CLF Stock Forecast: Is De-Globalization Working?

Summary

- CLF delivered great Q1 Results

- CLF has a strong competitive advantage over peers

- The high selling price for CLF may lead to a record cash flow this year

- Valuation models indicate CLF is currently undervalued

Company Overview

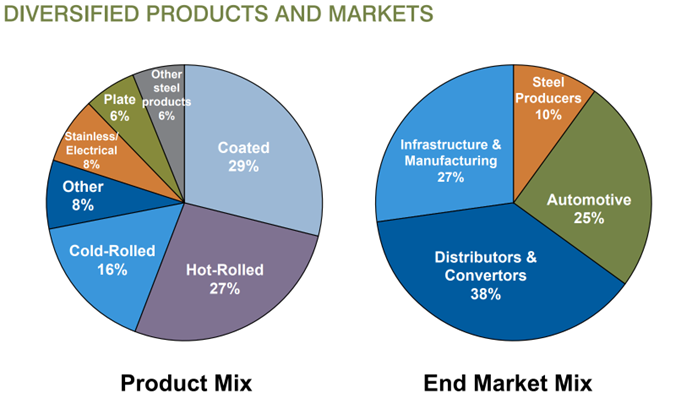

Headquartered in Cleveland, Ohio, Cleveland-Cliffs Inc. (CLF) is the largest producer of flat-rolled steel in North America. CLF has a diverse product portfolio as shown in Figure 1 below. It also produces iron ore pellets for customers who manufacture steel. Iron ore mining, iron, and steel production rolling finishing, and downstream hot and cold stamping of steel parts and components are all vertically integrated operations of the corporation. Flat-rolled carbon steel, plates, stainless steel, tinplate, and long steel products are among its main product categories. Direct reduced iron (DRI)-grade pellets are another product made there. The company’s US operations include the iron ore mines at Tilden, Hibbing, United Taconite, and Northshore. The business is active in both the US and Canada.

(Figure 1: Revenue Contribution by Product and End Market)

Is CLF a Good Business?

Based on the “Good Business” framework shown in Figure 2, CLF meets all the criteria except for business cycle risks. As mentioned above, CLF is the largest producer of flat-roller steel in North America, securing the market leader position. According to IBIS World Iron and Steel Manufacturing Industry Report, the annual growth rate for 2017 to 2022 is 4.5%, a stable market growth rate. CLF is rapidly gaining shares with a 5-year CAGR of 16.8% from 2018 to 2022 based on IBIS World. CLF generates a strong positive cash flow that can be used for strategic acquisition. CLF has a 41% ROIC based on Morningstar calculation. It seems like CLF is a great business, but it has high cyclical risks.

(Figure 3: Steel Price Chart)

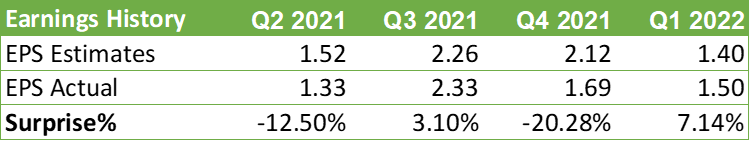

Despite the price of steel dropped since September 2021 as shown in Figure 3 above, CLF reported great quarterly earnings that beat expectations.

(Figure 4: CLF Earnings History)

On April 22, 2022, Cleveland-Cliffs held its earnings conference call for Q1 2022 results. CLF reported diluted earnings per share (EPS) of $1.50, representing a 7.17% surprise as shown in Figure 4 above. Last year’s diluted EPS for the same quarter was $0.07, indicating a 2000% increase year-over-year.

As shown in Figure 5 below, Q1 2022 revenue was about $6 billion, up 11% quarter-over-quarter and 47% year-over-year. Quarterly EBITDA grew 250% year-over-year and was able to maintain a similar level as the previous quarter while the price of steel has been volatile. The primary reason for the steady quarterly EBITDA was the magnitude of CLF’s fixed contract price increase that went into effect at the start of 2022. These price increases ultimately more than offset the backdrop of spot price weakness and led to higher overall average selling prices for CLF’s Q4 to Q1.

(Figure 5: CLF Quarterly Financials in Millions of USD)

Additionally, CLF is paying down debt consistently as shown in Figure 6 below. The total debt decreased by 12% year-over-year. CLF is expected to generate strong free cash flows to continuously pay down debt and buy back shares in the following quarters.

(Figure 6: CLF Quarterly Leverage)

With a market cap of $8.6 billion, CLF has about $5 billion in debt on its balance sheet, causing concerns for investors. However, the leverage ratio of CLF is in alignment with other comparable companies as shown in Figure 7 below. As CLF is determined to pay down debt in the future, the leverage will be alleviated for the company.

