“Breaking The Ice” Stock Market (And Sentiment Results)…

Key Market Outlook(s) and Pick(s)

On Tuesday, I joined Stuart Varney on Fox Business “Varney & Co” to discuss markets, AI, meltup chatter, earnings, Diageo, Estee Lauder, and more. Thanks to Stuart, Peyton Jennings, and Christian Dagger for having me on:

Canada Goose Update

As the saying goes, if public markets don’t value a business properly, an acquirer eventually will. Sure enough, Canada Goose reportedly found itself on the receiving end of multiple private takeover bids, valuing the company at roughly $1.4 billion, or ~$14 per share.

Management has since publicly declined the takeover speculation, noting they have no intention of being taken private.

Hallelujah. That is music to our ears, and we’re happy the board came to its senses. That’s because, despite what feels like a huge move off the bottom, doubling from the April lows, we didn’t get involved in the stock for a 50% gain. Frankly, a private buyout at those levels would have been highway robbery relative to the potential we continue to see over the next couple of years. Thankfully, GOOS is led by a CEO and Chairman from the founding family who owns 39.5% of the company. With that kind of skin in the game, management tends to respect shareholder equity and think beyond tomorrow’s newspaper, exactly why we invested in a company of this caliber to begin with.

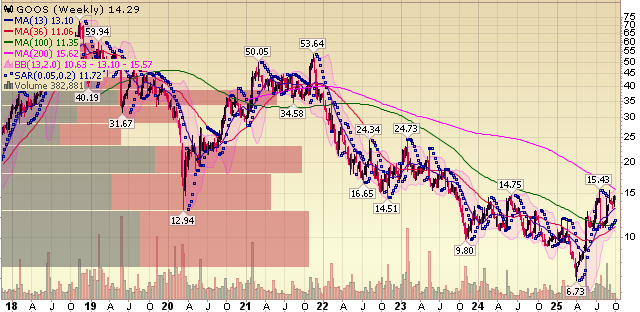

At the end of the day, this is a name that went from a flashy growth story to a left-for-dead value story (when we initiated), and we believe it has all the right pieces to return to that growth story as management executes its turnaround plan and gets a little help from the ongoing China recovery and pivot toward consumption.

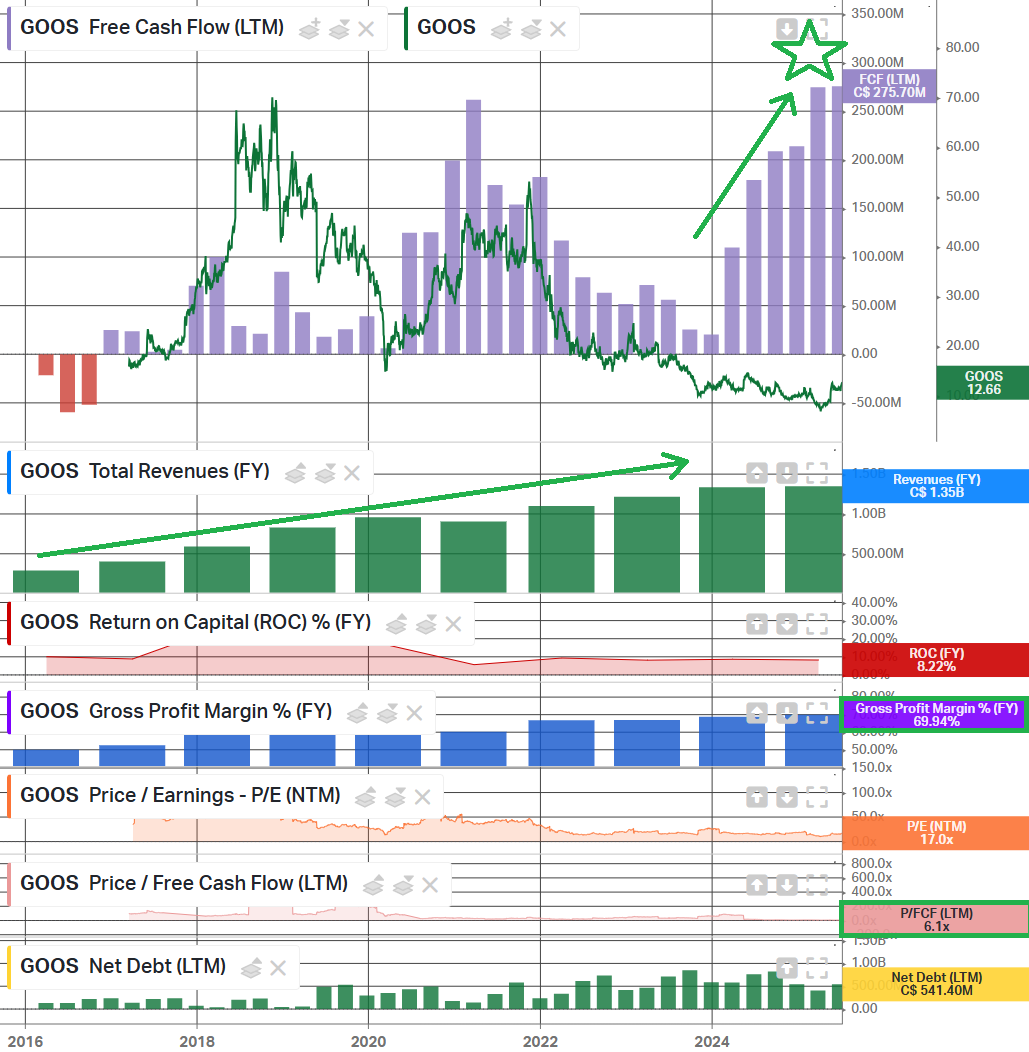

Over the past few quarters, we have seen management execute the turnaround exactly as promised, and then some. The name of the game with the GOOS turnaround starts with reducing exposure to wholesale and leaning into high-margin DTC stores, which have grown from ~29% of total revenues in 2017 to nearly 74% in the past fiscal year. With that shift comes a far more attractive margin profile, as DTC typically commands mid-70% margins compared with mid-to-high 40% margins for wholesale.

