Whose Bubble Is It Anyway?

Image Source: Pixabay

Plenty of ink has been spilled in the last year about the current AI Boom and whether it's actually an "AI Bubble".

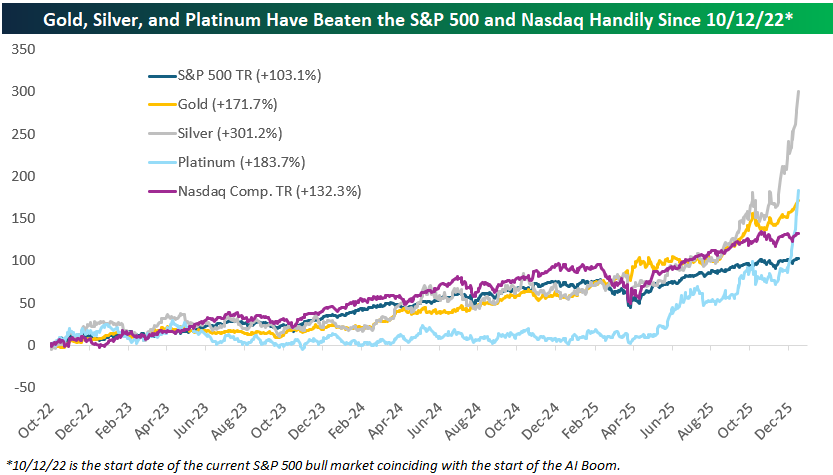

The current bull market for US stocks began on 10/12/22 based on the standard 20% rally/decline threshold. After a nasty bear market from the first trading day of 2022 through the 10/12/22 closing low, the current bull has seen the S&P rally 103% on a total return basis. The Tech/AI-heavy Nasdaq is up even more with a total return of 132.3% over the same time frame.

After the rally we've seen in the precious metals in the last couple of months, though, traders in the space must be looking at the AI Boom and thinking "hold my beer".

Below is a look at the performance of the S&P 500, the Nasdaq Composite, and gold, silver, and platinum since the current bull market for stocks began on 10/12/22.

(Click on image to enlarge)

As shown, gold is now up 171.7%, platinum is up 183.7%, and silver is up just over 300%! All three metals have now easily beaten the stock market during the AI Boom.

A doubling of the major indices over a 3+ year time frame certainly qualifies as a strong bull market, and it's hard to argue that valuations aren't a bit lofty. But if the current AI-driven bull market for stocks is a "bubble," then certainly what we've seen in precious metals lately qualifies as well.

Ironically, many bears that call the AI trade a speculative bubble also recommend increasing exposure to gold and other precious metals, but that kind of rationale gets more difficult now that the metals trade has gone even more parabolic than stocks!

More By This Author:

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more