(Figure 7: Most Recent Quarterly Leverage Ratio of CLF’s Peers)

CLF Has a Strong Competitive Advantage Over Peers

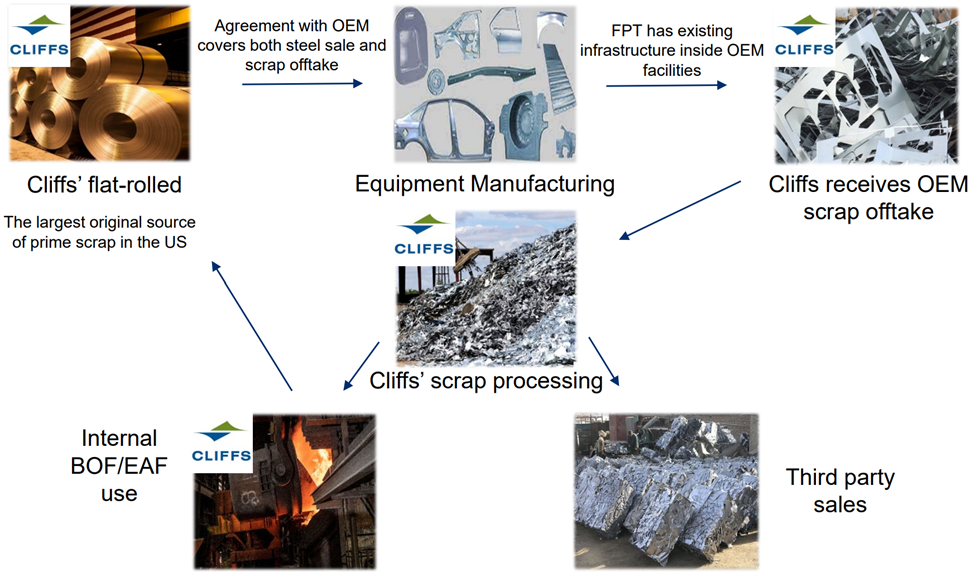

In November 2021, CLF acquired Ferrous Processing and Trading Company (FPT) for $775 million. FPT is one of the largest processors and distributors of prime ferrous scrap in North America. This acquisition enables CLF to cover the entire steel life cycle and have a true closed-loop steel recycling as shown in figure 8 below. Prime scrap is a primary source of raw materials for CLF. Having acquired FPT, CLF has significant access to prime scrap, where demand is expected to grow. Additionally, there is no middleman while sourcing the raw materials, leading to better margins. CLF now is able to leverage flat-rolled automotive and other customer relationships into closed-loop recycling partnerships to grow its prime scrap presence.

(Figure 8: Fully Covered Steel Life Cycle of CLF)

Covering the complete steel life cycle, CLF is the only US flat-rolled steel producer with zero reliance on imported pig iron and slabs. Russia and Ukraine are among the largest exporters of pig irons in the world. The ongoing war between Russia and Ukraine has negatively impacted the supply chain of many steel companies, such as CLF’s competitors.

As shown in Figure 9 below, CLF outperformed its competitors during the last two years while the whole world was experiencing supply chain issues due to the pandemic and geopolitical factors.

(Figure 9: CLF 5-Year Historical Return)

The High Selling Price for CLF May Lead to a Record Cash Flow This Year

According to the company’s guidance, the average selling price of steel increased from $1225 per ton to $1445 per ton for the following quarters. According to the earnings call, the increase was driven by three primary reasons: higher than expected prices on renewals of fixed-price contracts resetting April 1, 2022; higher expected spreads between hot-rolled and cold-rolled steel; and a higher futures curve that currently implies an average hot-rolled coil price of $1,300 per net ton for the full-year 2022.

Additionally, the demand is expected to continue to grow. With high steel prices and recovering demand from the pandemic, CLF is expected to generate a record cash flow for this year.