The long-term FY2028 target remains 80% DTC mix, which management expects will deliver gross margins consistently north of 70%.

There is no doubt GOOS is well on its way toward both. DTC mix, gross margins, and free cash flow are all at record highs, supported by cleaned-up inventories and a strong balance sheet. These are all the signs we want to see in any turnaround, and for that alone, the market has already rewarded us handsomely.

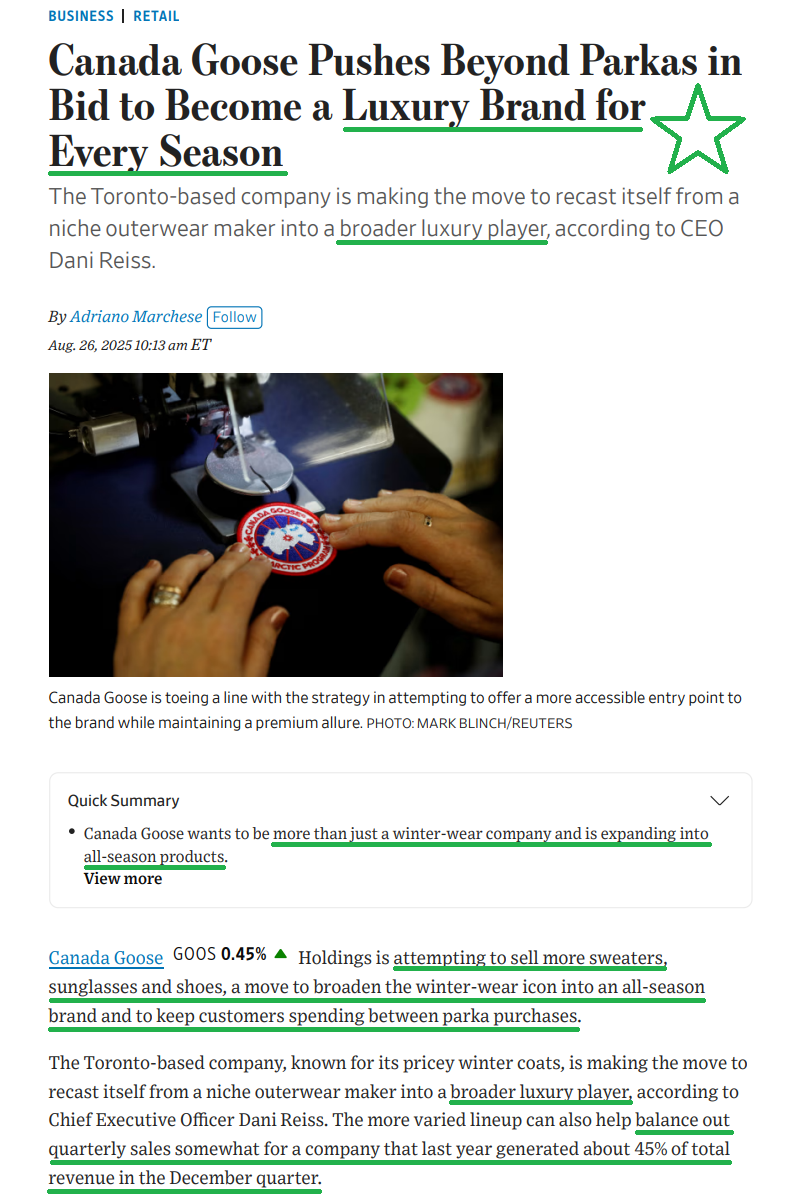

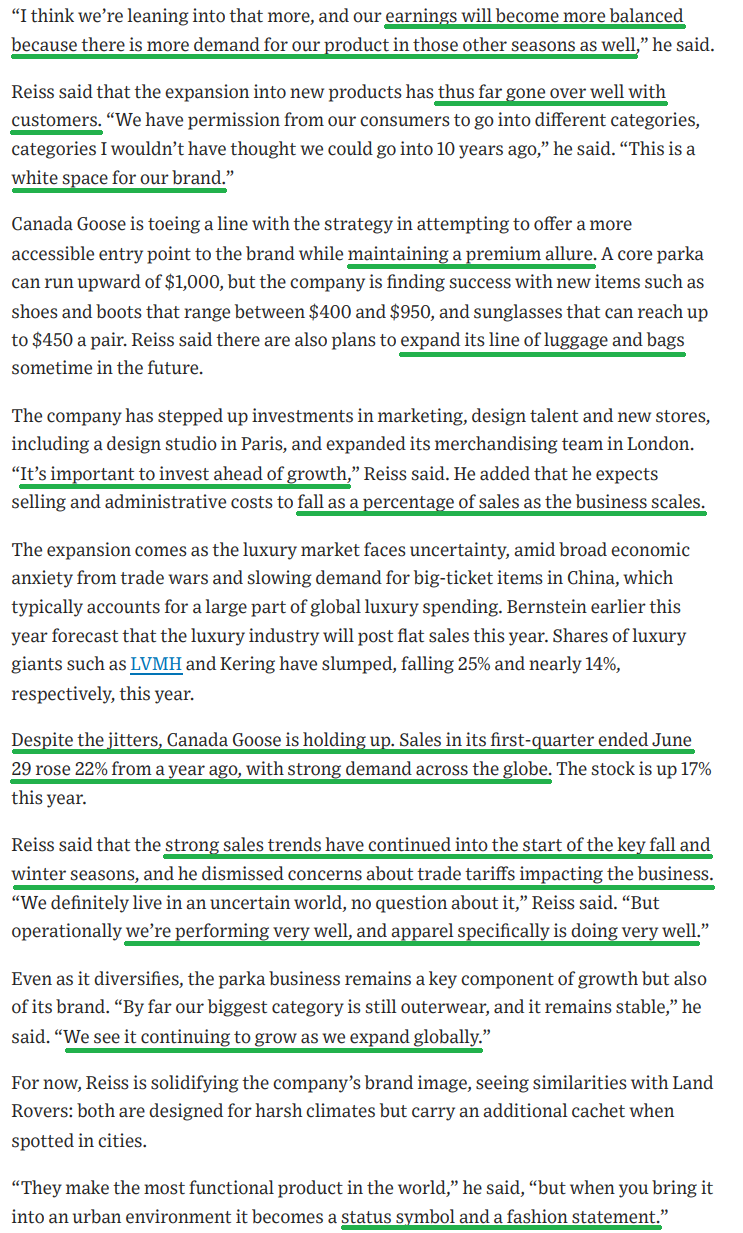

But the next leg of the turnaround is where the real upside lies, and if successful, it is where we continue to see 3-4x potential come into play. Right now, when most people think of Canada Goose, they think of $1,000+ luxury parkas. Management is working overtime to change that narrative, turning GOOS from a one-time purchase, winter-only luxury parka brand into an all-season, 365-day relevant brand. They have already doubled the mix of updated and brand-new styles, bringing more novelty than ever. Whether it’s rain