Buffett Exits Stage Left

Image Source: Wikipedia

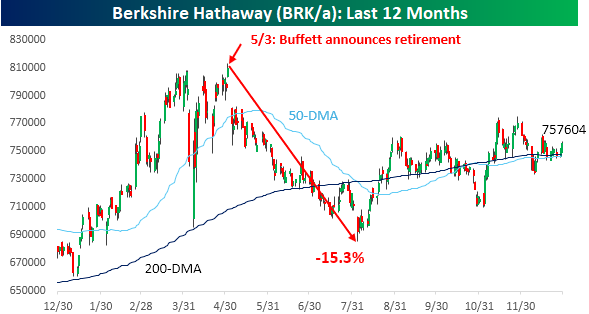

After over 55 years at the helm of Berkshire Hathaway (BRK-A), Warren Buffett will hand over control of the company he cobbled together to Greg Abel, ending an era of one of the most successful investment careers the world has ever known. Markets have known about this transition for just under seven months now, so the stock has had time to adjust to life without the cherry-coke drinking CEO. As shown in the chart below, when Buffett announced the transition at the annual meeting in May, the stock had closed at a record high the Friday before. When markets reopened the following Monday, the stock gapped lower and kept going down for the next three months, falling a total of 15.3%. The stock has since erased about half of those losses but remains well below its all-time high of $81,000 even as the S&P 500 closes out the year right near its highs.

Markets are forward-looking, but Buffett’s announcement in early May obviously caught the market off guard. While the announcement was a surprise, the fact that Buffett is in his mid-nineties and had just recently lost his long-time business partner, Charlie Munger, should have at least had the market starting to price in life without Buffett.

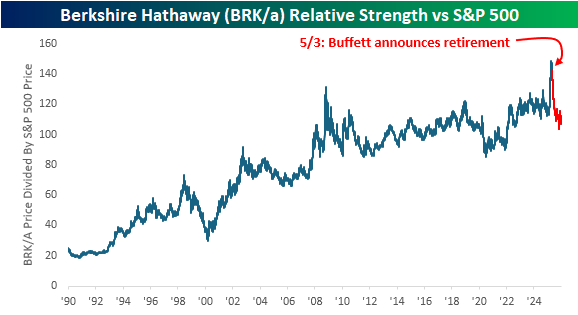

The reversal in Berkshire stock since Buffett made his retirement announcement is even more evident in terms of the stock’s relative strength versus the S&P 500. From 1990 through late 2008, the stock steadily outperformed the S&P 500 outside of a brief two-year period in the late 1990s during the dot-com bubble. After that peak relative strength reading in 2008, Berkshire basically moved sideways on a relative basis versus the market.

Earlier this year, the stock experienced a huge surge relative to the market during the tariff-tantrum and appeared on the verge of a new leg higher in relative strength. However, a combination of the market recovery and Buffett’s surprise announcement quickly reversed that relative strength. The last time the stock’s relative strength versus the S&P 500 spiked in late 2008 and then quickly pulled back, it didn’t see those levels again for more than 15 years. With this latest reversal, will it take another 15 years before the stock makes another relative strength all-time high, or will the new CEO prove to be ready, willing and ‘Abel’ tp lead the company in its next act?

More By This Author:

How This Year Stacks Up

Whose Bubble Is It Anyway?

Magnificent Metals

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more