Valuation Models Indicate CLF is Currently Undervalued

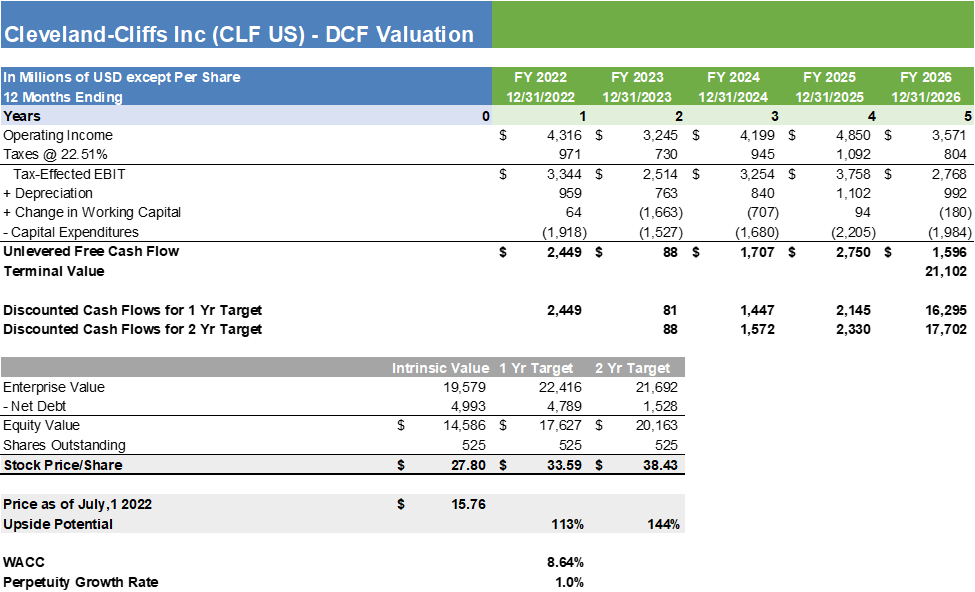

Based on a five-year DCF model, the one-year target price of CLF stock is $33.59, inferring a 113% upside from the current price of $15.76 as of July 1, 2022. The main assumptions made are revenue growth rates for the four segments based on historical data and macroeconomic expectations as well as the beta used for WACC calculations.

Beta is calculated based on comparable firms’ beta as shown in Figure 10 below. The average of levered beta is used since it is closer to the beta calculated by regression analysis.

The free cash flows used in the DCF model also factor into the cyclical nature of CLF as shown in Figure 11 below. A conservative perpetuity growth rate of 1% is used.

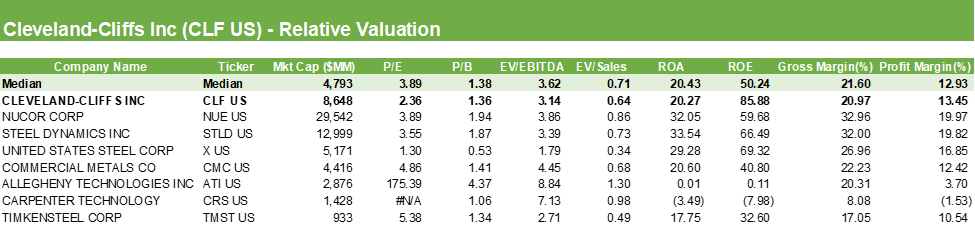

As shown in Figure 12 below, CLF has lower than median ratios for P/E, P/B, EV/EBITDA, and EV/Sales. However, CLF’s ROA, gross margin, and profit margin are in alignment with the median. Additionally, its ROE is much higher than its peers’. Both DCF and Relative valuation support the thesis that CLF is currently undervalued.

(Figure 12: CLF Stock Forecast Relative Valuation)

(Figure 13: CLF Recommendation Trends)

Based on Yahoo Finance coverage for CLF as shown in Figure 13, out of 12 analysts: 2 take Strong Buy and Buy positions, 5 take the Hold position, and 2 take the Underperform position. As shown in Figure 14, the analysts’ community puts the average target price for the stock at $30.63 while it is currently traded at $15.76 as of July 1, 2022.

(Figure 14: CLF Recommendation Rating and Analyst Price Targets)

Conclusion

Based on all the analysis above, I take a BUY side on CLF stock. Both the DCF and relative valuation indicate that the stock is currently undervalued. The one-year target price of $33.59 calculated by the DCF model represents over 100% upside from its current price of $15.76 as of July 1, 2022. The company will be better off from its operational strategies and advantage of vertical integration in the long term.

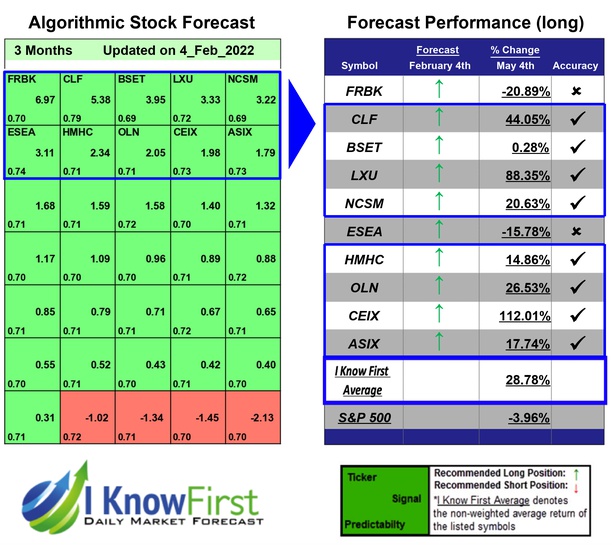

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the CLF stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with CLF Stock Forecast

I Know First has been bullish on the CLF stock forecast in the past. On February 4, 2022, the I Know First algorithm issued a forecast for CLF stock price and recommended CLF as one of the best stocks to buy. The AI-driven CLF stock prediction was successful on a 90-day time horizon resulting in more than 44.05%.