jackets, eyewear, shoes, or warm-weather clothing, Canada Goose now has it. Most importantly, consumers can’t get enough, with apparel not only becoming the fastest-growing category but also driving stronger growth in core outerwear.

Turning GOOS into a four-season brand is not only a massive opportunity to grow and scale the business, it also opens the door for significant operating leverage and margin expansion. Hence, the exact reason we continue to see these supposed takeout bids of $14 per share as an insult to the opportunity this stock offers.

Here’s a great WSJ article from a few weeks ago breaking down Canada Goose’s four-season strategy:

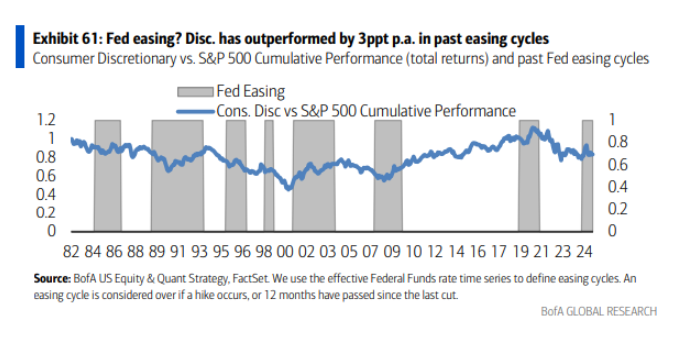

We think as the market starts to sniff out the luxury comeback, especially as Chinese consumers open their wallets and pivot toward consumption, this is a stock that will get a bid. Couple that with the start of a Fed easing cycle, and this is exactly the type of luxury name we want exposure to, expecting it to be a big winner over the next several years.

