Dazed And Confused... About Money

The misconceptions surrounding the understanding of the fiat monetary-system causes governments to implement inhumane austerity policies that end up increasing poverty and and economic dysfunction. In this article, I attempt to correct the misconceptions about money. (I reference Canada, but it applies to all currency-creators).

Where do dollars come from?

Money is not a physical reality. Money is a virtual entity; an idea, a law, a unit of account, a transferable tax-credit. Money is anything that we agree can release real resources like labour and materials.

Canada — like Japan, UK, US and every other currency-creating country — is monetarily-sovereign, which means that the Government spends dollars into existence; the Canadian dollar is created by Parliament’s spending-laws.The Government, when provisioning itself or when funding citizens directly, simply directs the central bank to increase the balance of the recipient’s private bank account… and dollars are created. The Canadian Government is the monopoly issuer of Canadian dollars and, as such, Canada cannot run out of dollars, any more than it can run out of laws. Anything Canada can do, it can pay for; it is self-funding. The Government can, however, choose not to spend, or it could find itself with a shortage of real resources; for example, there might not be enough doctors or teachers, but there can always be enough money.

The Canadian Government is the sole creator of the Canadian currency, but private banks are given license (charter) to create “temporary” money by making loans (bank credit) denominated in CDN$. Bank credit is “temporary” because every dollar created by a bank loan must be paid back and cancelled; either by the borrower or by the bank’s own capital.

A bank’s loan-creation far exceeds its own capital since banking regulations only require banks to maintain a capital-to-loans ratio of 3%; if 3% of a bank’s outstanding loans were to simultaneously fail, then all the bank’s capital would be gone, and the bank would technically be bankrupt. Lending standards in the individual banks work toward minimizing such a risk.

Both the Federal Government and the chartered banksuse double-entry accounting when they create money; they take “0” and write it as “+1 and -1” (an asset and off-setting liability). The difference between the Government and the banks is that the Federal Government can choose to not tax back and cancel some of the money created, while bank-credit must be paid back and cancelled. Only the Federal Government can create “permanent” money.

What are taxpayer dollars?

Tax legislation allows the government to tax back (and cancel) some of the money it created. When the government collects taxes, private bank accounts are debited, and dollars are destroyed. (Note: money exists only when it is part of the economy — where the real-sources are.)

Most people would be surprised to know that taxation is the foundation of the “market economy.”Taxes can only be paid in the currency of the monetary-sovereign. This forces Canadian taxpayers to acquire Canadian dollars to avoid breaking the law. Since taxpayers cannot “create” Canadian dollars, they must “earn” Canadian dollars by either selling their labour or some of their produce thus creating a market economy (and staying out of jail).

Taxes do not fund spending. In fact, it is the other way around; spending must come first to create the dollars that the taxpayer requires. (Note: this applies at the Federal level, not the Provincial. Provinces are not currency-creators and, therefore, require funding from taxes or transfers from the Federal Government.)

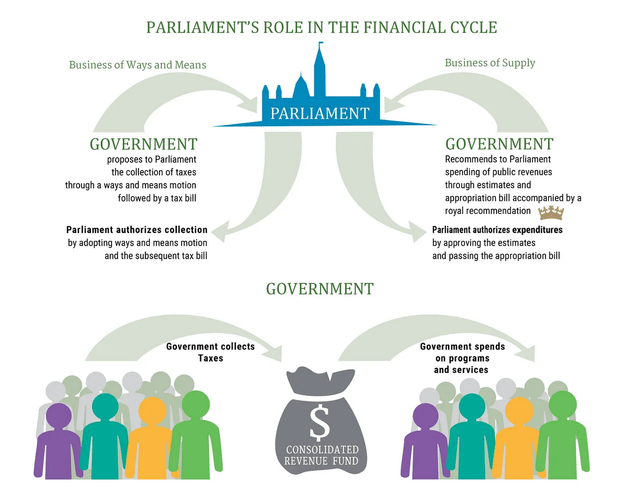

Almost-laughably, the Parliament of Canada does not understand its own monetary system. The chart below is implying that the government believes the taxpayer creates Canadian dollars; notice that the graphic shows the dollars originating with the taxpayer. The dollars that are used to pay taxes must first be created (spent into existence) by the government — any other dollar would be counterfeit. The official information coming from Parliament’s own website implies that the taxpayer is the source of Canadian dollars.

