Some Good And Some Bad In Small Business Optimism

Early this morning, the NFIB released the results of its February survey of small business optimism. The headline index rose to 90.9 versus expectations of it remaining unchanged at 90.3. In spite of the bounce, small businesses continue to report some of the worst sentiment of the past decade with the February reading right back in line with the April 2020 low.

Diving deeper into the categories of the report, breadth was mixed. Of the ten inputs into the headline number, four were lower month over month, one was unchanged, and the other half were higher. For the most part, these indices also remain in the bottom decile of their historical readings.

In today’s Morning Lineup, we highlighted how the report’s labor metrics have been improving in each of the past four months on an aggregate basis. Plans to increase employment remain healthy in the 77th percentile while the percentage of respondents reporting job openings as hard to fill hit a new record high after rising by a near record 9 points month over month. Although openings were harder to fill, firms also took on more workers. With actual employment changes moving up to 4, it hit the highest level of the post-pandemic period. However, that did clash with hiring plans falling 2 points to match December for one of the lowest readings of the past few years. Likewise, plans to increase compensation are at the lower end of their recent range even while actual observed changes to compensation have improved in the past few months.

(Click on image to enlarge)

The same dynamic in which plans are headed in the opposite direction of actual changes can be observed with regards to capital expenditures. Capital expenditure plans were unchanged at 21 last month for the joint lowest reading since March 2021. Meanwhile, actual capital expenditures rose to 60, the highest since March 2020 and credit conditions have improved. Turning to inventories, satisfaction (meaning the net percent of firms reporting if inventories are too low versus too high) fell to the lowest since the spring of 2020. As a result, a net 7% of firms are reporting that they plan to decrease inventories in the coming months.

(Click on image to enlarge)

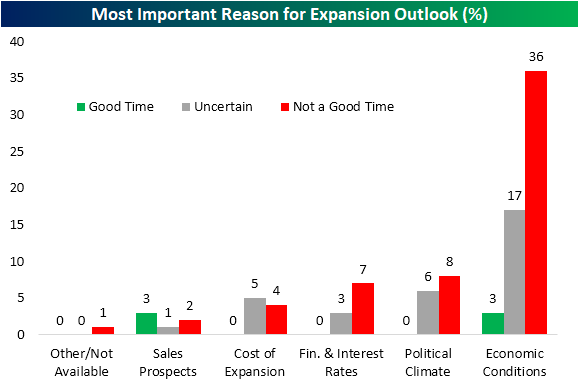

Finally, we would note that on net more firms are seeing lower rather than higher sales in spite of improvements to inflation metrics. The outlook for general business conditions has yet to see any improvement as few businesses report now is a good time to expand.

(Click on image to enlarge)

Most firms report now as a poor time to expand due to economic conditions at 36% of responses. The next most commonly credited reason is political climate followed by interest rates, which at 7% match the December reading for the highest since at least 2020.

More By This Author:

A Look At The Financial Sector’s WeightingDon’t Forget About CPI

March Volatility Emerging

Click here to learn more about Bespoke’s premium stock market research ...

more