Q1 Earnings Breakdown

10 Key Points

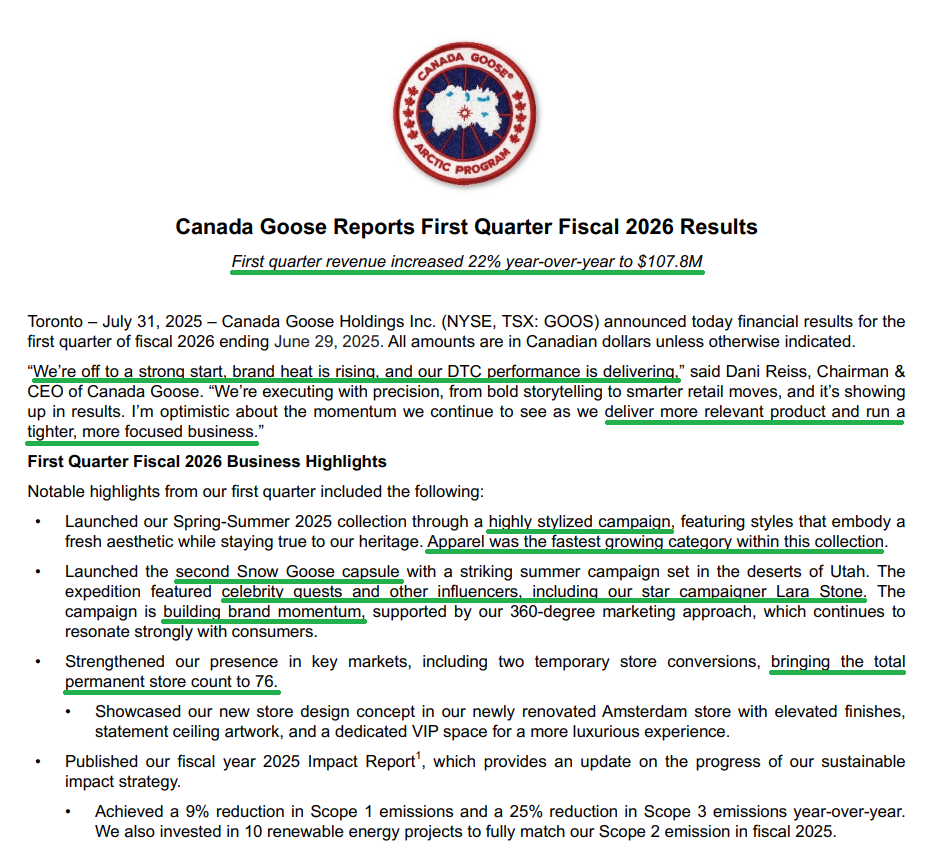

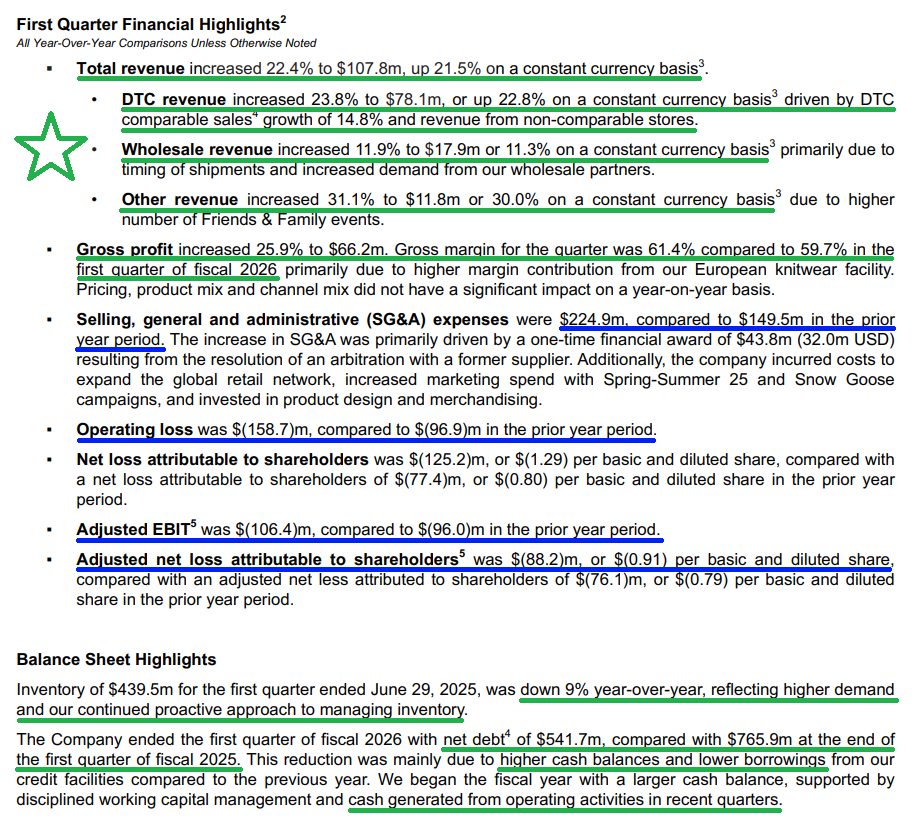

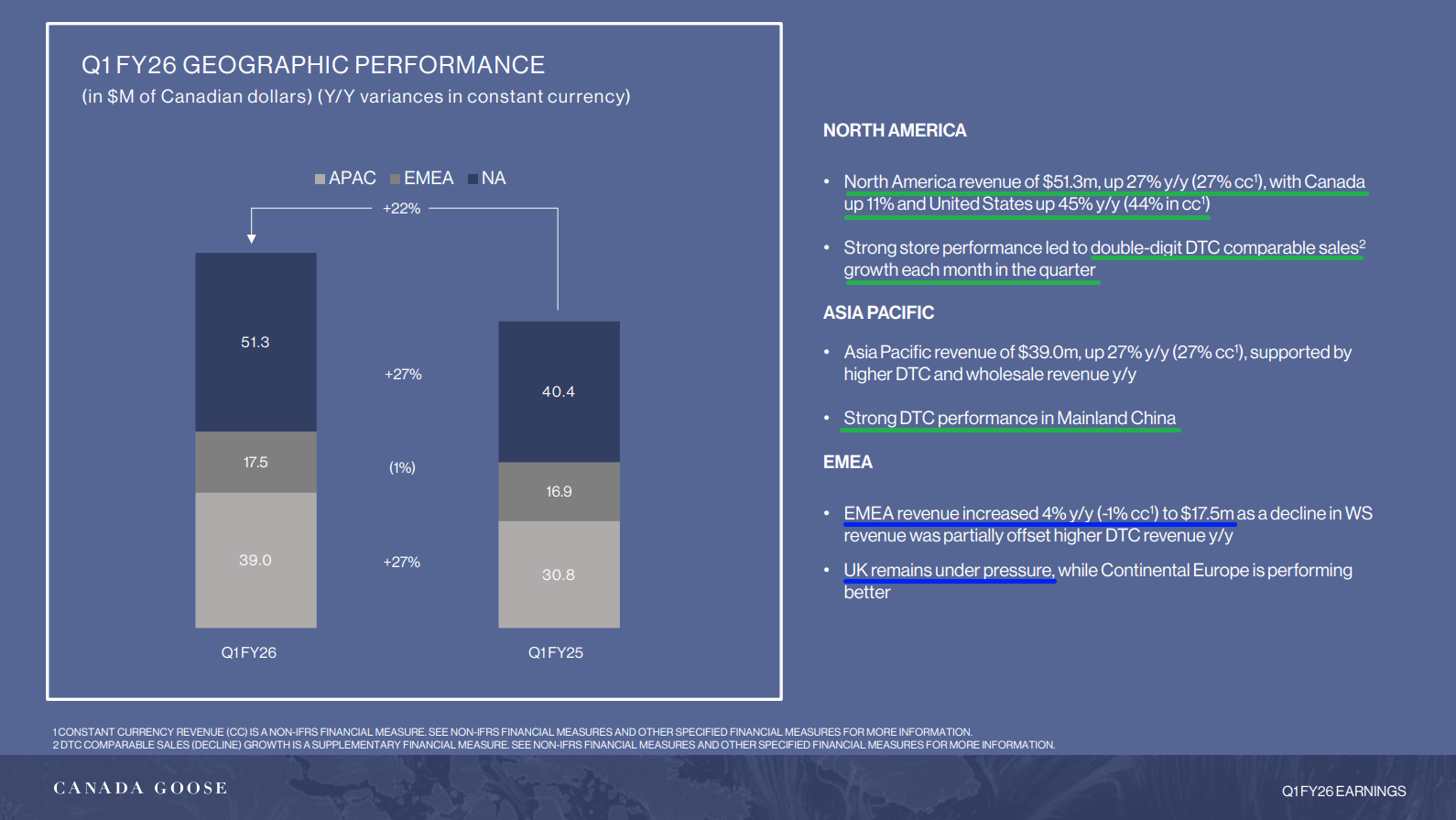

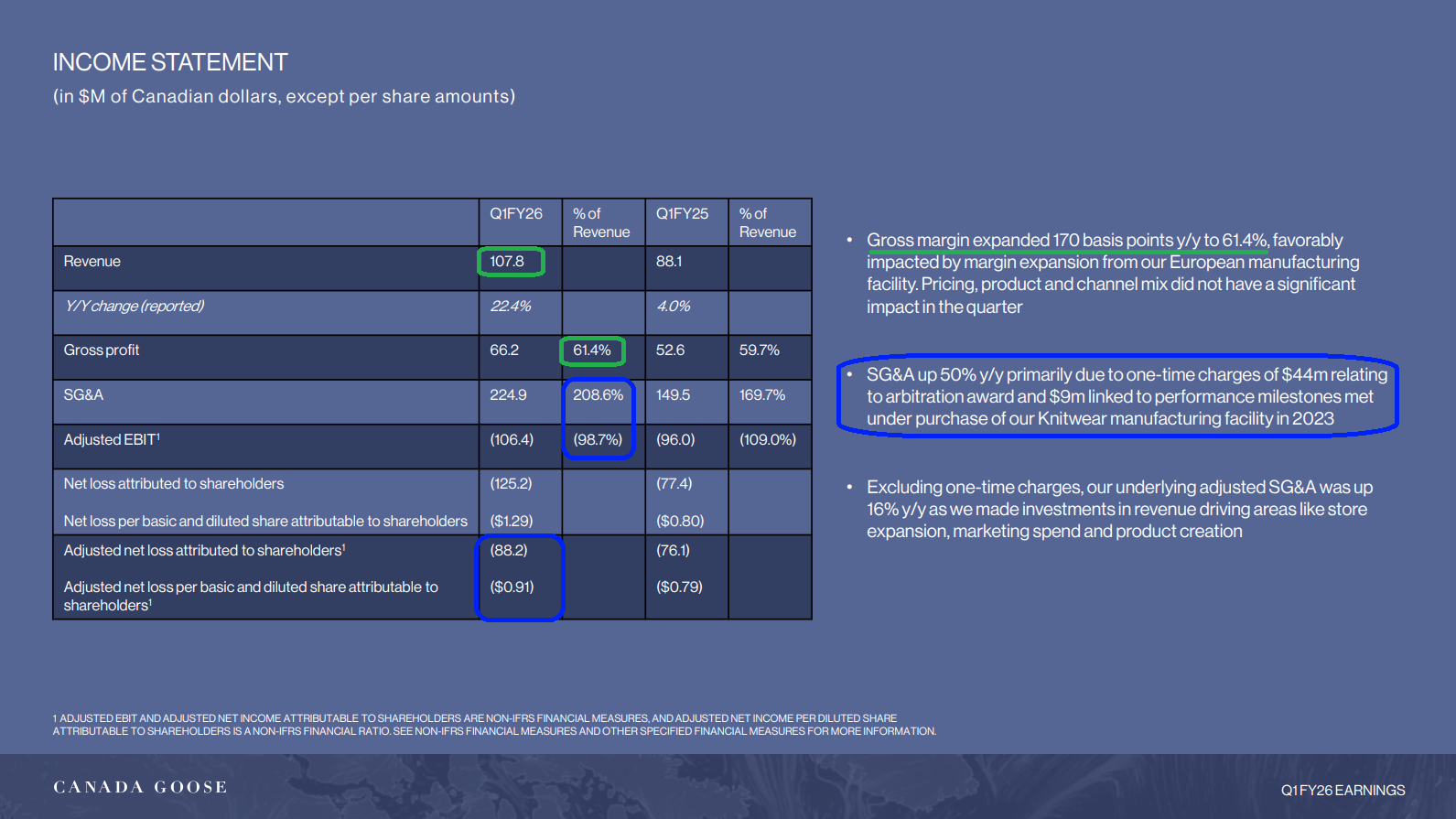

1) Canada Goose reported Q1 revenue of $107.8 million, up 22.4% year over year and beating