Fall Of The Empire Fed

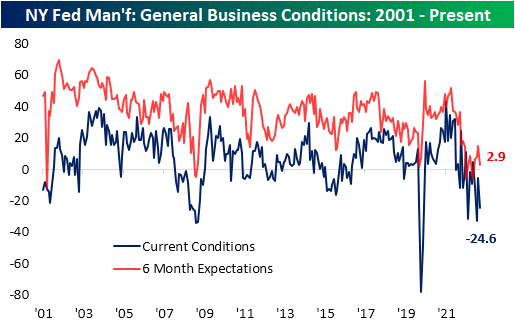

Among the bad news, this morning was disappointing economic data in the form of the New York Fed’s Empire Manufacturing report. The report was expected to remain in contraction falling to -7.9 versus a reading of -5.8 last month. Instead, the index plummeted to a much weaker reading of -24.6. Although that is not a new low with even weaker readings as recently as January and last August, the report indicated a significant deterioration in the region’s manufacturing sector, and whereas weather in January was an easy scapegoat for the weakness, that’s not the case for the March report.

Given the large drop in the headline number, breath was equally bad with many other significant declines. Like the headline number’s 5th percentile reading and month-over-month decline, New Orders and Shipments both saw double-digit declines into bottom decile readings. In the case of Shipments, that low reading comes after an expansionary reading last month. Inventories were the only other current conditions index to move from expansion to contraction leaving Prices Paid and Prices Received as the last expansionary categories.

As mentioned above, demand appears weak as New Orders and Shipments are the two most depressed categories from a historical perspective with each index coming in the bottom 3% of all months since the start of the survey in the early 2000s. Six-month expectations are equally low. Unfilled Orders were one of two categories to see a higher reading month over month with the 2.5 point increase much smaller than the move in expectations. Unfilled Orders expectations surged by 12.1 points, ranking in the 95th percentile of all monthly moves on record. That would indicate the region’s firms expect unfilled orders to rise at a rapid pace in the months ahead, likely as a result of weakened sales. That does not mean the area’s firms are expecting inventory build-ups, though. Inventory expectations saw a modest 1.4-point increase month over month in March, but that remains one of the lower readings of the past decade.

The only other current conditions index to move higher month over month was delivery times. Even though it moved higher, the index continues to indicate lead times are rapidly improving and expectations are calling for those improvements to continue.

Next to the dampened demand picture, employment metrics were perhaps the next most jarringly negative. Hiring is falling precipitously with the Number of Employees index hitting a new cycle low of -10.1. Average Workweek also is reaching new lows. At -18.5 it has only been as low during the spring of 2020 and during 2008 and 2009.

More By This Author:

Nothing SHY About ThisSome Good And Some Bad In Small Business Optimism

A Look At The Financial Sector’s Weighting

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more