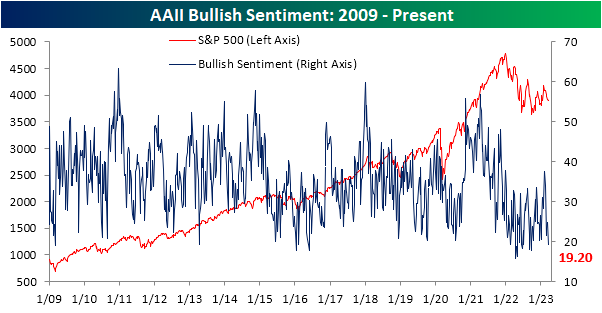

Bulls Back Below 20%

The fallout from bank failures over the past week has put a major dent in investor sentiment. Since the week of February 23rd, optimism has been muted with less than a quarter of respondents to the weekly AAII sentiment survey having reported as bullish. That includes a new low of 19.2% set this week. That is the least optimistic reading on sentiment since September of last year.

The drop in bullishness was met with a corresponding jump in bearish sentiment. That reading climbed from 41.7% up to 48.4%, the highest level since the week of December 22nd.While close to half of respondents are reporting as bearish, that remains well below the much higher readings that eclipsed 60% last year.

Last month saw the end to a record streak in which bearish sentiment outweighed bullish sentiment. However, the bull-bear spread has now been negative for four weeks in a row once again. In fact, this week was the most negative reading in the spread since late December.

Factoring in other sentiment readings like the Investors Intelligence survey and the NAAIM Exposure Index—both of which similarly saw sentiment pivot toward more bearish tones this week—our sentiment composite is once again below -1, meaning the average sentiment indicator is reading extremely bearish sentiment. While prior to 2022 such depressed levels of sentiment were not commonplace, it has been the norm over the past year or so.

More By This Author:

Fall Of The Empire Fed

Nothing SHY About This

Some Good And Some Bad In Small Business Optimism

Click here to learn more about Bespoke’s premium stock market research ...

more