Fund-Flows For Fiscal-2025 Q1, And For The Month Of December

The month of December, 2024 compared to December, 2023:

| Type of Flow |

2024 |

2023 |

| Net-transfer (daily average) | +$62B |

+$63B |

| Nominal-spending (daily average) | $584B | $541B |

| Change in bank credit | +48B |

+$109B |

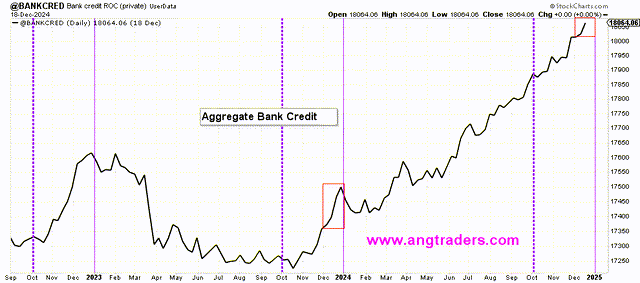

The net money-creation was lower this December than December 2023 (+$117B compared to +$178B). This was due to last December's bank credit increase (chart below).

The fiscal-2025 Q1, compared to the fiscal-2024 Q1:

| Type of Flow |

Fiscal-2025 |

Fiscal-2024 |

| Net-transfer (annualized) | +$620B (+$2,481B) |

+$394B (+1,576B) |

| Nominal-spending (annualized) | $1,891B ($7,564B) | $1,676B ($6,704B) |

| Change in bank credit | +$214B | +$231B |

Compared to fiscal-2024 Q1:

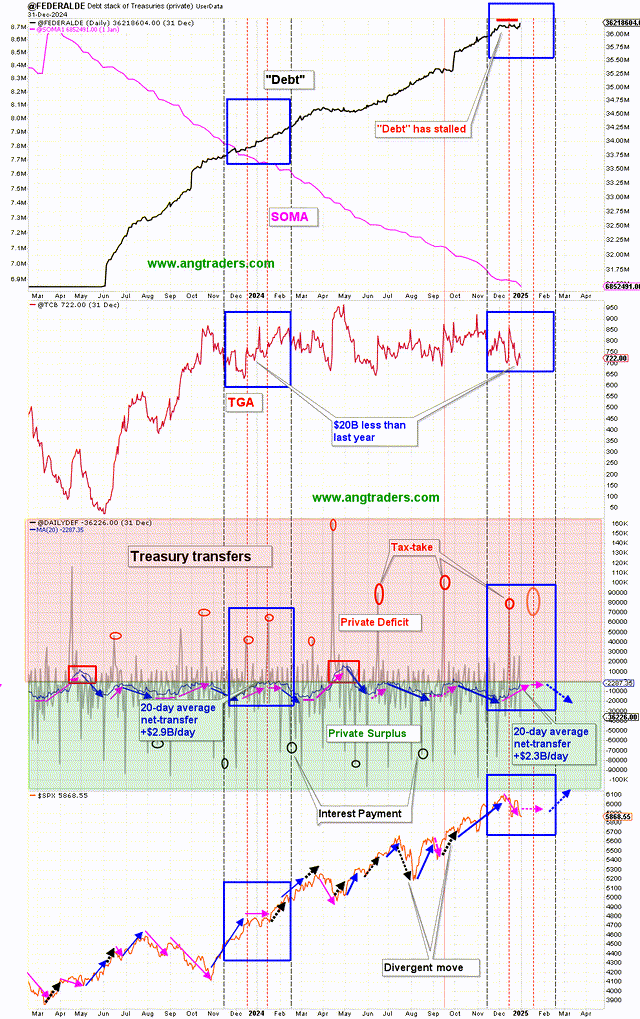

- The Treasury net-transfer is $226B higher than in fiscal-2024. (Nominal-spending is $215B higher.)

- The change in bank credit is $17B lower than last year.

- The Fed's IOR (interest on reserves) has paid $16.6B so far, which is $10B lower than last year (it was $26.4B last year).

- Total net money-creation is +$199B more than last year which continues to explain the SPX rally, but which has been decreasing during the month of December.

The average net-transfer (from the Treasury to the private sector) is decreasing according to the seasonal pattern (pink arrows inside the blue boxes). This tendency (lower net-transfer) should last until the mid-January tax-take. The SPX is likely to be in a trading-range until then.

More By This Author:

Dazed And Confused... About Money

Why The Bull Market Continues

Republican And Democratic Presidents, Which Is Better For The Economy And Stock Market?