Source: Parliament of Canada

It is not “debt”

If the government spends (creates) more dollars than it taxes back (destroys), then the accounting procedures register a deficit (-1) on the Government side of the ledger, and a surplus (+1) on the private sector side. Recall the identity 0 = -1 +1 which accounts for the creation of money ‘out of thin air’ and can be expressed as:

Government Deficit = Private Sector Surplus

This shows that every dollar the Government spends and does not tax back remain in private hands as private savings. The Government’s budget deficit is the money it net-transfers to private bank accounts.

If a household (non-currency creating) budget spends more than its income, then the resulting deficit must be borrowed. If a government (currency-creating) budget spends more than it taxes, since the government is self-funding, there is no need to borrow the money, it can create as needed.

The matching of Government deficits with bond sales is a vestigial leftover from the fixed-exchange monetary-system (gold-standard) which started in 1917 as “Liberty Bonds” to pay for the war effort, but it is not a functional requirement in the current floating-exchange monetary-system (since 1971).

On the gold-standard, the value of the dollar was the ratio — amount of currency/amount of gold. If more dollars were created, without at the same time increasing the Government’s gold holdings, then the value of each dollar would go down (i.e. inflation). Selling bonds was an attempt to avoid printing dollars (which would have diluted the dollar relative to the gold holdings). In 1917 they said, “see, we are not printing dollars, we are just borrowing already-existing dollars”. Of course, that only delayed the inevitable; when the bonds matured, the government had to either print money to pay it back (plus interest), or tax parts of the economy. This reality forced the Government to remove the dollar from the gold-standard, first internally in 1933, and then internationally in 1971.

The matching of deficits with bond sales continues even though there is no functional reason to do it. Why? For several reasons:

- To maintain the interest rate set by the central bank.

- As a reserve drain to mitigate the effects of increased currency supply.

- To provide financial institutions and wealthy individuals with risk-free income which helps maintain the exchange rate of the dollar.

However, the Government selling Treasury-bonds, denominated in its own currency, is NOT “debt” like household debt. The monetarily-sovereign government does not borrow what it creates as needed, and what is commonly (and erroneously) referred to as the “Public Debt” is nothing more than the accounting of the money that the Government has not taxed back.

Those advocating for the elimination of the $1.2T “debt” ($36T in the case of the US) have not thought it through; it would require taxing $1.2T out of the private sector. The same can be said about those advocating for a ‘balanced budget’; it would require taxing back every dollar that is spent, thereby leaving nothing in private hands. Nobody would want that.

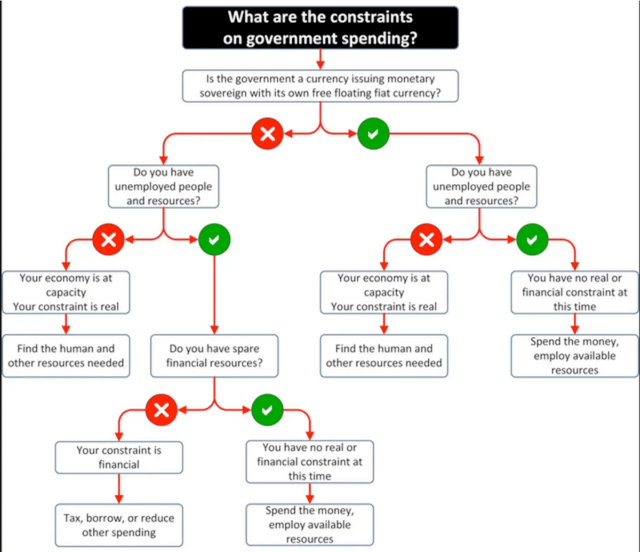

A currency-issuing government’s spending is limited only by the availability of real resources, not by the availability of its own money. Anything we can do, we can pay for.

Source: Malcolm Reavell

The misconceptions around what money is and how it is created, leads to austerity and unnecessary human suffering.

More By This Author:

Why The Bull Market Continues

Republican And Democratic Presidents, Which Is Better For The Economy And Stock Market?

There Is A Divergence In The Market