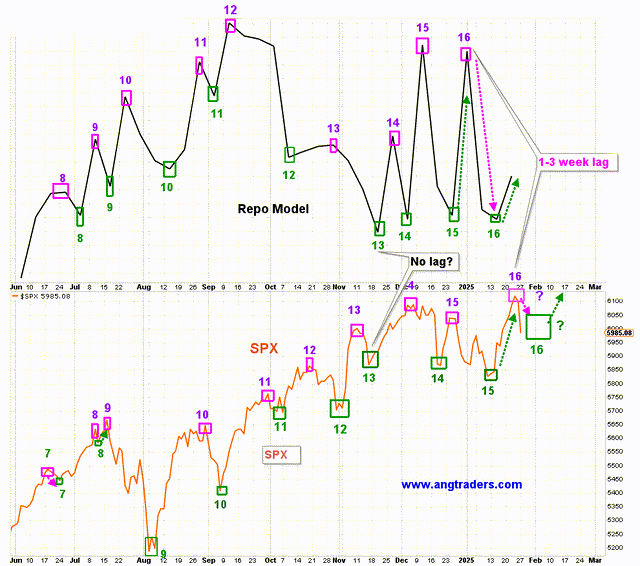

The repo model has confirmed its #16 low and the SPX, which lags the repo model by 1-3 weeks on average, has started toward its #16 low.

ANG Traders, stockcharts

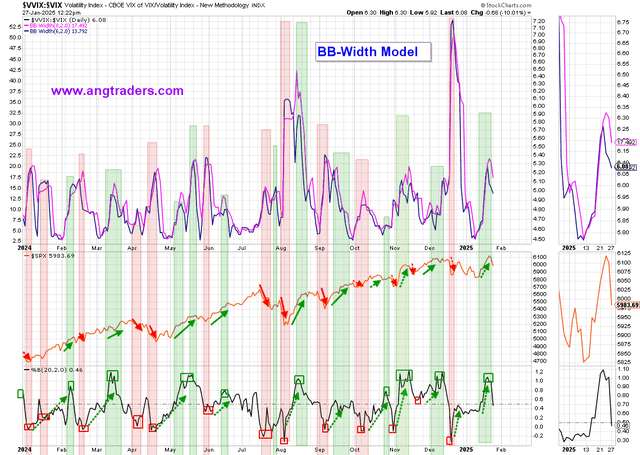

The BB-width model has ended its tailwind period and is already half-way though its headwind period.

ANG Traders, stockcharts

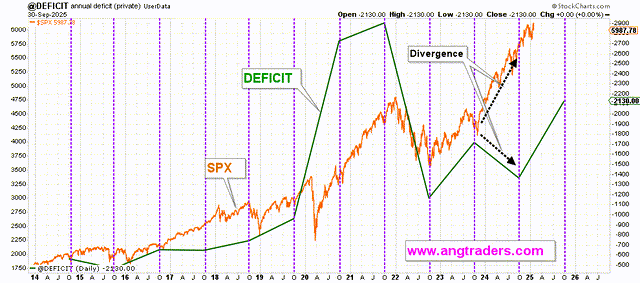

The current "dip" in the SPX, triggered by DeepSeek fear, was expected by our models and is almost complete--this is not the start of a recession. There is too much money creation (deficit-spending) for a bear market to start at this point. The chart below shows the current rate of deficit-spending is the highest it has been since the COVID stimulus four-years ago. It is highly unlikely that a recession starts when the money-creation is this high.

ANG Traders, stockhouse

We view this pullback as a 'buy-the-dip' opportunity.

More By This Author:

Fund-Flows For Fiscal-2025 Q1, And For The Month Of December

Dazed And Confused... About Money

Why The Bull Market Continues