Street estimates by $11.1 million, a 16.7% upside surprise.

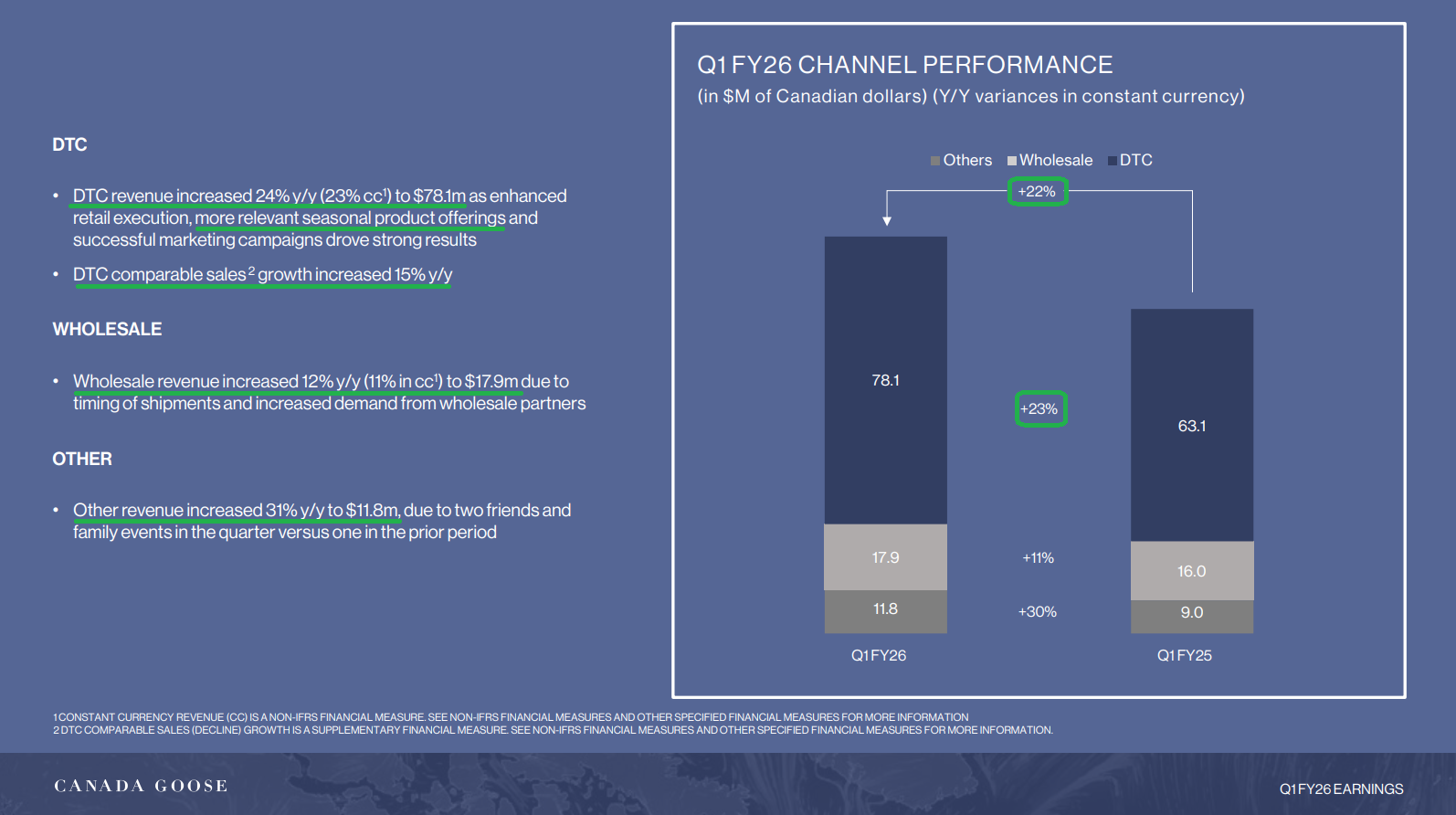

2) Direct-to-Consumer (DTC) continues to be a standout, with DTC revenue up 24% to $78.1 million, driven by 14.8% comp sales growth led by strength in mainland China and North America. Most importantly, DTC now represents nearly 73% of overall revenue compared to just ~29% in 2017, which comes with a far more attractive margin profile. This marks the seventh consecutive quarter of positive DTC comp sales growth, with Q1 store conversion rates also higher year over year in every single region.

3) Gross margins continued to benefit from the push into DTC, rising to 61.4% from 59.7% in the prior year period (+170 bps), driven by margin expansion from the company’s European manufacturing facility. Pricing, product, and channel mix had minimal impact during the quarter, implying that even with record product newness (nearly doubling the mix of new items), these additions remain accretive to the overall margin profile.

4) SG&A expenses came in at $224.9 million during the quarter, up nearly 50% YoY from $149.5 million in the prior year period. This was primarily driven by a one-time financial award of $44 million resulting from the resolution of an arbitration with a former supplier. Excluding the one-time charge, SG&A was up 16% YoY, well below overall revenue growth, representing an 850 bps improvement as a percentage of revenue. Management continues to focus on expense management and staying lean, and they expect this will drive significant EBIT margin expansion over time.

5) The wholesale segment, which has faced significant pressure over the past couple of years (down 16.5% during FY2025) as GOOS focuses on DTC expansion, posted revenue growth of 11.9% to $17.9 million. Management expects the segment to maintain stable performance for the full year, with the order book response remaining strong and continuing to grow. Over the longer term, management still views the channel as important for the brand and a meaningful growth opportunity.

6) During the quarter, management launched the Spring-Summer 2025 collection, designed to make offerings more seasonally relevant, and also introduced the second Snow Goose capsule. Both campaigns drove strong consumer engagement, lifts in earned media, and follower growth, clear signals that the campaigns landed. With GOOS introducing more newness than ever before, apparel has become the company’s fastest-growing category, while also boosting revenue growth in core outerwear products and increasing overall basket size. Management still has several campaign drops scheduled, including a Fall Snow Goose capsule.

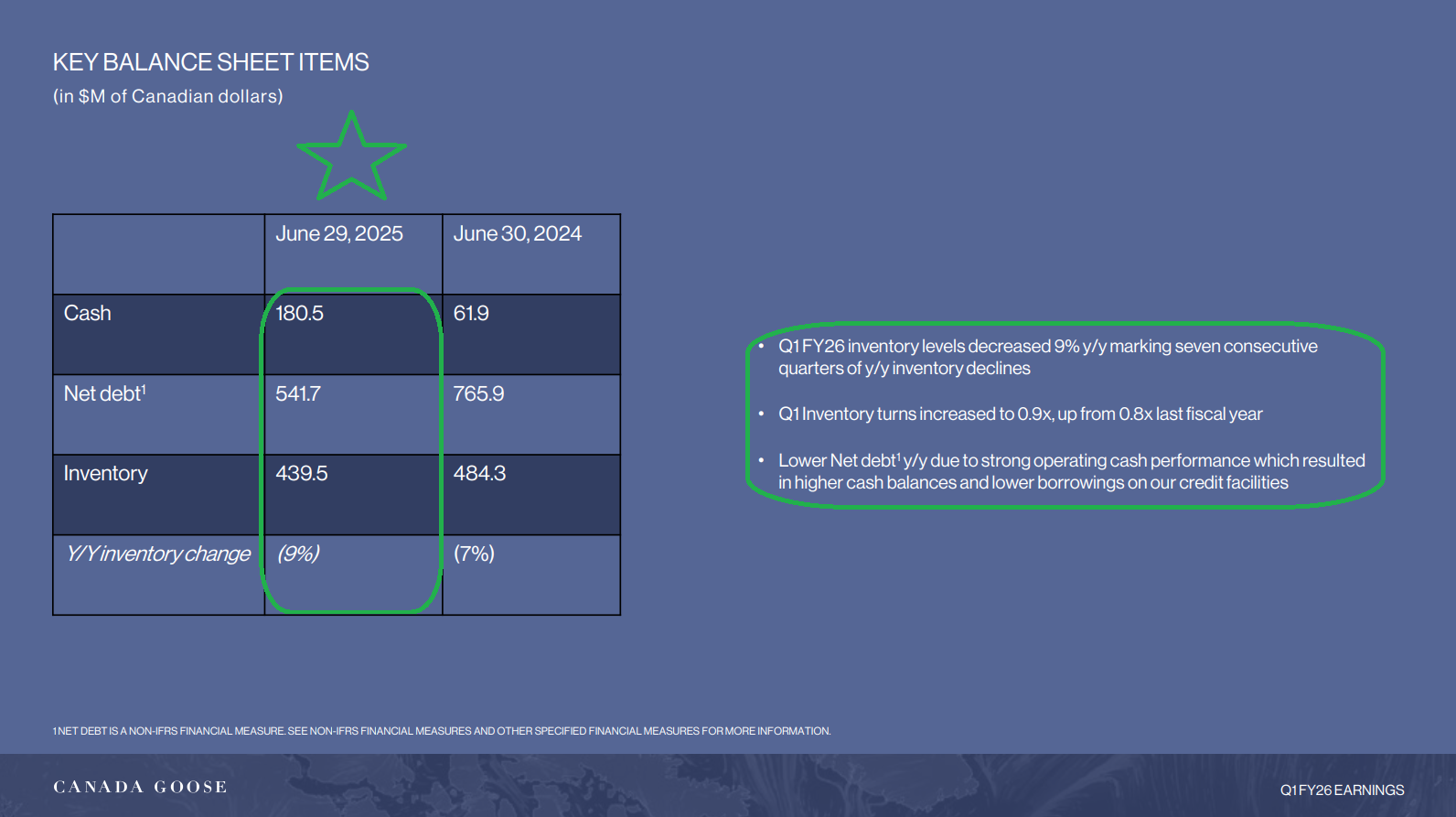

7) At the end of the quarter, net debt stood at $541.7 million compared to $765.9 million in the prior year period, reducing net leverage to 1.8x from 2.8x. The improvement was driven by lower borrowings from credit facilities, strong operating cash flow, and a higher cash balance, which now stands at $180.5 million, or ~13% of the company’s overall market cap.

8) Canada Goose continues to clean up its inventory position, reducing it to $439.5 million, down 9% YoY, driven by higher demand and proactive inventory management. This marks the seventh consecutive quarter of YoY inventory declines, with Q1 inventory turns rising to 0.9x from 0.8x last fiscal year.

9) Canada Goose remains largely immune to tariffs, with 75% of its units manufactured in Canada and nearly all meeting USMCA requirements. For European products that are exposed, management is paying modestly higher tariffs but still expects the full-year impact to be minimal.

10) Canada Goose’s total permanent store count now stands at 76, with two net new stores added during the quarter. Management continues to expect total net store openings to exceed FY2025 levels for the full year.

Earnings Call Highlights

QXO Update

A few weeks ago, Brad Jacobs fielded investor questions at a conference, laying out the QXO playbook and how he plans to build a $50B+ powerhouse within the $800B building products distribution industry.

As we’ve said time and again, and especially after spending time with Brad himself and seeing his acuity firsthand, there has never been a CEO more consistent at creating massive shareholder value at scale. What separates Brad from the rest is that he’s obsessed with value creation. He feeds off it. He’s the type of leader who works seven days a week and never lets up. Leaders like that run circles around everyone else.

Just as you’d expect, his track record speaks for itself. An investment in XPO when he first got involved would have been a 50x bagger. United Rentals would have been closer to a 200x bagger. Altogether, investing alongside Jacobs across his companies would have generated more than a 300x return.

These are the types of CEOs Buffett talks about, and when you find them, you bet on them. Through both GXO and QXO, we’ve done exactly that.

So not only is this one of our favorite levered “arms dealer” plays on housing, it’s also a bet on one of the best jockies out there.

Below, we’ve highlighted the Q&A and key points since completing the Beacon acquisition in late April:

1) Every senior leader has material skin in the game, with the management team and board collectively owning ~35% of total equity and compensation directly tied to total shareholder return targets that must outperform the S&P 500.

2) Management is rolling out a digital pricing platform aimed at addressing ~$200 million of pricing leakage caused by undisciplined discounting and inefficiencies at legacy Beacon.

3) Though the total headcount is largely unchanged, management has flattened the organizational structure from nine layers to four, removing ~250 mid-level and senior roles and replacing them with frontline resources, including 100 salespeople, truck drivers, warehouse associates, and executives in procurement and technology. Not only is this expected to drive stronger top-line growth and win share, but it has also resulted in a more efficient cost structure.

4) Inventory availability has already improved dramatically thanks to automated replenishment and forecasting. ~4% of SKUs drive nearly 80% of sales, and before the acquisition, many of these fast-moving SKUs were frequently out of stock.

5) QXO has embedded AI into its quoting, routing, and sales workflows, already driving double-digit productivity gains.

General Market

The CNN “Fear and Greed Index” ticked up to 53 this week from 51 last week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

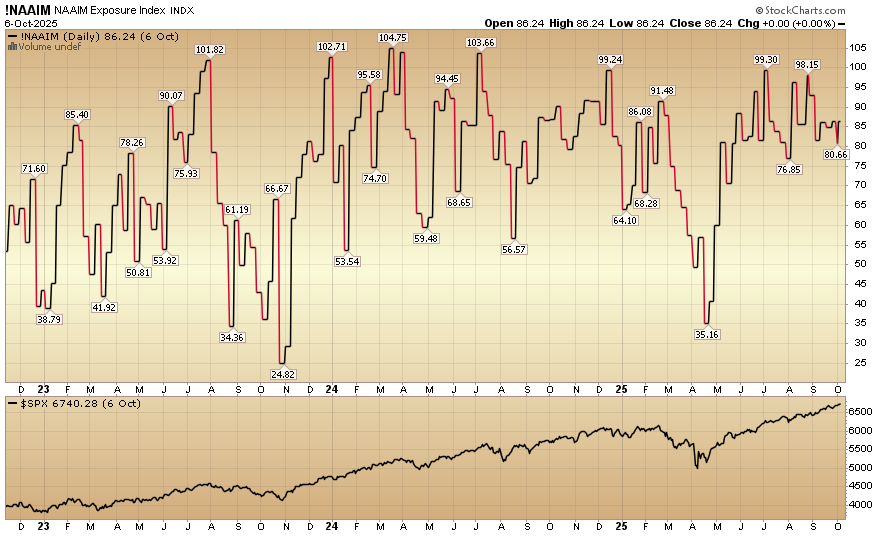

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) held steady at 86.24% equity exposure this week, matching last week’s reading.

Our podcast|videocast will be out sometime today. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in intra-quarter (Q3) with larger sized accounts, and to those existing clients who upsized their contributions to their accounts.

Not a solicitation.

*Opinion, Not Advice. See Terms

More By This Author:

“Foundation For A Comeback” Stock Market (And Sentiment Results)

“Early Innings” Stock Market (And Sentiment Results)

“The Fuel Behind The Future” Stock Market (And Sentiment Results)

Long all mentioned tickers.

Disclaimer: Not investment advice. For educational purposes only: Learn more at more